The United States is seeing increased expectations that the recent surge in inflation might be as temporary or transitory as currently expected.

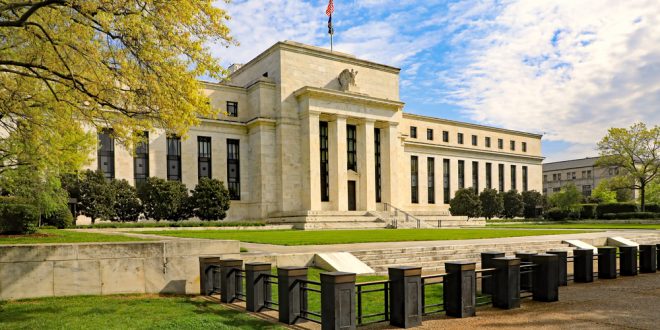

The President of the Federal Reserve Bank of Atlanta, Raphael Bostic, believes that raising interest rates could take place next year, given the upside surprise in recent data points, but said the temporary inflationary pressures will last longer than expected.

Recent expectations said that the huge jump in consumer prices may easy by the end of the summer, but Bostic disagrees.

“Temporary is going to be a little longer than we expected initially.”

“Rather than it being two to three months it may be six to nine months.”

Fed Governor Michelle Bowman also said today that it could take some time for inflation to ease.

The President of the Federal Reserve Bank of Boston, Eric Rosengren, said on Wednesday that the Fed must closely monitor financial stability risks and the rising home prices.

“Long periods of very low interest rates do encourage people to take risk, Rosengren said during an event organized by the National Association of Corporate Directors, noting that despite the surge in home prices being similar to the last housing crisis, the same scenario will likely not be repeated.

“The money-market fund reform that occurred after the last crisis actually made things worse and so far there has not been a solution.”

Rosengren expects inflation in 2022 will be a little above 2%.

Yesterday, Fed Chairman Jerome Powell told lawmakers on Tuesday that the economy has achieved progress on its way to recovery from the Coronavirus crisis, indicating no plans to raise interest rates too soon just to combat what it still views as a transitory inflation rise.

“We will not raise interest rates pre-emptively because we fear the possible onset of inflation. We will wait for evidence of actual inflation or other imbalances.”

Powell also ruled out huge sustainable inflationary pressures, similar to what the U.S. saw in the 1970s, as the Fed remains committed to price stability.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations