The US jobs print on Friday could impact the Fed’s future policy course. A dismal NFP could weaken the US dollar further, and attention might be drawn to the dollar’s major pairs, to determine which assets are winners and which losers. While GBP awaits fiscal clues, policy direction from China may have a greater impact on the AUD than the yuan. The Swiss CPI may affect expectations of a March rate cut, but the appeal of the NZD remains a reliable guide, to give a brief summary of the recent market backdrop.

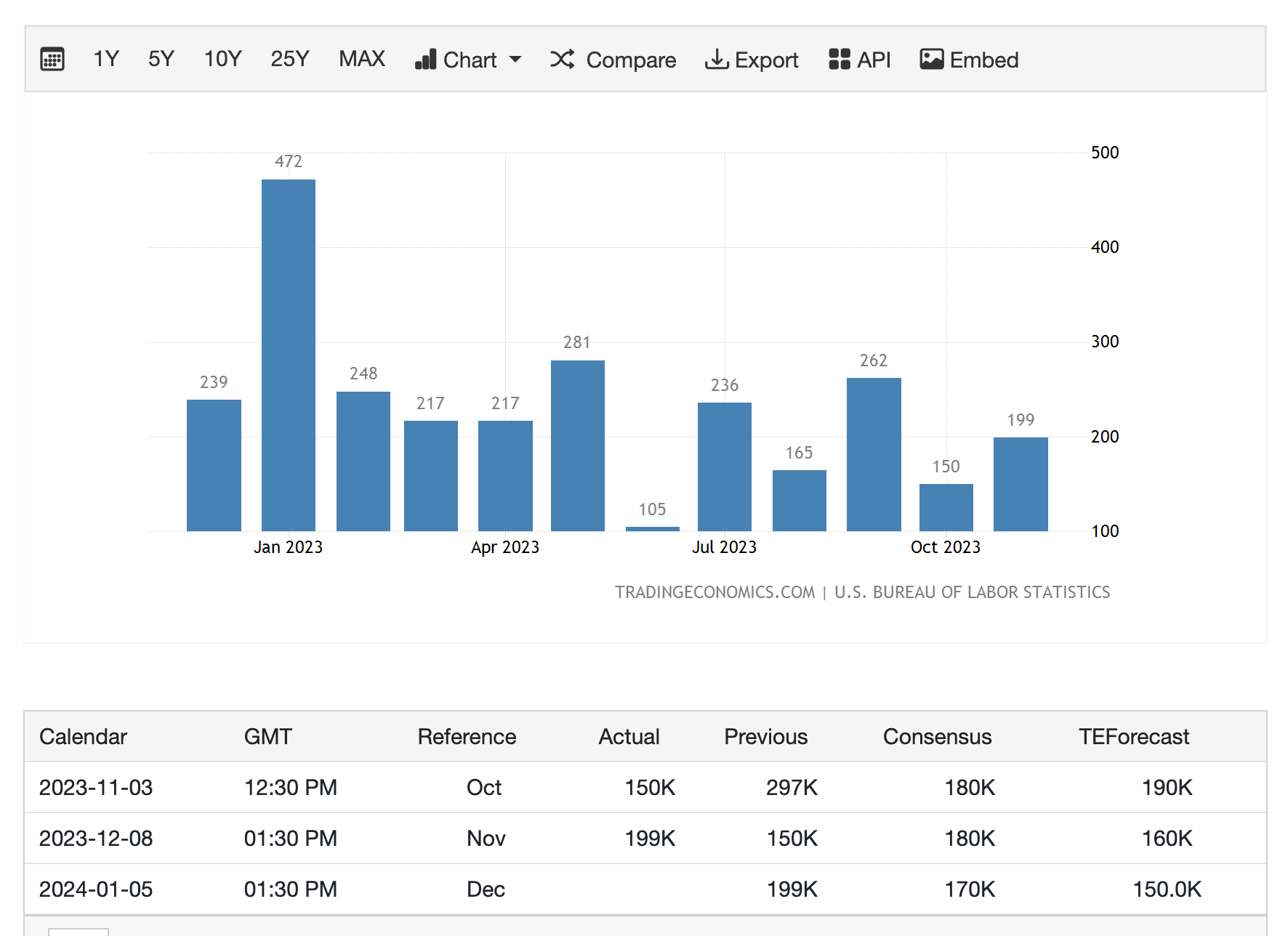

Expectations tend to suggest a 200K rise in Nonfarm Payrolls following the stronger-than-expected 353000 previous. Average Hourly Earnings could slow to 4.3% versus the previous 4.5% in January, and the Unemployment Rate is poised to remain steady at 3.7%.

Ahead of the key NFP data, the dollar deepened its decline, causing the USD Index to break below the 103.00 support for the first time since early February. The DXY Index is standing at the 102.818 mark, down -0.52% at the time of writing. The continuation of the solid sentiment surrounding risk-linked assets kept the dollar under additional pressure.

The US Nonfarm Payrolls data for February is expected to have a larger impact on the EUR/USD than Thursday’s ECB policy announcement. The upcoming print, if upbeat, is is expected to boost consumer confidence and spending, further boosting the US economy.

It is worthy to remind investors that the substantial appreciation of USD/JPY on the day after the January NFP data exceeded expectations is proof that NFP can have a big effect on currency valuations.

Interest rates are influenced by employment data in addition to the performance of financial assets across several markets. If the NFP report is good again, the US rate-cutting process may take longer to begin. In USD/JPY, a break over the 150.93 mark could push the pair to 151.88.

Due to the fact that investors typically adjust their holdings of assets in reaction to the economic outlook provided by NFP figures, this emphasizes how sensitive the price movement of the assets is to employment data.

Interest rate policy path is also influenced by employment data. For example, the fact that 10-year Treasury yields reached year-to-date highs near 4.15% after a robust January NFP data, this shows how encouraging employment data can raise inflation expectations and prompt the Fed to change interest rates sooner.

This link demonstrates how NFP data can have a cascading effect on different financial sectors. The figures would probably be positive once more if the stock indices served as an economic alternative. Still, nothing is harder to anticipate than how the NFPs will turn out.

The US rate-cutting process may take longer to begin if the NFP report is good again. With a 70% probability, Fed funds futures are pricing in 25 basis point rate cut at the June 12 meeting.

Conversely; an extremely poor NFP number will make a rate cut more likely and cause the dollar to decline. Under these circumstances, the USD/JPY might drop below 149.06 and reach the subsequent support level at 147.73. Another market to watch is, indeed, the gold market, which is currently well prepared to soar and has turned higher. A drop to the breakout point in $2088 will likely be met with cheers for late buyers.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations