The recent trading week concluded amid a state of chaos dominated by sharp contradictions that swept through global markets and major institutions, forcing investors to reassess fundamental risks, redistribute capital, and rearrange their diversified asset portfolios.

Amid government deadlock in Washington and an unprecedented escalation in the trade war between superpowers, gold prices and shares of artificial intelligence and technology companies rose, while oil prices and U.S. Treasury yields declined.

The week clearly revealed unprecedented structural challenges placing central banks (the Fed and the European Central Bank) in an unenviable political and economic predicament, confirming that political and geopolitical factors have become the strongest determinant of key asset prices in global markets. However, the most prominent factor continuing to inflate the market is NVIDIA’s dominance in the AI sector, creating a divided world where revolutionary technology outperforms turbulent geopolitical factors.

First: Institutional Crises and Their Impact on Currencies and Bonds

The week witnessed a tangible erosion of institutional confidence in both the United States and Europe, directly reflected in currency performance and bond yields, increasingly pushing investors toward defensive assets and safe havens in search of refuge from policy volatility and legislative ambiguity.

The U.S. Government Shutdown and the European Crisis: Erosion of Confidence

The ongoing U.S. government shutdown is no longer a mere transient administrative disruption; it has transformed into an economic burden costing the gross domestic product an estimated $15 billion weekly, with no near-term end in sight, reducing national growth by 0.1 to 0.2 percentage points per week—a figure reflecting the growing impact of political paralysis on overall economic performance.

This paralysis has led to estimated losses for major defense companies reliant on government contracts for 60% to 75% of their revenues, with unrealized losses amounting to approximately $10 to $12 billion, threatening liquidity in sensitive defense supply chains and creating a state of cautious slowdown in capital spending. The disruption in releasing key economic data has also deepened uncertainty among policymakers and investors alike.

In parallel, the shock of French Prime Minister Sébastien Lecornu’s resignation shook confidence in the eurozone’s second-largest economy at the start of the week, pushing the EUR/USD pair to trade near 1.1560, barely above its weekly low of 1.1542. This European weakness was accompanied by a sharp 11 basis point rise in French 10-year government bond yields, increasing borrowing costs amid a fiscal deficit nearing 6% of GDP, clearly indicating the depth of the structural political and financial crisis reflecting ongoing uncertainty in the continent’s stability and its ability to achieve the fiscal cohesion needed to face economic challenges.

Trade Tensions and Collapse of Bond Yields: Treasury Safe Haven

The renewal of trade tensions, with President Donald Trump’s threat of a “massive escalation in tariffs” on China, led to a widespread risk-off wave globally. Beijing’s response was strategic, involving tightened controls on rare earth exports (critical elements for electric vehicles and chips widely used in defense industries), confirming that the confrontation has shifted to controlling strategic resources that form the technological backbone of modern industry.

The U.S. bond market’s reaction was immediate and strong; the benchmark 10-year Treasury yield fell to 4.061%, marking a daily decline of 0.081 basis points (1.96%). The 2-year yield dropped to 3.524%, while the 30-year yield fell to 4.649%, clearly reflecting investors’ fears of global growth slowdown potentially imposed by this trade escalation, and their urgent desire to seek shelter in U.S. government debt, still considered the most reliable safe haven compared to Germany’s yields (2.64%) or Japan’s (1.70%).

Monetary Policies: Fed Conflicts and Cautious Dollar Movement

Conflicts in Federal Reserve officials’ positions placed the week in a state of anticipation, confirming that the U.S. central bank is walking a tightrope between inflation risks and the need to support growth, directly impacting the dollar index and reflecting a tense balance between the two stances.

Internal Division in the Federal Reserve

Statements from senior Fed officials reflected the tug-of-war between inflation risks and the need for growth support, placing Federal Reserve Chair Jerome Powell in a delicate position requiring “precise calibration and patience.” Several central bank members and the monetary policy committee warned of the implications and risks of persistent inflation due to pressures from new tariffs that raise import costs and affect consumer spending power, projecting core inflation to remain near or above 3% by year-end—far higher than the Fed’s 2% target. The tone from some Fed members suggested discomfort with rapid easing, insisting that monetary policy remains “moderately restrictive,” noting that waiting two years for inflation to return to target might be too long for consumers, especially in the services sector.

In contrast, other Fed statements presented a more optimistic picture, indicating that inflation “came in much lower than feared” and that prior tightening was effective. These statements overall affirmed that the market is approaching a point where further labor market slowdown becomes “concerning,” opening the door to additional rate cuts if inflation deceleration continues, aligning with market expectations of two cuts later this year.

Dollar Performance:

Currency markets interpreted this divergence as further confirmation of the Fed’s “data-dependent” stance. The dollar index (DXY) fell slightly to trade near 99.4, where cautionary statements curbed bets on rapid cuts, while opposing statements prevented broader dollar weakness, resulting in a moderately stable currency reflecting the Fed’s balance between hawkish tightening bias and dovish easing flexibility, confirming the central bank’s tightrope walk to achieve equilibrium between price control and growth support.

Global Monetary Policy Divergence

European Central Bank (ECB): The ECB remains in a tightening bias to combat inflation but is threatened by undermining institutional confidence in the euro due to the French political crisis and growth slowdown, placing Christine Lagarde and her team in a delicate position to balance tightening with supporting the eurozone’s fragile recovery.

Bank of Japan (BoJ): It continues with monetary easing, keeping the Japanese yen under persistent downward pressure, recording its lowest levels in about eight months against the dollar, in sharp contrast to the Fed’s path, reflecting stark divergences in major economies’ responses to inflation.

NVIDIA Leads Massive AI Momentum

U.S. stocks maintained performance resilience, driven by AI momentum, largely ignoring short-term political risks, as fear of missing out (FOMO) bolstered investor confidence in the bull market that began about three years ago.

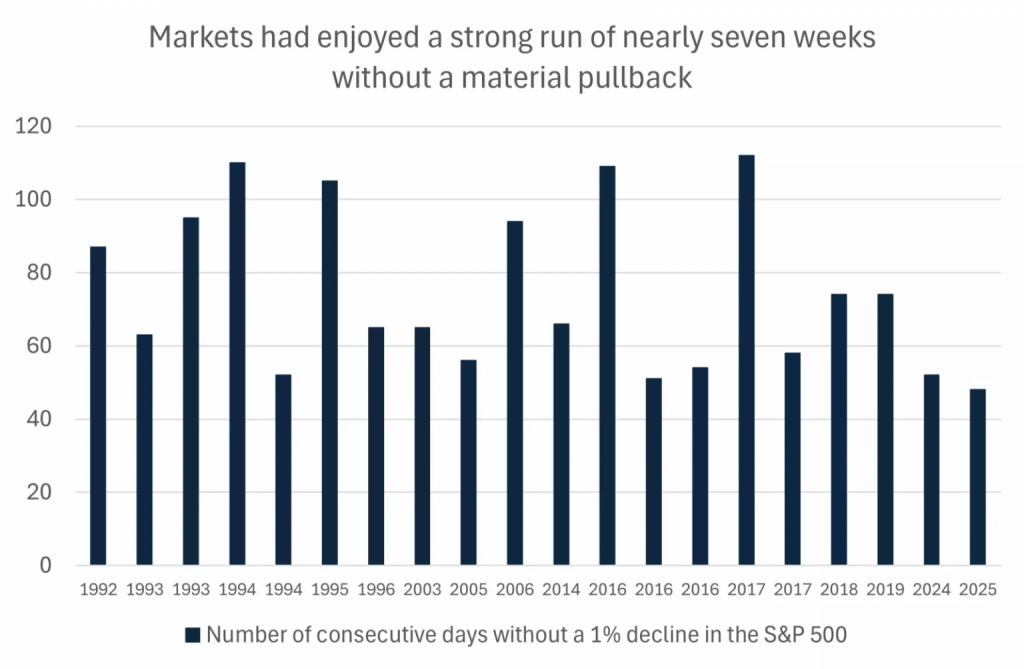

Stock Markets See Strong Performance for Nearly Seven Weeks Without Significant Pullback – Consecutive Days Without a 1% Decline in the S&P 500 Index

Source: Bloomberg

NVIDIA’s Pivotal Performance: An Unstoppable Leader

The week saw NVIDIA’s unprecedented market dominance continue, with its market capitalization surpassing $4.4 trillion, becoming the first company globally to achieve this milestone, with shares rising over 40% year-to-date, thanks to its commanding position in AI infrastructure.

Record High: NVIDIA shares traded near all-time highs on Friday (October 10), reaching about $188.59, with bullish projections up to $255 based on technical analysis.

Analyst Expectations: Most analysts raised their target prices to $300, expecting the company’s market cap to reach $7 trillion, with NVIDIA projected to capture at least 75% of the AI accelerator market, driven by massive demand for its infrastructure.

Fundamental Momentum: This rise is bolstered by enormous infrastructure demand; according to NVIDIA, its data center revenue in the third quarter of fiscal 2025 reached $30.8 billion, up 112% year-over-year. The company also announced a strategic partnership with OpenAI to deploy at least 10 gigawatts of NVIDIA systems, reflecting a major investment shift toward accelerated computing infrastructure, confirming that AI is not a bubble but a radical structural transformation.

Broadening AI Gains and Other Stocks

Nasdaq Momentum: The Nasdaq 100 remained trading near 25,192 points, supported by AI trade expansion into energy, construction, and logistics sectors due to growing data center infrastructure demand, reducing risks of market concentration in traditional tech stocks. The University of Michigan consumer sentiment index also indicated spending resilience, supporting overall optimism.

Company Performance: Intel shares rose 1.7% pre-market after an upgrade, while Applied Digital jumped 24.3% after beating revenue expectations, confirming strong data center demand. In contrast, Levi Strauss fell 7.2% after cutting annual profit guidance, highlighting increasing consumer sensitivity to price pressures.

European Stocks: European stocks remained under far greater pressure throughout the week due to the French political crisis and structural stagnation, exacerbating their weakness compared to U.S. momentum, as investors await third-quarter earnings to assess if fundamentals justify elevated valuations.

PepsiCo: A Mirror of the Consumer Economy

PepsiCo’s earnings provided an accurate picture of the economic situation; strong profits supported by international growth revealed slowing demand in North America. The company adopted a strategy of shrinking package sizes and incorporating olive and avocado oils to counter inflation pressures and meet “America’s Health” movement requirements, amid growing structural pressures from activist investor Elliott, with a $4 billion stake, to restructure operations and improve efficiency.

Fourth: Commodities and Cryptocurrencies: Flight from Risk

Commodities and cryptocurrencies performance sharply diverged, with trade threats pushing gold to new highs while battering oil, as tech stocks maintained their ascent.

Gold and Oil: Sharp Contrast

Gold: Trade tensions bolstered gold’s strength, breaking the $4,000 per ounce barrier, closing with 2.7% weekly gains, marking its eighth consecutive week of advances. Silver rose 2.1% to $50.13 per ounce, boosting its year-to-date gains over 73%, amid investor fears of geopolitical fallout and potential rate cuts.

Crude Oil: In contrast, West Texas Intermediate (WTI) crude collapsed 4% to close below $60 per barrel, its largest daily drop since June, as oil became the biggest victim of deteriorating global demand expectations due to trade escalation.

Cryptocurrencies: Profit-Taking Pressures and “Uptober”

Bitcoin: Bitcoin declined slightly, down 0.5% to $121,525.6 after hitting a record high above $126,000 earlier in the week. This pullback is attributed to profit-taking and growing doubts surrounding the U.S. government shutdown, which delayed key economic data releases. Nonetheless, Bitcoin retains a 6.2% monthly gain in October, showing the continued impact of seasonal “Uptober.”

Institutional Debate: Debate over cryptocurrencies intensified, with UK warnings that Bitcoin “has no intrinsic value,” indicating ongoing divergence between institutional adoption and traditional caution, despite the UK lifting regulatory bans on exchange-traded cryptocurrency investment products (ETPs).

The recent trading week was a true test of markets’ ability to separate political risks from technological opportunities. With gold continuing as the best safe haven and AI led by NVIDIA as the strongest driver, global investments’ fate remains hinged on the Fed’s ability to maintain balance amid governmental and trade crises in the final quarter of 2025. Political and institutional stability is the most valuable currency in the current phase.

The Week Ahead

The new trading week is expected to see significant focus from investors and traders on key U.S. economic data, with the Consumer Price Index (CPI) release on Wednesday, October 15, Producer Price Index (PPI) on Thursday, October 16, and jobs and retail sales data on Friday, October 17, among the highlights that could directly impact gold prices soaring to record levels for the first time, benefiting from geopolitical tensions and relative dollar weakness. Higher-than-expected inflation (around 2.9% annually) could push the U.S. dollar higher, pressuring gold prices, while for oil, this week follows OPEC+’s decision to increase production by about 137,000 barrels per day for November, raising fears of supply surplus and potentially driving Brent prices, which fell over 7% last week to around $64, further down, especially amid global economic slowdown concerns.

For currencies like the euro and pound sterling, these data will amplify their volatility with expectations of relative dollar stability if they confirm projections of two additional Fed rate cuts this year. In the cryptocurrency market, focus continues on volatility from trade policies, with Bitcoin retreating to around $120,000 after Trump’s new tariff threats, bolstering gold’s role as a safe haven alternative, while traders expect potential Bitcoin upside if inflation data eases dollar pressures.

Key events include the launch of the AI system and collective governance DAO in the ARK project on October 13, the release of G-SHOCK City game, and the unlocking of 83% of GRASS tokens, which could increase liquidity and volatility in related token prices.

The U.S. consumer confidence index on October 14 is also a critical marker for cryptocurrencies, reflecting general economic confidence that often drives investors toward digital assets in times of doubt, making this week an opportunity to monitor linkages between traditional and digital markets, with potential Ethereum upside if data shows weakness in the traditional economy. However, all this comes amid the ongoing U.S. federal government shutdown since October 1, 2025, due to Congress’s failure to agree on government funding, impacting operations of agencies like the Bureau of Labor Statistics and Census Bureau. If the shutdown persists, expect delays in releasing these key economic data like the aforementioned CPI and PPI, jobs, and retail sales, as they rely on government employees on furlough during the shutdown, as occurred in previous shutdowns like 2018-2019, where releases were postponed until government reopening, meaning they may not issue on scheduled dates unless the shutdown is resolved beforehand.

While some non-directly related data may continue to release, the main focus on these issuances increases uncertainty and affects traders’ decisions, making it essential to monitor daily updates from sources like the White House website or BLS to know if there’s a near-term agreement to end the government shutdown.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations