At midnight on September 30, 2025, the United States entered a government shutdown after Congress failed to agree on government funding, leading to the suspension of non-essential operations and the temporary furlough of thousands of non-essential federal employees. As the shutdown enters its fifth day on October 5, 2025, at the time of this report’s writing, the deadlock in negotiations between Democrats and Republicans continues, with threats of permanent layoffs that could accelerate a contraction in the labor market.

Caution is key in trading amid volatility, with a need to monitor evolving developments. The shutdown highlights how political dysfunction can ripple through the economy, but its impact is so far considered limited due to strong economic momentum, supported by resilient consumer spending and record investments in Artificial Intelligence (AI).

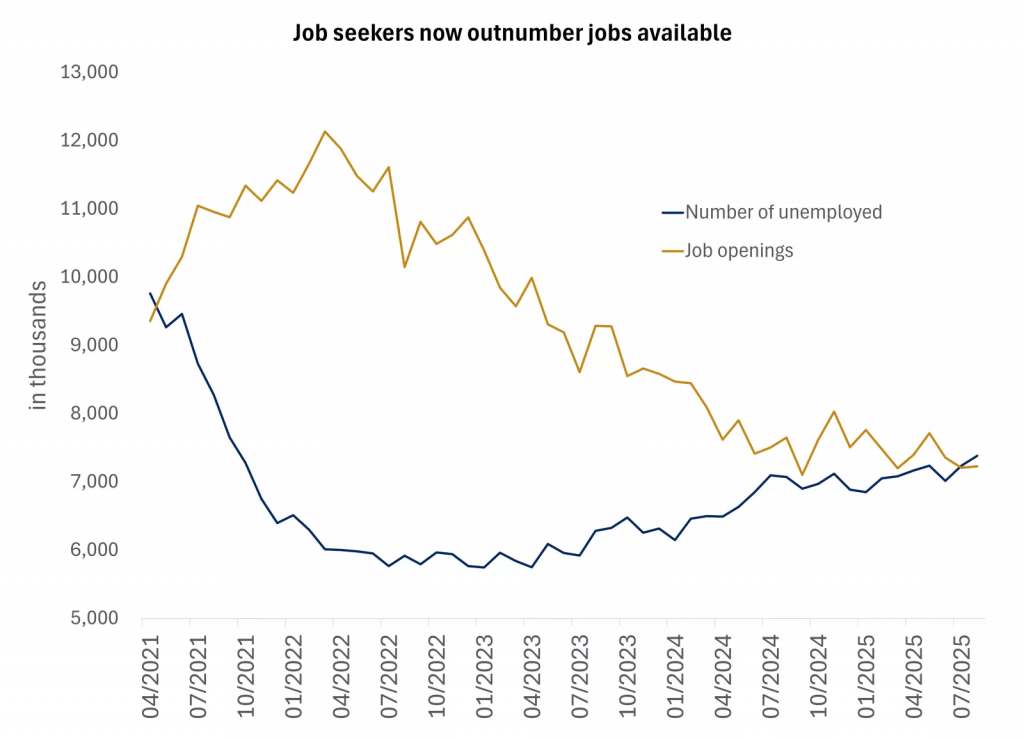

This shutdown differs from previous ones due to the threat of permanent federal job cuts, which monetary policymakers may view as additional pressure toward slower hiring. Therefore, traders and investors must closely monitor private sector indicators, relying on alternative proprietary data in the absence of official reports.

The Federal Reserve’s Rate Path Amid Data Drought

Federal Reserve officials re-calibrated their policy last month, resuming interest rate cuts after a year-long pause, citing a slowdown in the labor market and manageable inflation. Most view the current policy as leaning toward being restrictive and anticipate a gradual easing toward a neutral range of 3.0%–3.5% to counter downside employment risks.

Source: Bloomberg

The shutdown has disrupted the release of Non-Farm Payrolls and unemployment data, increasing reliance on secondary data like private ADP reports, which showed a decline in private payrolls. If the shutdown persists, it could strengthen the case for another 25-basis-point cut at the October 29, 2025 meeting, especially if the permanent federal layoff forecasts materialize. While some policymakers support the cut, others warn against the risks of excessive easing. However, the majority points to a calculated downward trajectory through 2026. Enhanced productivity via AI technologies may sustain growth, mitigating the risks of a traditional slowdown.

Gold Performance: Record Surge Amid Global Economic Fears

Gold saw a remarkable rally last week, setting new record highs of $3,899.40 per ounce before stabilizing near $3,886, with weekly gains exceeding 3.2% and monthly gains over 9% in September 2025. This surge is due to fundamental factors, most notably the risks of the US government shutdown, which raised doubts about the stability of the world’s largest economy, driving investors toward safe-haven assets.

Expectations of Federal Reserve rate cuts, supported by stable inflation data, have reduced the cost of holding gold. A weaker Dollar—with the DXY index dropping 0.15% to close at 97.711—made gold more attractive to foreign buyers. Furthermore, geopolitical tensions, such as conflicts in Eastern Europe, bolstered demand for the yellow metal as a hedging tool.

With continued Central Bank purchases, particularly in Asia, gold maintains its momentum as one of the safest assets in an unstable environment, especially with the Dollar’s decline. This reflects continued weakness against the basket of major currencies (Euro 57.6%, Japanese Yen 13.6%, British Pound 11.9%, Canadian Dollar 9.1%, Swedish Krona 4.2%, Swiss Franc 3.6%).

Silver Performance: Rise Supported by Industrial Demand and Economic Stimulus

Silver showed strong performance during the week, breaking records in September to reach about $48 per ounce, with gains exceeding those of gold at times and expectations for reaching higher levels in 2026. This rise reflects its dual role as a safe haven and an industrial metal, as industrial demand accounts for about 58% of global consumption, driven by the expansion of the renewable energy sector, such as solar cells, as part of China’s pledges to reduce emissions by 7-10% by 2035.

Economic stimulus measures in China, including interest rate cuts, boosted industrial activity, increasing demand for silver in electronics and electric vehicles. Concurrently, the Dollar’s weakness, down 0.15% daily and 9.97% year-to-date, supported silver as a cheaper alternative, despite supply constraints resulting from mine disruptions in Indonesia. This suggests continued upward pressure amid global economic challenges.

Oil Performance: Limited Volatility Due to Global Demand Concerns

Oil experienced slight fluctuations during the week ending October 3, 2025, closing at $60.68 per barrel, after trading in a daily range between $60.55 and $61.38. Brent crude closed at $64.37 per barrel, after trading in a daily range between $64.20 and $65.02. This performance comes amid concerns of a global demand slowdown, particularly in the US, where the government shutdown disrupted economic data, increasing consumption uncertainty.

A contraction in China’s manufacturing activity for the sixth consecutive month also lowered forecasts, despite Beijing’s pledges to increase monetary stimulus to support growth. On the positive side, Federal Reserve policies provided some support, but the expected OPEC+ production increase of 547,000 barrels per day exerted downward pressure, reflecting a delicate balance between supply and demand in the global oil market. According to market analyses, some traders anticipate a bullish rebound for US crude toward $65–$66.40 from demand zones at $64.35–$64.70, supported by a positive divergence in the RSI, while others focus on selling opportunities with the potential for a further decline toward $61.84 if key support is broken. For Brent, expectations suggest a potential rise toward $69.5–$70, reflecting the impact of geopolitical tensions on short-term prices.

US Stocks Performance: Record Gains Despite Government Shutdown

US stocks achieved strong weekly gains, with the S&P 500 rising 1.1% in the week ending October 3, 2025, recording a record close at 6,715.79. The Dow Jones climbed 1.1% to 46,758, and the Nasdaq rose 1.3% to 22,780. Investors largely ignored the government shutdown risks, preferring to focus on expectations of two additional Federal Reserve rate cuts in 2025 amid rising unemployment and inflation concerns. Strong corporate earnings, especially in the technology sector, contributed to the upward push, supported by AI growth and a resilient economy. This performance reflects the market’s confidence in the US economy’s ability to overcome political challenges, despite warnings of potential shocks if the shutdown is prolonged.

Source: Bloomberg

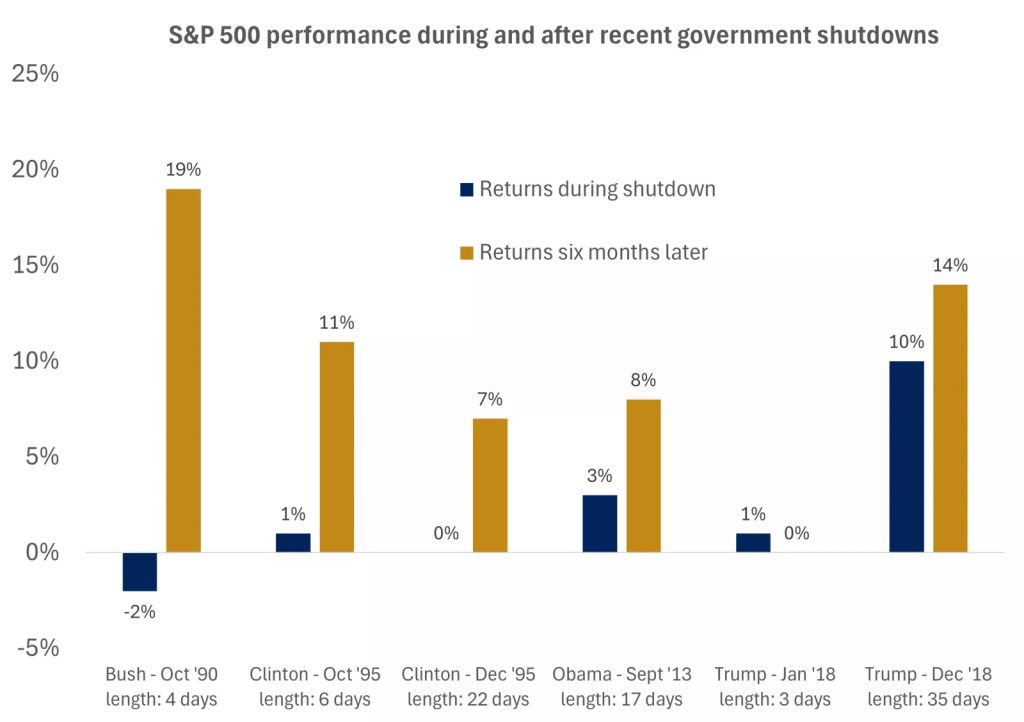

US stocks ended the third quarter strongly, with the S&P 500 up 8%, Nasdaq up 11%, and small-cap stocks up 12%. AI innovations and lower prices propelled the semiconductor sectors, leading to 31 new all-time highs this year. Historically, of 20 shutdowns since 1976, stocks rose during half of them and advanced three to six months afterward, suggesting a limited long-term impact. However, after a 35% climb since April without major pullbacks, profit-taking might increase amid uncertainty. Corporate earnings, expected to grow in double digits for the fourth consecutive quarter, will provide further evidence.

European Stocks Performance: Stability with Strong Monthly Gains

The week ended with a 0.53% rise in the STOXX 600 index to 567.60, marking its best week since April with gains reaching 2.4%, supported by the healthcare sector which climbed 0.9%. Deals like the Pfizer agreement helped alleviate uncertainty, while cooling bond sales helped calm markets. Rising metal prices boosted the mining sector by 1.7%, despite the US shutdown concerns delaying global data. However, European markets have lagged Wall Street due to financial challenges, suggesting a need for more monetary support from the European Central Bank (ECB) to maintain momentum.

Asian Stocks Performance: Trade Pressures with Positive Signals from China

Asian stocks faced mixed pressures, with the Hang Seng down 0.9% to 27,052, despite weekly gains reaching 3.9% in some Chinese markets due to stimulus. A proposal for new US tariffs heightened caution, especially ahead of China’s holidays, with manufacturing activity contracting for the sixth month. However, Beijing’s pledges for increased monetary support provided some backing, boosting gold stocks like Zijin Gold by 66% on its listing. The Nikkei climbed 1.8%, reflecting the impact of trade tensions on the region, with expectations of better growth in 2025 if the stimulus succeeds.

Monetary Policy and the Chinese Economy: Crucial Impact on Global Markets

In the global monetary policy context, the Federal Reserve’s recent rate cuts stand out, leading to a weaker Dollar (down 4.12% year-over-year in the DXY index) and supporting other assets like gold and stocks, despite the shutdown.

In China, the Central Bank has pledged to increase monetary support to achieve 5% growth in 2025, following a six-month manufacturing contraction, which boosts demand for industrial metals like silver. This stimulus faces challenges from trade tensions with Washington but provides support for Asian and global markets, with stronger growth expected in the second half of the year. These dynamics underscore how monetary policies in China and the US form the core of global stability, especially amidst political and geopolitical uncertainties.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations