The USD/JPY pair experienced a significant decline during the recent North American trading session, falling below the crucial 144.00 level, at 143.61 as of this writing This downward movement was primarily driven by a combination of factors, including weaker-than-expected US job market data, increased expectations of a potential interest rate cut by the Federal Reserve, and a broader bearish market sentiment.

US Job Market Data:

The release of weaker-than-expected US Job Openings and Labor Turnover Survey (JOLTS) data for July fueled speculation that the Federal Reserve might need to ease monetary policy to support economic growth. This expectation led to a decline in US Treasury yields, which, in turn, put pressure on the US dollar.

Interest Rate Expectations: The market’s growing anticipation of a potential interest rate cut by the Federal Reserve also contributed to the decline in the USD/JPY pair. A rate cut would typically weaken the US dollar, making it less attractive to investors.

Broader Market Sentiment: The overall bearish sentiment prevailing in the financial markets also played a role in the decline of the USD/JPY pair. Risk-off sentiment, driven by concerns about global economic growth and geopolitical tensions, often leads to a weakening of risk-sensitive currencies like the US dollar.

Technical Analysis

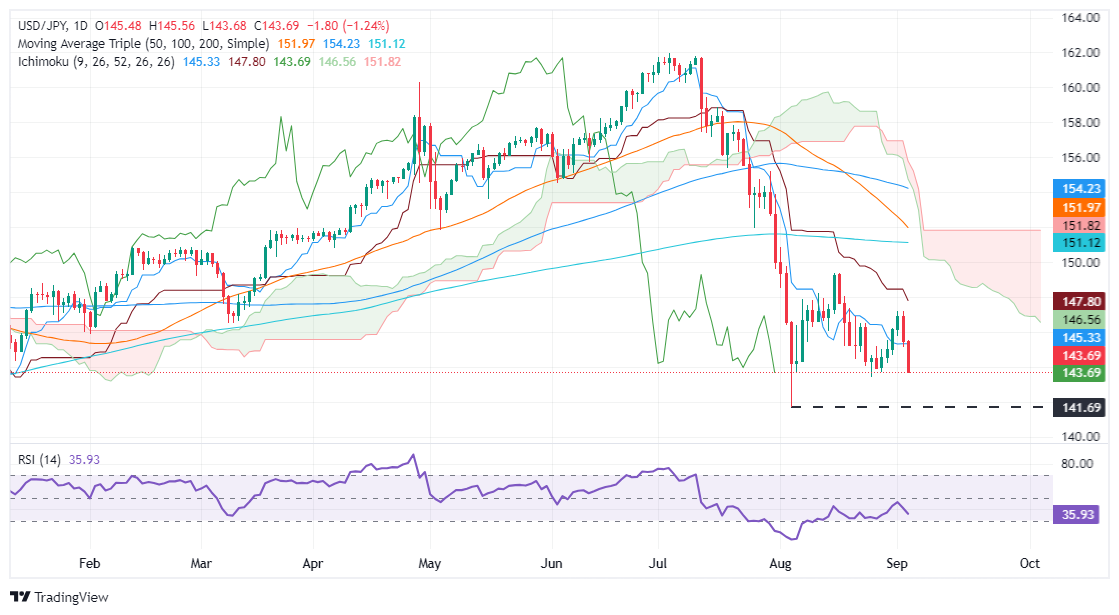

From a technical perspective, the USD/JPY pair’s recent downtrend is supported by bearish momentum as indicated by the Relative Strength Index (RSI). The immediate support level for the pair is at 143.45. If this level is breached, further downside is likely, with key psychological supports at 143.00, 142.50, and 142.00.

For a bullish reversal, the USD/JPY pair must reclaim the Kijun-Sen at 148.45 and subsequently break above the 150.00 level.

USD/JPY Forecast:

The future direction of the USD/JPY exchange rate is unpredictable. It could continue to fall if the Federal Reserve lowers interest rates or if overall market conditions worsen. However, the situation might improve if the US economy strengthens or if investor attitudes change. To understand how these factors will affect the USD/JPY pair, investors should keep a close eye on the US economy, Federal Reserve decisions, and global market trends.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations