The recent US nonfarm payrolls report delivered a resounding message: the American labour market remains a force to be reckoned with. December witnessed a robust 256,000 job additions, significantly surpassing expectations and solidifying the economy’s resilience. This robust growth, particularly evident in the private sector, underscores the continued strength of the US economy despite the ongoing global economic headwinds.

While manufacturing employment contracted slightly, this was a minor blip on the radar compared to the broader picture of robust job creation. The unemployment rate unexpectedly dipped to 4.1%, further emphasizing the tightness of the labour market. This robust demand for labour is a testament to the underlying strength of the US economy and consumer confidence.

Most notably, wage growth moderated to 3.9% year-over-year. This moderation is a crucial development for the Federal Reserve. The central bank has been closely monitoring wage growth as a key indicator of inflationary pressures. While still elevated, the moderating trend suggests that the Fed’s efforts to cool the economy may be starting to bear fruit.

Implications for Monetary Policy

This robust employment data, coupled with moderating wage growth, reinforces the Federal Reserve’s patient stance on interest rate cuts. The central bank is navigating a delicate balancing act: maintaining economic growth while mitigating the risks of persistent inflation. The current data suggests that the Fed may be successfully steering the economy towards a “soft landing,” achieving a gradual cooling of the labour market without triggering a significant economic slowdown.

However, the Fed must remain vigilant. Global economic uncertainties, including the ongoing geopolitical tensions and the potential for a global recession, could impact the US economy. The Fed will need to carefully monitor these external factors and adjust its monetary policy stance as needed to ensure the stability and sustainability of the US economy.

Market Reactions and Outlook

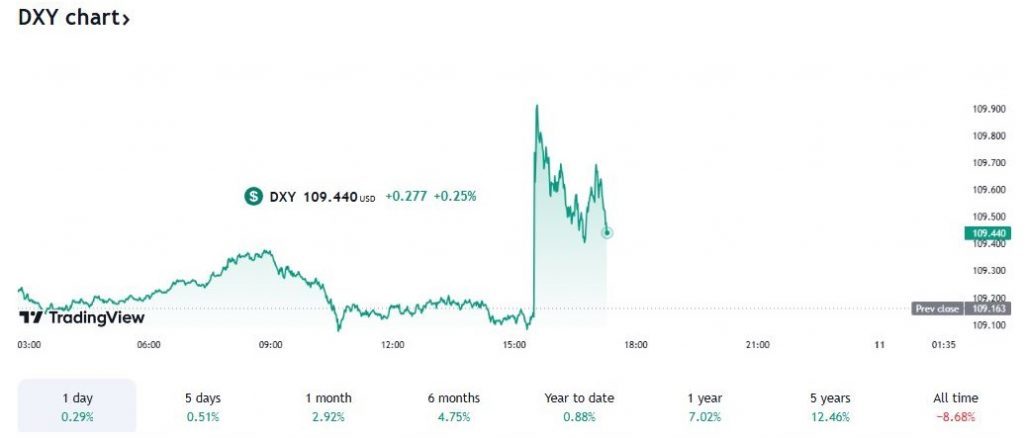

The robust employment data has had a significant impact on financial markets. The US dollar has strengthened, reflecting increased confidence in the US economy. Conversely, bond yields have risen, reflecting expectations of a continued pause in interest rate cuts and the potential for a longer period of higher interest rates.

DXY Performance Post-NFP – Source: TradingView

Global equity markets, particularly in Europe, have experienced some weakness as the stronger dollar and higher yields impact global economic activity. The stronger dollar makes US exports more expensive, potentially impacting global trade flows. Higher interest rates increase bourrowing costs for businesses and consumers, potentially slowing economic growth.

The Road Ahead

The US labour market remains a crucial driver of the broader economy. Continued job growth, coupled with a gradual cooling of wage growth, will be essential for maintaining economic stability and achieving the Fed’s dual mandate of price stability and maximum employment.

While the current data provides a positive outlook, it is crucial to remain mindful of potential headwinds. The global economic landscape remains uncertain, and unforeseen events could significantly impact the US economy.

The Fed will continue to carefully assess incoming data and adjust its monetary policy stance as needed to ensure a sustainable economic trajectory. The path ahead may involve navigating a delicate balance between supporting economic growth and mitigating inflationary risks.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations