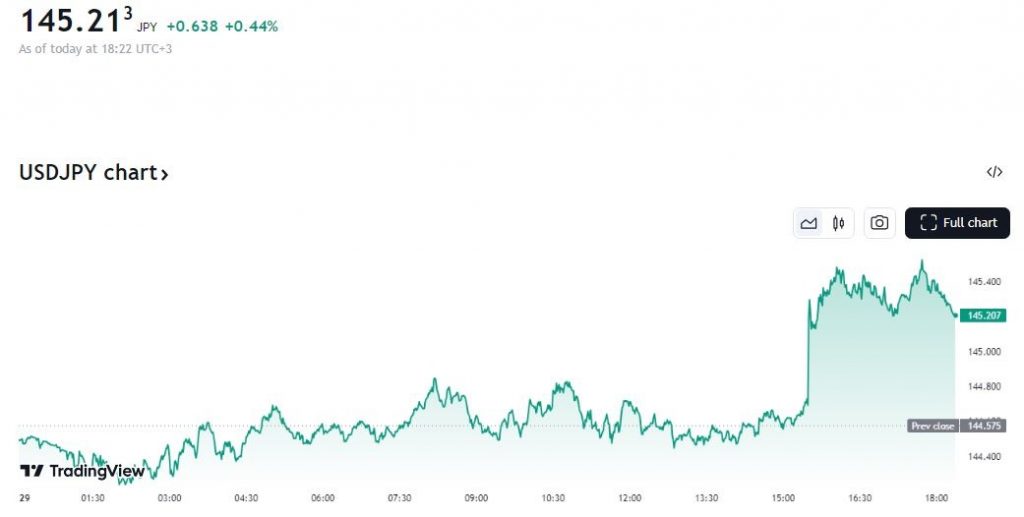

The USD/JPY pair recovered and is trading 0.44%, at 145.21 at the time of writing. Earlier on Thursday’s trading, the pair remains confined below the crucial resistance level of 145.00, reflecting a cautious stance from investors ahead of the highly anticipated US Personal Consumption Expenditure (PCE) inflation report for July. This key economic indicator, scheduled for release on Friday, is expected to significantly influence the Federal Reserve’s (Fed) decision on interest rate adjustments in September.

Global market sentiment is currently asset-specific, with risk-sensitive currencies facing selling pressure while the S&P 500 futures demonstrate resilience. The US Dollar Index (DXY) continues its upward trajectory, surpassing the 101.20 mark.

The upcoming US PCE inflation report holds immense importance as it will likely drive the next move in the US Dollar (USD). Market participants are keenly focused on the data to gauge the Fed’s potential pivot toward policy normalization in September. While the CME FedWatch tool suggests a high probability of rate cuts, there remains uncertainty regarding the magnitude of these adjustments.

In addition to the PCE inflation data, investors are also closely watching other economic indicators. Revised estimates for Q2 Gross Domestic Product (GDP) and Initial Jobless Claims are due for release, providing valuable insights into the health of the US economy. Particular attention is being paid to the jobless claims data, as the Fed has expressed growing concerns about a potential deterioration in the labor market.

On the Japanese front, the Japanese Yen (JPY) is receiving support from the expectation of further interest rate hikes by the Bank of Japan (BoJ). BoJ Deputy Governor Ryozo Himino recently reiterated the central bank’s commitment to adjusting monetary policy if economic activity and prices deviate from projections.

Furthermore, investors are eagerly awaiting the release of the Tokyo Consumer Price Index (CPI) data for August. The inflation report is anticipated to show a steady increase in the CPI, excluding fresh food, of 2.2%.

As the market eagerly awaits the release of these crucial economic indicators, the USD/JPY pair is likely to remain volatile. Investors are closely monitoring developments to assess the potential impact on both domestic and global markets.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations