The first trading week of 2026 did not begin like any conventional year; instead, it was packed with momentous events that defined the economic and political trends for the coming period.

From the start of the month through January 9th, financial markets faced a “triangle” of pivotal developments: US military actions in Venezuela, the release of US labor market data following a period of uncertainty, and the anticipation of a Supreme Court decision regarding tariff policies.

This report monitors the most prominent developments in the trading markets for the week ending January 9, 2026, focusing on the interactions between economic data, geopolitical shifts, and the performance of key assets including equities, currencies, commodities, and cryptocurrencies.

According to experts, the immediate economic impacts may remain limited, with expectations persisting for one or two interest rate cuts by the Federal Reserve in 2026.

However, analysts warn against impulsive investment decisions, as rapid geopolitical and economic fluctuations could lead to significant financial losses.

This underscores the need for professional financial consultation to ensure portfolios remain aligned with long-term goals.

Geopolitical Developments and Market Impact

At the start of the week, the United States launched a military strike on Venezuela, leading to the arrest of President Nicolás Maduro and his wife, Cilia Flores, who were transported to New York to face charges of narco-terrorism.

President Donald Trump announced that Washington would temporarily administer Venezuela until a secure transition of power is achieved, with plans to rebuild oil infrastructure supported by major US energy firms—though some firms have shown hesitation due to the specific viscosity and characteristics of Venezuelan crude.

While Venezuela represents less than 1% of global GDP and trade, and only 1% of global oil production, it holds approximately 17% of global oil reserves. Analyses suggest immediate economic effects are contained—provided tensions do not escalate with major powers like China and Russia—but the move sets a long-term geopolitical precedent.

However, US Senate moves on Thursday to push a resolution limiting further military action in Venezuela without Congressional approval calmed some fears regarding a massive oil supply glut, helping restore relative market stability.

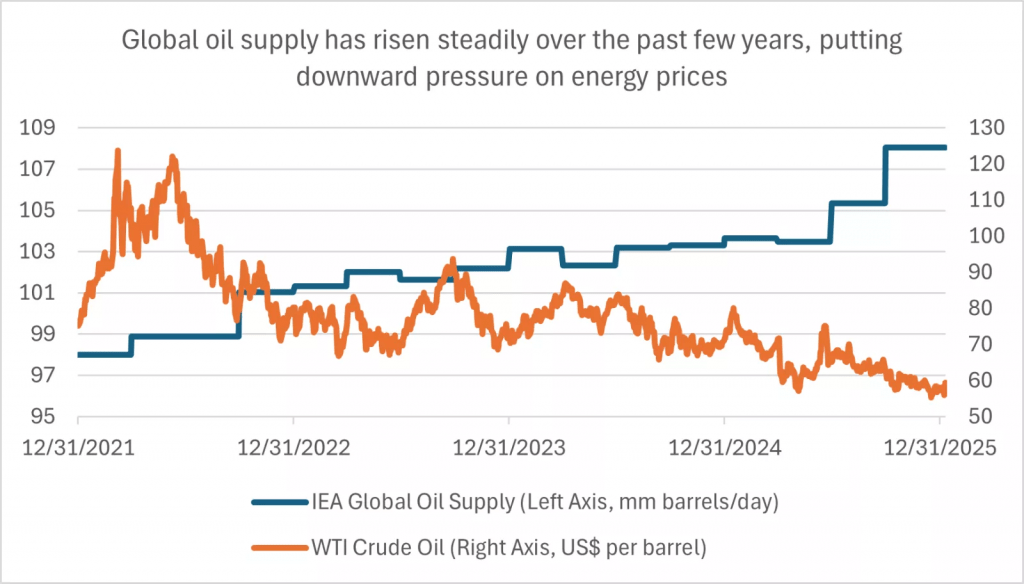

Meanwhile, tensions in Iran and Russia raised additional supply disruption concerns, supporting energy prices despite the difficult context of 2025, which saw the worst annual oil price decline in five years.

Asset reactions were as follows:

Oil: Brent crude initially rose to $61.83, followed by WTI to $58.39 Prices later softened on fears of increased supply following the easing of US sanctions and an agreement to import 50 million barrels of Venezuelan oil.

By week’s end, oil rose again on positive US demand data. Estimates suggest rehabilitating Venezuela’s oil industry could take 10 years and cost over $100billion, potentially pressuring long-term prices through increased supply. Supply risks from Russia (Black Sea attacks), Iran (protests), and Iraq (nationalization of West Qurna 2) drove prices up for a third consecutive week, with Brent settling at $62.44 and WTI at $58.03

Source: Bloomberg

Key Economic Data and Its Influence

Markets awaited delayed US economic data caused by the government shutdown, which was crucial for determining the Federal Reserve’s interest rate path.

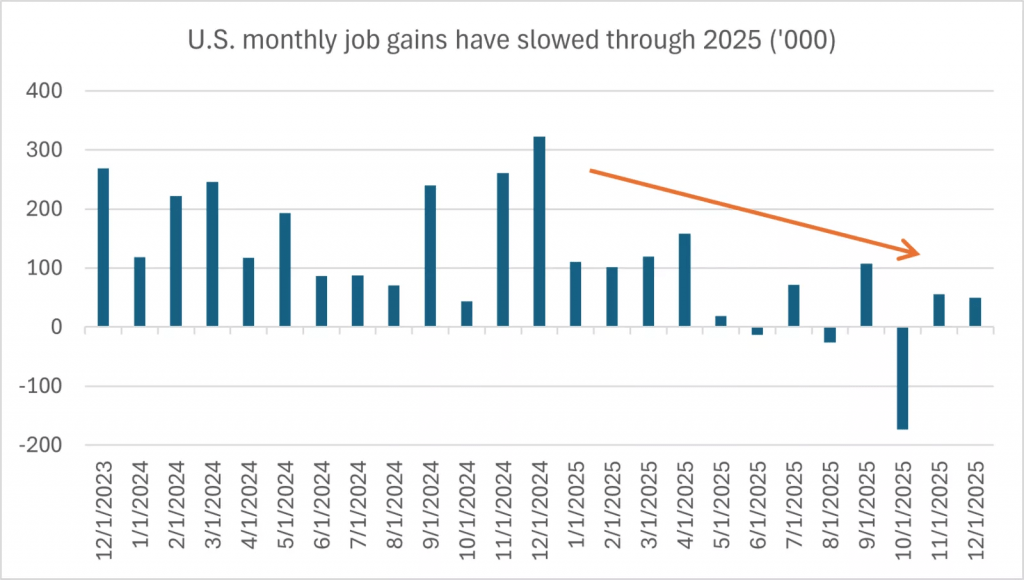

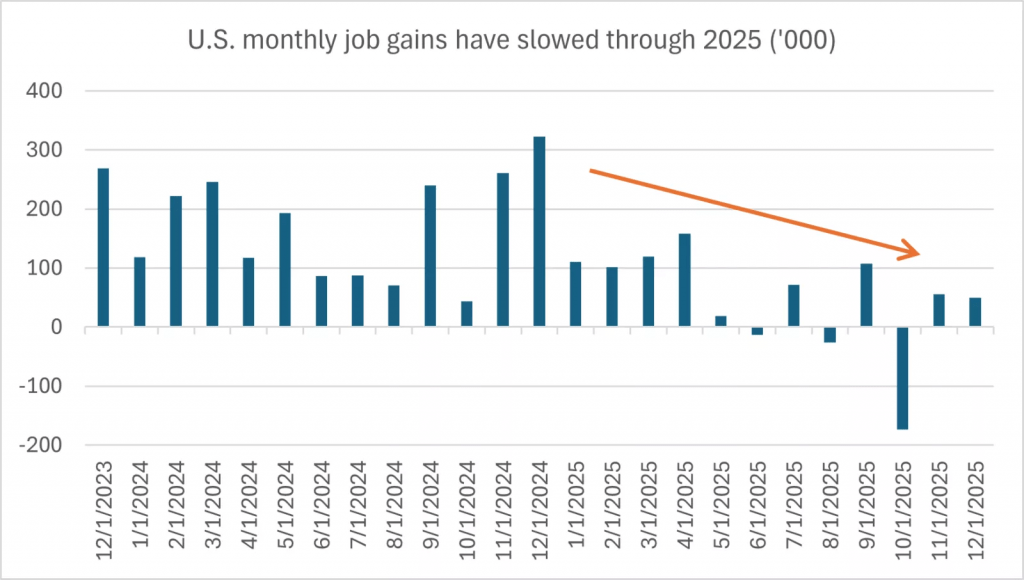

US Labor Market: The Non-Farm Payrolls (NFP) report revealed the addition of 50,000 jobs in December (below the 60,000 expected).

However, the unemployment rate fell to 4.4% (better than the 4.5% forecast), and average wages rose 0.3% monthly and 3.8% annually.

Source: Bloomberg

JOLTS job openings fell to 7.146 million, and layoffs hit a 17-month low. These indicators suggest a slowdown in job growth (averaging 49,000 monthly in 2025 vs. 168,000 in 2024), supporting a cautious monetary policy.

Fed officials noted that hiring is concentrated in Healthcare and AI, suggesting structural shifts in the economy.

Source: Bloomberg

Productivity and Trade Deficit: Productivity rose 4.9% in Q3 (a two-year high), and the trade deficit shrank to $29.4 billion (the lowest in 16 years), boosting growth confidence.

The Michigan Consumer Sentiment index rose to 54.0 in January. Reports indicate that productivity gains are driven by AI investments, enhancing efficiency and dampening inflationary pressures.

European and Chinese Data:

The Eurozone Economic Sentiment indicator fell to 96.7, and producer prices dropped 1.7% annually, though unemployment fell to 6.3%.

In Germany, industrial orders rose 5.6% and industrial production rose 0.8%, but inflation was weaker than expected at 2.0%.

In China, inflation rose 0.8% annually in December, signaling improved domestic demand.

Supreme Court Ruling on Tariffs

Markets awaited a Supreme Court decision on the legality of tariffs under the International Emergency Economic Powers Act (IEEPA), which was delayed to Wednesday, January 13, 2026.

Experts suggest that even if the court strikes down the tariffs, the impact might be limited as the Trump administration could pivot to Section 232 (National Security) or 301 (Unfair Trade Practices).

Refunding duties (roughly $150billion) would take time and is relatively small compared to the $38trillion federal debt.Global Equity PerformanceStocks rose supported by the energy and tech sectors but faced geopolitical volatility.

Germany’s DAX rose 0.1%, France’s CAC 0.5%, and the UK’s FTSE 0.3%. In Asia, the Nikkei 225 gained 1% on yen weakness, while the Australian ASX rose 0.3%.

US Equities: The S&P 500 and Dow Jones rose, led by chipmakers like SanDisk (+22%) and defense stocks. Lockheed Martin (+4%), Northrop Grumman (+3%), and Kratos Defense (+14%) climbed following statements about increasing military spending to $1.5trillion by 2027.

Conversely, tech giants stumbled (Nvidia -2%, Oracle -1%, Apple down for a seventh day). The Russell 2000 hit an all-time high, and Alphabet surpassed Apple in market cap ($3.888trillion).Tesla & Strategy: Tesla fell (-4%) due to declining deliveries (-16% quarterly) and competition from China’s BYD. Strategy rose (+4%) after temporarily avoiding exclusion from MSCI indices.

European & British Stocks:

The Stoxx 600 hit a record high of 601.76. Germany’s Rheinmetall jumped 10%. The FTSE 100 tested new record levels supported by mining and defense, while markets look ahead to merger talks between Glencore and Rio Tinto.

Forex Markets

US Dollar: The greenback hit a 3-week high as a safe haven but faced pressure from weak manufacturing data (ISM at 47.9). The dollar faces structural pressure from expectations of a 50-basis point rate cut in 2026 and the anticipation of a new, more “dovish” Fed Chair announcement expected in January following the Davos forum.Other Currencies:

The Euro fell (-0.3%) on weak data, while the British Pound outperformed, hitting its highest level against the Euro since October.

The Japanese Yen saw a slight recovery (+0.1%) despite pressures from defense spending and tensions with China, keeping the USD/JPY pair near 158.00.

Commodities and Metals

Gold and Silver: Gold rose to approximately $4,496per ounce (a 64% annual gain) supported by central bank buying from China and Poland. Experts forecast a move toward $5,000 in 2026 due to “de-dollarization” efforts.

Silver saw a sharp rise to the $79.56 – \$81 range, driven by industrial demand for AI chips and supply chain disruptions following the Taiwan earthquake.

Base Metals: Copper rose 1.3% to a record $12,867 per tonne on potential tariff concerns.

Cryptocurrencies

Bitcoin: Stabilized near $91,000 ($90,946) despite ETF outflows exceeding $1billion. Ethereum rose to $3,119, and Solana gained 5%. Proposals for a Bitcoin reserve in Florida and a national US reserve (with Greenland as a mining site) sparked optimism despite “whale” liquidations.

The Week Ahead:

Next week carries clear market drivers: US inflation and retail sales data alongside the start of the Q4 earnings season (led by J.P. Morgan and TSMC). Confidence indicators from the Eurozone and Japanese data will also be in focus. The strong start for 2026 US equities will be immediately tested by these results amidst a volatile geopolitical landscape.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations