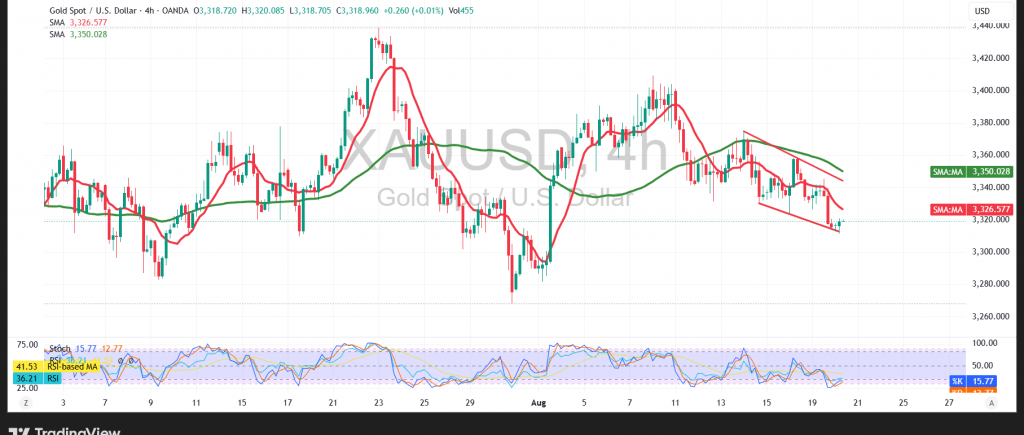

Gold prices (XAU/USD) saw a sharp decline during the previous trading session, continuing the movement anticipated in our last technical report. Prices have already touched the target level of $3310.

Technical Outlook – 4-Hour Timeframe

Gold prices are trading below the major support level around 3325, which was broken during the previous session. The price continues to move consistently within a short-term descending channel. This is occurring while the 50-day Simple Moving Average (SMA) continues to exert negative pressure. Although the Relative Strength Index (RSI) has reached oversold territory, the weak upward momentum reflects the extent of the sellers’ dominance.

Probable Scenario:

Bullish Scenario: The bearish wave remains in control as long as trading stays below 3340, which increases the chances of continued decline. A clear break of the 3310 support level would pave the way for losses targeting 3305 as the first support area, followed by 3290 as a major support area.

Bearish Scenario: A breakout above the 3340 resistance level could open the door for a recovery attempt, quickly targeting 3359 and then 3368.

Fundamental Note:

• High-Impact Data: On Wednesday, markets are awaiting high-impact economic data from the U.S. economy: the Federal Reserve’s FOMC Meeting Minutes. This data could cause strong price volatility upon its release.

Warning: The risk level is elevated due to ongoing trade and geopolitical tensions, and all scenarios are possible.

Risk Disclaimer: Trading in Contracts for Difference (CFDs) involves risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 3305.00 | R1: 3340.00 |

| S2: 3290.00 | R2: 3359.00 |

| S3: 3271.00 | R3: 3374.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations