US dollar closed this week’s trading with modest gains as it managed to make the best use of optimism around the future of trade between the two largest economies all over the world after USA and China announced an agreement on temporary tariffs cut for 90 days.

Dollar gains were limited by some bearish factors which led to small weekly rise, including economic data and other issues.

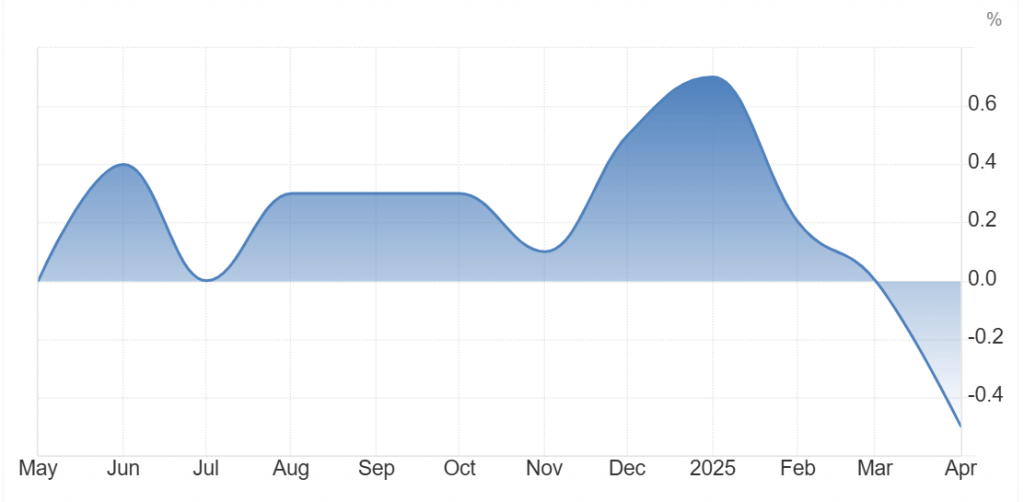

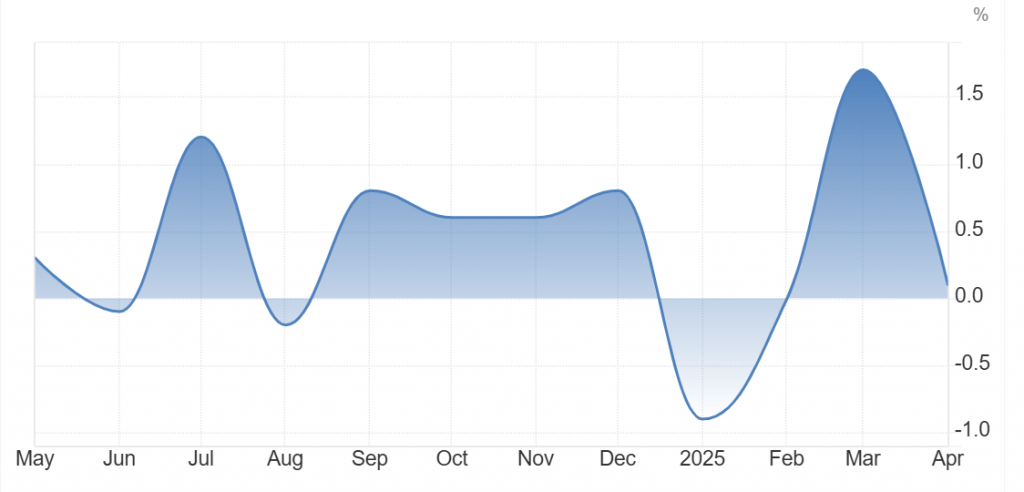

The greenback was negatively impacted by inflation data on both of consumer and producers prices levels.

On economic data front, a number of readings in various sectors were released last week to announce a state of weakness in economic activity in the country.

In April, the Consumer Price Index for All Urban Consumers rose 0.2 percent, seasonally adjusted, and rose 2.3 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.2 percent in April (SA); up 2.8 percent over the year, according to Bureau of Labour Statistics (BLS)

The US Apr final-demand PPI report of -0.5% m/m and +2.4% y/y was weaker than expectations of +0.2% m/m and +2.5% y/y.

US Apr retail sales rose +0.1% m/m, stronger than expectations of no change, although Apr retail sales ex-autos rose +0.1% m/m, weaker than expectations of +0.3% m/m.

US Apr housing starts rose +1.6% m/m to 1.361 million, weaker than expectations of 1.364 million. Also, Apr building permits, a proxy for future construction, fell -4.7% m/m to 1.412 million, weaker than the consensus of 1.450 million.

The US Apr import price index ex-petroleum rose +0.4% m/m, stronger than expectations of +0.1% m/m and the biggest increase in a year.

The University of Michigan US May consumer sentiment index unexpectedly fell -1.4 to a 3-year low of 50.8, weaker than expectations of an increase to 53.4.

The University of Michigan US May 1-year inflation expectations jumped to a 43-year high of 7.3%, higher than expectations of no change at 6.5%. Also, the May 5-10-year inflation expectations rose to a 34-year high of 4.6%, higher than the expectations of no change at 4.4%.

Credit rating and politics

Moody’s Ratings downgraded the United States’ debt on to Aa1 versus AAA, which comes after USA held the rating since 1917.

Now, the agency has lowered its assessment to Aa1, aligning with Fitch Ratings and S&P, which previously reduced their evaluations of US debt in 2023 and 2011, respectively.

On political front, fears of Trump administration’s failing to realize its legislative agenda harmed the greenback after Republican hardliners managed to block “One Big Beautiful Bill Act” – of tax and public spending cuts – as the House budget committee didn’t approve it to be qualified for a full floor vote.

A number of republican saw that tax cuts are not steep enough to boot the performance of economy and could add a lot to US public debt which stands at $36tr.

US Stocks added gains

Trade policy updates played a significant role in market movements over the past week, as improving U.S.-China relations and advancements in tech sector trade provided a boost to stock markets. These positive developments helped propel the S&P 500 back into positive territory for 2025.

Uncertainty surrounding tariff policies seems to be fading, with tariffs in the U.S. moving toward a projected average of 10%–15%. While this range may cause a short-term rise in inflation and a slowdown in economic growth, a growing emphasis on policies that support expansion later in the year is expected to help mitigate worst-case recession risks.

As trade negotiations are expected to continue for months, investors should anticipate occasional market volatility. Implementing diversification and rebalancing strategies can help maintain a portfolio designed to meet financial goals despite uncertainties. Given this landscape, we continue to favour overweighting stocks over bonds, with a particular emphasis on U.S. large- and mid-cap stocks.

Dow Jones manged to add 3.4% while S&P500 added 5.3%. in the opposite direction, there was NASDAQ which lost almost 0.5% of compared to previous weekly close.

Gold and Oil in complete contradiction

Gold was a net looser last week because of the inverse correlation with the greenback which soared on optimism around US- China trade relations.

The precious metal lost about 3.7% last week versus the previous week close.

On the other hand, oil’s gains were limited by an increase in US oil inventories as well as positive signs regarding peace talks between Russia and Ukraine.

A surge in US oil inventories by 3.454 m barrels versus previous reading which showed decline by 1.078 m barrels.

This decline in oil prices came in spite of OPEC maintaining its global demand unchanged for 2025 and 2026.

US president Donald Trump gave statements highlighting potential progress in Ukraine peace talks and -US openness on an agreement with Iran.

Euro and Sterling

European currencies had taken different tracks last week as the single currency were among the losers last week while Pound Sterling made weekly gains.

The single currency was pressured by dollar strength as the greenback was in the uptrend buoyed by Trade optimism.

President Trump said the European Union is “nastier than China” in trying to forge a trade deal.

In addition, Treasury Secretary Bessent previously said the European Union suffers from a “collective action problem” that’s hampering trade negotiations, and trade talks between the US and Europe “may be a bit slower.”, which added to downside pressures on the euro.

Statements of ECB’s monetary policy makers also harmed the currency, including ECB Vice President Guindos who warned that trade tensions, high funding costs, and weak economic growth could pose headwinds to Eurozone companies and households and that increased defence spending could pressure public finances.

Olli Rehn and Gediminas Simkus, ECB coverning coucil memers, annonceed last week that they are inclined to support further rate cut.

On the other hand, one piece of positive news was behind weekly gains of Sterling.

Cryptocurrencies made weekly gains

Bitcoin led cryptocurrencies to weekly gains last week amid increasing institutional demand throughout the last two weeks.

Spot Bitcoin ETFs bought 26700 bitcoins so far in May, which were all mined during the same period.

The news highlights that ETFs demand for cryptocurrencies is outpacing supply.

This huge increase spotlights growing confidence in digital assets, which means that bitcoin could be on the right path towards turning into a long term asset.

This week

This week is expected to see a number of market drivers which could control price action throughout the five trading day.

Data expected to impact markets this week include S&P PMIs, existing home sales, jobless claims, and other indicators.

Home Depot, Lowe’s, Target, TJX, and Palo Alto Networks are to release their quqrterly earning reports this week.

A number of Fed’s policymakers are scheduled to give statements, including Philip Jefferson, Michelle Bowman, and John Williams.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations