US Dollar ended last week higher buoyed several market drivers, including concerns of Trump’s administration tariffs, Federal Reserve Bank rate decision and its chief Jerome Powell’s statements, and US data of inflation and spending.

Such market drivers were impactful om the greenback and all other traded assets in global financial markets throughout last week. For example, we have seen gold failure to take decisive moves most of the week.

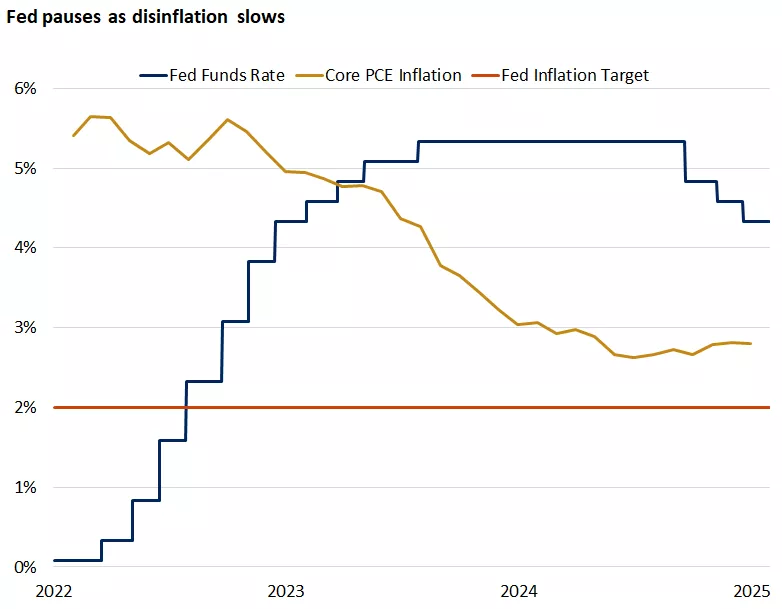

The Fed cemented fund rate at the same levels adopted since the previous FOMC meeting at 4.25%/4.50% on deposits and loans.

The central bank said in rate statement: “Recent indicators suggest that economic activity has continued to expand at a solid pace. The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated”.

Powell said: “Review of policy framework will wrap up by late summer”, adding that “We do not need to be in a hurry to adjust policy stance”.

Tariffs also played a role in the strong upward trend of the dollar, especially once they had been turned from mere concerns to actual measures.

The white house Press Secretary Karoline Leavitt announced that tariffs on imports from Canada and Mexico are being implemented starting from the first of February 2025. This announcement washed away all expectation of delaying such measures to at least the first of March.

On Saturday, White House said Trump has signed order to impose tariffs on Canada, Mexico and China.

The US dollar settled at high levels by the end of last week trading after posting weekly gains, with the Dollar Index (DXY) above 108.50 points versus the previous week’s close of 107.57 points. The index reached a low of 107.16 points last week and hit a high of 109.33 points.

Wallstreet stocks: limited gains

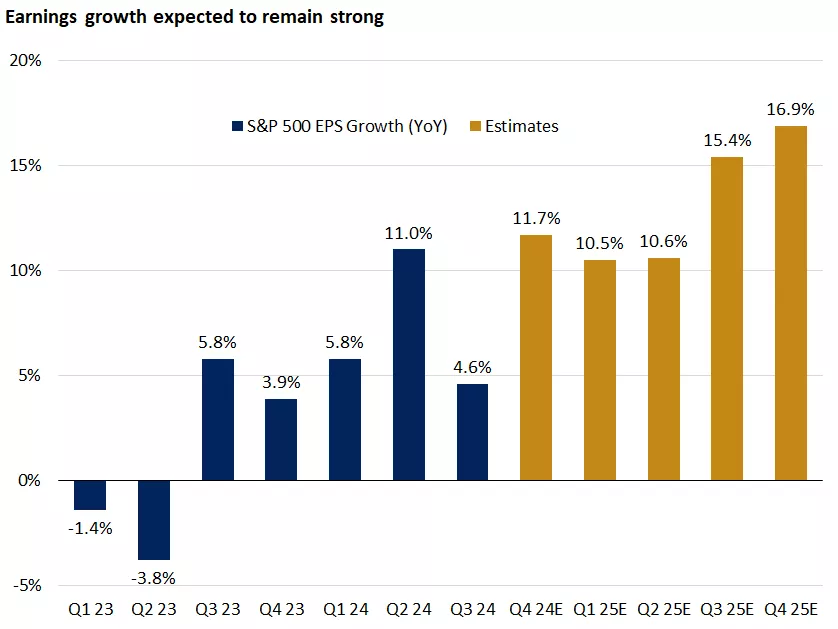

US stocks made modest gains after markets received good news from earning reports. Four of the Magnificent 7 companies reported earnings this week, contributing to a strong corporate earnings season thus far.

But some factors led such gains to be limited, including DeepSeek shock, Fed’s decision to leave rates unchanged, and Trump’s tariffs.

After DeepSeek’s app soared to the top of Apple’s App Store this week, the Chinese AI lab quickly became the focal point of the tech industry.

DeepSeek’s mobile app quickly ascended to the top of Apple’s App Store charts early in the week and maintained its lead position through Friday, surpassing OpenAI’s ChatGPT. Reports revealed that the development of its new R1 model, which competes with OpenAI’s o1, cost a mere $6 million, leading to a decline in shares of chipmaker Nvidia.

Dow Jones Industrial Average added more than 200 points, or 0.3%, at the end of last week. S&P 500 saw a slight increase, closing at 6033 points compared to the previous week’s close of 6016 points. Meanwhile, the tech-heavy Nasdaq gained more than 300 points over the past week to be the biggest winner in NYSE.

Euro and Lagarde

ECB cut interest rates by 25 basis points to 2.75%, and President Lagarde indicated that additional easing could occur if inflation decreases. Despite this, growth risks remain due to low confidence and geopolitical tensions. Lagarde also dismissed Bitcoin as a reserve asset, emphasizing the importance of liquidity and security.

Christine Lagarde, ECB chief, said in the press conference held after rate decision announcement: “Domestic inflation remains high, mostly because wages and prices in certain sectors are still adjusting to past inflation surge with a substantial delay”.

“Will follow a data-dependent and meeting-by-meeting approach to determining appropriate monetary policy stanceStop “, adding that further rate cuts are likely if inflation continues to decline and economic conditions warrant additional support.

“In particular, interest rate decisions will be based on its assessment of inflation outlook in light of incoming economic and financial data, dynamics of underlying inflation and strength of monetary policy transmission”.

The statements by ECB and its chief pressured the Euro down towards weekly losses and may continue going south this week.

Canadian Dollar also dropped after Bank of Canada cut rates and warned that Trump’s tariffs are likely a main source of threat to Canadian economy. The currency lost 1.3%.

Dollar strength also pressured gold, which led to losses of 1.7% after reaching record highs.

This week

Important economic releases this week include the ISM Manufacturing PMI and nonfarm payrolls report for January.

In addition, a number of tech giants will release earnings reports including Alphabet, Amazon, and Arm. There are other important earnings releases like MicroStrategy this week.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations