As of today, Monday, August 25, 2025, markets are waking up to a new and completely different landscape from the beginning of last week’s trading. The final week, which concluded on August 22, 2025, was a complex work of art on which the U.S. Dollar’s (USD) movements charted a path full of volatility and shifts.

It’s worth noting that the week, which began with a notable degree of caution and anticipation, ended with a louder drumbeat of change following a highly anticipated and decisive speech from Jerome Powell, Chairman of the Federal Reserve Board of Governors. Initially, things appeared to be moving in favor of the greenback. The U.S. Dollar Index (DXY), which measures the dollar’s value against a basket of major currencies, managed to cross the 97.90 barrier on Monday, August 18, thanks to a slight increase in U.S. Treasury yields.

This rise was not random but was supported by strong fundamental factors. First, the slight increase in U.S. Treasury yields made the dollar more attractive to investors seeking returns in a global environment filled with uncertainty. Second, there were prevailing expectations that Fed Chairman Jerome Powell might adopt a more hawkish tone in his anticipated Jackson Hole speech, which could signal a potential delay or reduction in the number of interest rate cuts. These expectations led traders to accumulate long positions on the dollar, believing it would remain strong.

However, this scenario changed dramatically on Friday. Powell delivered a speech that surprised markets with its more moderate, dovish tone, indicating that upcoming economic data, especially any related to potential weakness in the labor market, could justify an interest rate cut. These words came as a surprise, and markets immediately began pricing in a rate cut scenario for the upcoming September policy meeting, which triggered a strong wave of selling for the dollar.

Source: Bloomberg

The DXY closed the week at 97.732, below its peak at the start of the week, confirming that investors had already begun abandoning their positions in favor of other assets. This radical shift in expected policy will place the dollar on the defensive in the coming days as investors now await more economic data, such as inflation figures and consumer confidence indicators, to confirm that an interest rate cut is imminent.

Gold: A New Era of Brilliance Fueled by Hopes of Easing

Gold, the historical safe haven, put in a remarkable and convincing performance last week, with its price rising by 1.43% despite the sharp volatility at the beginning of the week. Gold, which provides no yield, becomes more attractive to investors when interest rates fall or are expected to fall, as this reduces the opportunity cost of holding it compared to yield-bearing government bonds. This is precisely what happened: Powell’s speech strengthened rate-cut expectations, leading to a flow of money into the yellow metal. Gold closed the week at $3,364.190 per ounce, after trading near $3,317 at the start of the week. This strong performance suggests that gold may be entering a new phase of a rally, especially if rate-cut expectations continue to solidify. Moreover, ongoing, albeit minor, concerns about inflation, along with intermittent geopolitical tensions, will continue to support gold’s appeal as a hedge against risk.

Crude Oil: A Rally on the Back of a Weak Dollar and Geopolitical Tensions

Meanwhile, crude oil markets presented an interesting display of alternating strength and weakness. The week began with a retreat in oil prices, with West Texas Intermediate (WTI) falling below $61 a barrel. This decline was primarily driven by investor hopes that the anticipated summit between Presidents Trump and Zelensky might lead to a de-escalation of tensions between Ukraine and Russia, which could increase global energy supplies. However, this optimism was short-lived. By the end of the week, oil prices had recovered strongly, rising by 2.89% over the week to close with WTI at $63.74 a barrel. This rise was due to two main factors: first, the weakness of the U.S. dollar after Powell’s speech, which made oil, priced in dollars, cheaper for investors holding other currencies, thereby stimulating demand.

Second, U.S. oil inventory data showed an unexpected decrease, indicating that demand remains robust. This strong performance suggests that oil may continue its upward trajectory in the coming days, especially if expectations of a weaker dollar persist, which would make oil cheaper for non-dollar-holding investors and reinforce optimism about sustained global energy demand.

Bitcoin: Between Liquidity and a Safe Haven

Bitcoin’s (BTCUSD) performance was more complex and contentious. Over the week, Bitcoin’s price fell by 4.13%, despite a rally after Powell’s speech. This paradox can be explained by two opposing factors at play simultaneously. First, Bitcoin is still considered a high-risk asset, which makes it vulnerable to volatility in times of uncertainty.

Second, and more importantly, last week’s negative performance was due to a wave of liquidations exceeding $300 million, which negatively impacted the price. This liquidation led to a sharp price drop. However, after Powell’s speech, Bitcoin’s price saw a rally, surpassing $117,000. This increase reflects the view of some analysts that Bitcoin can serve as a safe haven against inflation and the weakening of traditional currencies, particularly amid growing concerns about U.S. debt. The question remains: Can Bitcoin sustain this momentum, or will it continue its volatile path? The coming week will provide a clearer answer.

Stocks

U.S. stock markets had a dramatic and noteworthy week, shifting from caution and anticipation to a historic surge fueled by the Federal Reserve’s notable change in tone. At the start of the week, the major indices were trading cautiously as investors awaited Fed Chairman Jerome Powell’s speech, which led to price volatility.

However, this volatility completely dissipated on Friday, as Powell indicated that upcoming economic data could justify an imminent cut in U.S. interest rates. These words served as a green light for investors who had been waiting for a clear signal to enter the market. The stock indices immediately launched into a strong upward trajectory, allowing the S&P 500 to recover its losses and post modest gains for the week.

Simultaneously, the Dow Jones Industrial Average surged to a new record high, achieving significant gains fueled by hopes of a rate cut that would provide a more favorable economic environment for companies. This rally was not limited to the major indices but also extended to the NASDAQ 100, which includes major technology companies, and the Russell 2000, which represents small-cap firms, reflecting a broad-based optimism across all market sectors. This powerful momentum confirms that markets are now focused on a rate-cut scenario, which is a major catalyst for stock investment.

The Week Ahead

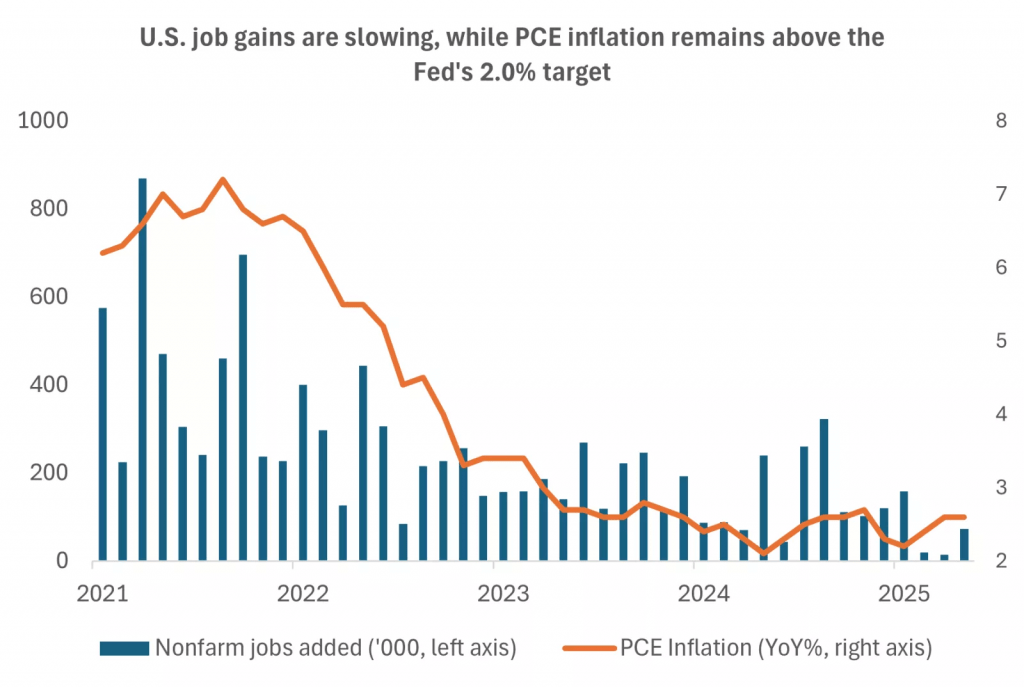

All eyes are now on the upcoming economic data, which will serve as the roadmap for the Federal Reserve in the coming weeks. The week ahead will be packed with data that could either confirm or alter rate-cut expectations. The release of consumer spending data, a key indicator of the health of the U.S. economy, as well as the Personal Consumption Expenditures (PCE) report, the Fed’s preferred inflation gauge, are both expected. The Consumer Confidence Index will also be released, providing insight into public sentiment towards the economy. This data will be crucial in determining whether the Fed will indeed cut rates in September. Globally, the latest Purchasing Managers’ Index (PMI) readings are expected from several regions, which will provide a clearer picture of the health of global economies and impact currency and commodity markets.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations