Global financial landscape this week were shaped by a convergence of trade policy upheavals, measured responses from central banks, and supply-side pressures, resulting in a dynamic interplay of volatility and strategic adjustments. This analysis explores movements in gold, crude oil, U.S. equities, cryptocurrencies, and key currency pairs, with a focus on inflationary trends in the U.S., the Turkish lira’s sharp decline, and the broader implications of Trump’s tariff initiatives affecting nations like India, China, Canada, the UK, and the Eurozone. Insights from Goldman Sachs and shifts in U.S. Treasury yields further enrich this perspective.

Global Crude Oil: Tight Supply Propels Prices Upward

Crude oil markets posted gains on Friday, marking a second consecutive week of increases driven by constrained supply dynamics. Brent crude rose by 12 cents (0.2%) to $72.12 per barrel, closing at $72.16, while WTI advanced 15 cents (0.2%) to $68.22, settling at $68.28. Weekly gains stood at 2.1% for Brent and 1.6% for WTI, the most robust performance since early 2025.

Fresh U.S. sanctions targeting Iran’s oil infrastructure, including a Chinese refiner, were announced Thursday as part of Trump’s aggressive export-curbing strategy. Analysts at ANZ Bank estimate a potential reduction of 1 million barrels per day from Iran’s February output of 1.8 million bpd. OPEC+ complemented this with a plan where seven members committed to cuts ranging from 189,000 to 435,000 bpd through June 2026 to address overproduction, while eight others will increase output by 138,000 bpd starting in April, partially unwinding the 5.85 million bpd reductions in place since 2022. Questions linger over compliance from nations like Iraq, Kazakhstan, and Russia, yet geopolitical tensions and tariff-related uncertainties bolstered a bullish outlook. Goldman Sachs highlighted commodities futures, such as oil, as a prudent investment amid inflationary pressures and supply disruptions. Meanwhile, Canada’s central bank governor, Tiff Macklem, cautioned about tariff impacts on energy prices, a concern echoed by the Bank of England and ECB President Christine Lagarde regarding energy cost vulnerabilities.

Global Gold (XAU/USD): Defensive Strength Amid Uncertainty

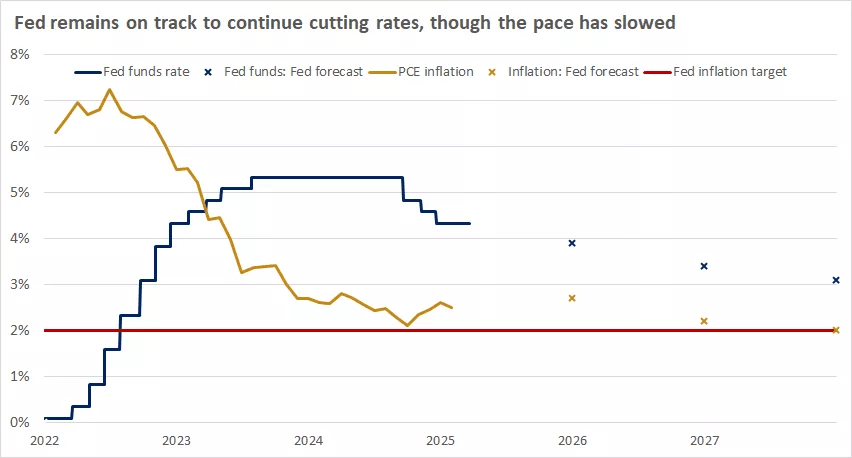

Gold experienced a softening on Friday, with XAU/USD declining 0.81% to $3,019 due to profit-taking after two days of losses. Nevertheless, it achieved a weekly uptick, underpinned by a strengthening U.S. dollar (DXY up 0.31% to 104.114, including a 0.2% Friday rise) and heightened geopolitical risks. The resumption of Israel’s military operations in Gaza, breaking a two-month ceasefire, reinforced gold’s safe-haven status. However, U.S. Treasury yield movements—10-year T-note dropping to 4.237% from 4.315% (after peaking at 4.320%)—moderated its ascent following Fed Chair Jerome Powell’s emphasis on economic uncertainty tied to Trump’s tariffs. The Fed maintained its projection of two 25-basis-point rate cuts for 2025, keeping the fed funds rate at 4.25%-4.5%. Powell underscored the ambiguity surrounding Trump’s tariff policies, stating that “much of the upward revision in inflation forecasts is linked to tariffs,” which he views as likely temporary but requiring further observation. With Trump’s tariffs set to take effect on April 2, gold’s role as a hedge grew more pronounced, resonating with Goldman Sachs’ endorsement of commodities as a buffer against inflation.

Source: U.S. Federal Reserve, U.S. Bureau of Economic Analysis.

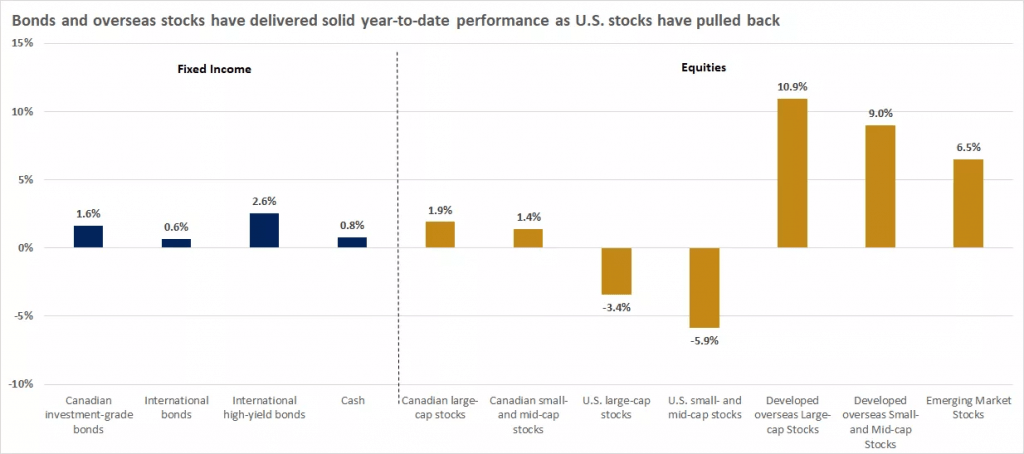

U.S. Stocks: Stability Amid Turbulence

U.S. equity markets displayed resilience despite volatility, with the Dow Jones Industrial Average closing Friday down 37 points (-0.1%) near the 42,000 mark, the S&P 500 slipping 0.2%, and the Nasdaq edging up 0.1%. Weekly gains were modest, with the S&P 500 rising 0.2%, potentially halting a four-week decline. A “quadruple witching” event involving $4.7 trillion in expiring options amplified fluctuations, exacerbated by ambiguity around Trump’s tariff plans targeting China, India, and possibly the EU. Technology stocks weakened (Nvidia -1.2%, Micron -7.6%), while Boeing surged 4.2% on a defense contract win. Corporate earnings reflected uneven performance, with Nike (-5.8%) and FedEx (-6.5%) faltering on pessimistic guidance. Fed Governor John Williams reinforced a hawkish outlook, noting that “current policy entails modest tightening, fitting given robust labor conditions and inflation exceeding our 2% goal,” contributing to a risk-off mood that enhanced dollar liquidity and weighed on equities. The Fed’s decision on Wednesday to hold rates at 4.25%-4.5%, paired with a lowered GDP growth forecast to 1.7% from 2.1%, prompted significant Treasury purchases, driving 10-year yields down to 4.237%. Goldman Sachs cautioned against overvalued equities in this inflationary climate, advocating for commodities futures as a diversification tool.

Source: Morning Star

Cryptocurrencies: Hesitation with Underlying Optimism

The cryptocurrency sector saw declines on Friday, March 21, with Bitcoin falling 2.08% to $84,117 and Ethereum dipping to $1,971. Market capitalization fluctuated between $2.75 trillion and $2.86 trillion, up 0.49%, though trading volume dropped 6.49% to $98.3 billion. The Fear & Greed Index at 26 reflected a cautious sentiment. Bitcoin hovered near $84,000, with $80,000 as a critical support level—Bitfinex’s six-month high in long positions suggested bullish potential, though a breach below could trigger broader declines. Ethereum’s downturn influenced altcoins variably: Solana ($127.87), XRP ($2.40), Binance Coin ($631.37), and Dogecoin ($0.1683). An upcoming SEC roundtable on crypto regulation looms, with pro-crypto outcomes potentially lifting prices and restrictive signals risking further gloom. Trump’s supportive crypto stance contended with inflationary pressures, a strong dollar, and tariff uncertainties, limiting gains. A Bitcoin close above $84,000 could target $90,000, while a drop below $80,000 may pressure altcoins further.

Major Forex Pairs: Dollar Gains, Lira Slumps, Mixed Signals Elsewhere

The U.S. dollar strengthened on Friday, rising 0.2% to 104.114 on the DXY (consistent with a reported 0.31% gain), leveraging a retreat in risk appetite. The index moved from 103.76 to 104.22, up from Thursday’s 103.8 close. EUR/USD declined to 1.0815 by Friday (from Thursday’s 1.0847, after falling to 1.0850 from 1.0878 post-Lagarde), marking a weekly drop exceeding 1%, driven by dollar strength and eurozone tariff concerns. ECB President Christine Lagarde cautioned that EU-U.S. trade escalation could shave 0.5 points off GDP, though she minimized sustained inflation risks, noting, “Inflation is decelerating appropriately, but trade tensions constrain rate commitments,” with ECB’s Villeroy de Galhau suggesting room for cuts. EUR/USD ranged 1.0795-1.0861 Friday, with support at 1.0780-1.0730 (1.0660 next) and resistance at 1.0900-1.1000. The British Pound strengthened after the BoE held rates at 4.5% on Thursday—eight of nine MPC members favored holding, one sought a 0.25% cut—linking future easing to controlling inflation (3.0% in January, projected at 3.7% in 2025, above 2%), supporting GBP/EUR and softening GBP/USD declines. The Turkish lira plunged, with USD/TRY at 37.9482, down 3.7% weekly—its steepest fall since June 2023—amid political turmoil following Istanbul Mayor Ekrem Imamoglu’s detention, crashing the Borsa Istanbul 100 Index 7.8% ($30 billion lost) and pushing 10-year bond yields up 207 bps to 33.38%. Policy responses—a rate hike, $9 billion in dollar sales, and a 91-day bill—faltered amid unrest. Canada’s Tiff Macklem highlighted tariff risks, adopting a flexible inflation stance, potentially weakening CAD. Trump’s April 2 tariffs on India ($7 billion export risk) and China (20% duties) intensified forex pressures.

U.S. Inflation and Policy: Fed’s Cautious Stance Amid Tariff Fog

Inflation dynamics took center stage, with the Fed maintaining rates at 4.25%-4.5% on Wednesday and forecasting two 2025 cuts. Updated projections raised PCE inflation to 2.7% for 2025 (from 2.5%), driven by tariffs, while GDP growth was trimmed to 1.7% from 2.1%, reflecting subdued consumer spending and mixed sectoral data, per Powell. He emphasized “considerable uncertainty” around Trump’s tariff policies, stating, “The ultimate effects are paramount,” and stressed the Fed’s need for clarity, noting, “We’re not rushing; much of the inflation uptick ties to tariffs,” likely transient but dependent on persistence. Powell added that labor markets remain balanced, not fueling inflation, though recent surveys signal rising uncertainty. Fed voices—Powell, Williams, Goolsbee—upheld a 2% target with “modest tightening,” reducing 2025 easing expectations to 72 bps. Treasury buying surged, lowering 10-year yields to 4.237%, reflecting investor caution. Goldman Sachs advocated commodities futures as a hedge against inflation and portfolio stabilizer.

Market Drivers and Forward Look

• U.S. Policy and Inflation: Powell’s tariff focus and Williams’ hawkish tone bolstered the dollar and softened Treasury yields.

• Trump’s Trade Agenda: April 2 tariffs on India ($129.2 billion trade at stake) and China (20% duties) unleashed a “China Shock,” flooding markets and threatening jobs, impacting UK, Canadian, and Eurozone’s growth.

• Turkish Turmoil: Political instability drove a severe lira sell-off.

• Oil Momentum: Sanctions on Iran and OPEC+ cuts supported crude, aligning with Goldman Sachs’ commodity outlook.

• Crypto Outlook: Regulatory uncertainty balanced against bullish signals in a cautious market.

• Pound’s Fortitude: The BoE’s firm stance at 4.5%, targeting 3.7% inflation, propped up GBP amid tepid growth (0.7% in 2025).

• Eurozone Strain: Lagarde’s tariff concerns weakened the euro, with easing inflation opening cut possibilities.

• Canadian Exposure: The BoC’s tariff vigilance hinted at CAD risks.

• Geopolitical Factors: Gaza unrest lifted gold and oil; Heathrow disruptions hit European airlines—IAG (-3.5%), Wizz Air (-2.53%), Air France-KLM (-3.14%), EasyJet (-1.82%), Lufthansa (-2.5%)—with IAG facing 1-3% EBIT losses.

• Japan’s Wage Growth: A 5.4% rise—the highest in 34 years—bolstered yen prospects.

• India’s Challenge: Trump’s tariffs jeopardize $7 billion in exports, tempered by “Make in India” potential.

• Goldman Sachs’ Strategy: Commodities futures emerged as a bulwark against tariff risks, inflation, and overvalued equities.

Looking ahead, markets will monitor U.S. inflation updates, Turkish developments, crypto regulatory signals, tariff repercussions, and trade effects across Canada, the UK, and the Eurozone. Crude’s supply-driven strength, gold’s protective role, the lira’s fragility, the Pound’s resilience, the euro’s vulnerability, Japan’s yen momentum, India’s trade balancing act, and Goldman Sachs’ commodity pivot will shape strategies. Trump’s “America First” push—redefining global trade—casts a long shadow, with Powell and Lagarde highlighting the uncertainty as opportunities and challenges converge.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations