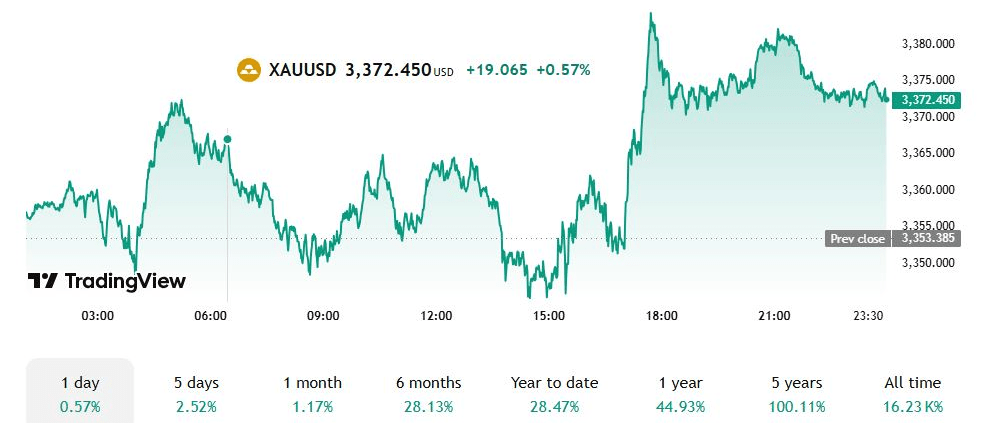

Rising amidst economic headwinds, gold has once again demonstrated its traditional role as a safe-haven asset. Recent economic indicators from the United States, alongside escalating trade tensions, have fueled a notable rally in bullion prices, pushing gold to 3,382 after touching a daily low of 3,343. This upward movement comes as investors seek refuge from uncertainty in a shifting economic landscape.

Source: TradinView.com

A Cooling US Economy and Its Implications

Recent data suggest a significant cooling in the US economy, which could prompt a re-evaluation of monetary policy. The Institute for Supply Management (ISM) reported a contraction in the services sector for the first time in nearly a year, indicating a broader slowdown in business activity. Concurrently, the ADP National Employment Change data revealed a sharp deceleration in private sector hiring for May, adding only 37,000 jobs against an estimated 110,000. These figures collectively paint a picture of an economy losing momentum, leading to a decline in US Treasury yields and a weakening dollar, both of which typically provide tailwinds for gold. The US Dollar Index (DXY) notably fell 0.44% to 98.81, while the 10-year Treasury yield plunged 7.5 basis points to 4.383%.

Trade Tensions Add Fuel to the Fire

Compounding the economic slowdown are escalating trade tensions between the US and China. President Donald Trump signed an executive order increasing tariffs on steel and aluminum from 25% to 50%, effective June 4. This move, ahead of a scheduled call between President Trump and Chinese President Xi Jinping, signals a hardening stance in trade relations. Such geopolitical friction typically heightens market volatility and encourages a flight to safety, with gold being a primary beneficiary. The uncertainty surrounding the outcome of these trade discussions is expected to continue underpinning gold prices.

The Federal Reserve’s Stance and Market Expectations

Despite the softening economic data, Federal Reserve officials have expressed a patient approach regarding further easing of monetary policy. They emphasize the unknown impact of tariffs on inflation and the broader economy, suggesting caution before resuming the easing cycle that began last year. However, money markets reflect a different sentiment, with traders pricing in 54 basis points of easing by the end of the year, according to Prime Market Terminal data. This divergence between the Federal Reserve’s stated position and market expectations adds another layer of complexity, keeping investors attuned to upcoming data releases, particularly US Initial Jobless Claims and Nonfarm Payroll figures, for further cues on the trajectory of monetary policy.

Gold’s Technical Outlook

From a technical perspective, gold remains in a bullish trend. Although it briefly failed to clear the current week’s peak of 3,392, momentum indicators, such as the Relative Strength Index (RSI), suggest that buyers are in control. A decisive breach above the 3,400 mark would likely clear the path for gold to test higher resistance levels, including the May 7 peak of 3,438, followed by 3,450, and ultimately, the all-time high of 3,500. The confluence of a slowing US economy, escalating trade tensions, and the Federal Reserve’s cautious stance creates fertile ground for gold to maintain its upward trajectory as a preferred safe-haven asset.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations