The US Dollar experienced a decline on Thursday following the release of mixed economic data. While services sectors showed signs of growth, labour market indicators hinted at potential weakness. This confluence of factors has led investors to speculate on a more aggressive interest rate cut by the Federal Reserve in September.

US Dollar’s recent decline is primarily driven by mixed economic data and increasing expectations for a more aggressive rate cut by the Federal Reserve. As investors closely monitor upcoming economic releases, particularly the Nonfarm Payrolls report, the trajectory of the US Dollar is likely to remain volatile. The interplay of domestic economic factors, global events, and trade policies will continue to shape the currency’s future direction.

Key Economic Indicators

Labour Market

ADP Employment Change fell short of expectations, indicating a slowdown in job growth. The data showed that 99,000 jobs were added in August, compared to the consensus estimate of 122,000. This marked a significant decline from the revised July figure of 111,000.

Initial Jobless Claims remained relatively low, suggesting a resilient labour market. However, they rose slightly to 227,000 from 232,000 in the previous week.

Continuing Claims decreased from 1.860 million to 1.838 million, indicating fewer individuals remained unemployed for more than one week.

Nonfarm Productivity increased slightly to 2.5% from 2.3% in the previous quarter, suggesting that workers were becoming more efficient.

Labour Costs fell from 0.9% to 0.4%, indicating a potential easing of inflationary pressures.

Services Sector: S&P Global’s Services PMI rose from 55.2 to 55.7, indicating expansion in the services sector. The Composite PMI increased from 54.1 to 54.6, suggesting overall economic growth. The ISM’s Services PMI improved slightly from 51.4 to 51.5, remaining above the 50-point level that indicates expansion.

The Employment Index within the ISM Services PMI declined from 51.1 to 50.2, indicating a potential cooling in the labour market. The mixed economic data has increased expectations for a more significant interest rate cut by the Federal Reserve in September. The CME FedWatch Tool now suggests a 55% probability of a 25 basis point cut and a 45% probability of a 50 basis point cut. This shift in expectations reflects growing concerns about the potential for a recession and the need to stimulate economic growth.

Technical Factors:

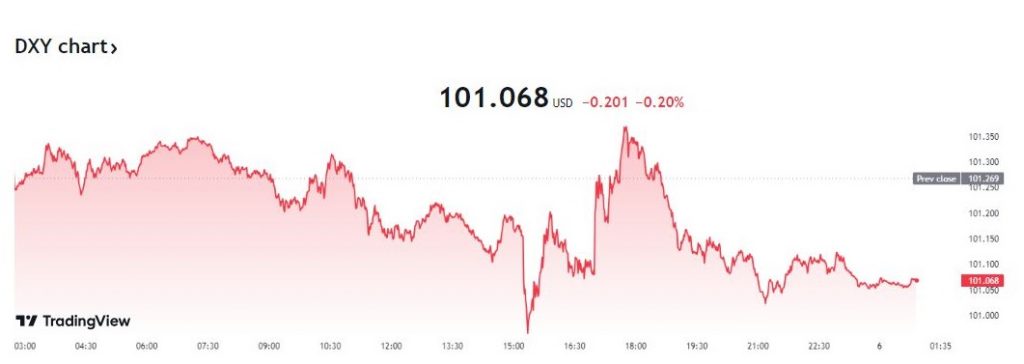

The US Dollar Index’s technical indicators continue to suggest a bearish trend. The index has encountered resistance at its 20-day Simple Moving Average, signaling a potential downward move. Support levels are at 100.50, while resistance levels are at 101.80, 102.00, and 102.30. The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) remain in negative territory, indicating continued bearish momentum.

Factors Affecting the US Dollar: In addition to domestic economic data, several other factors are influencing the US Dollar’s value. These include:

Global Economic Conditions: The global economic outlook, particularly in Europe and China, can impact the demand for US assets and the value of the US Dollar.

Political instability or tensions can lead to safe-haven flows into the US Dollar. Trade disputes or changes in trade policies can affect the US Dollar’s value by influencing the country’s current account balance.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations