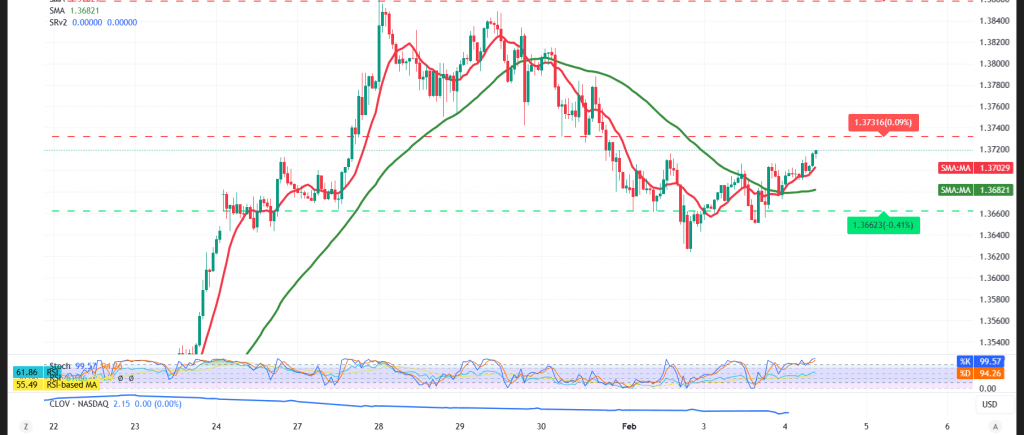

The GBP/USD pair is showing a short-term upward move as it attempts to recover losses from previous sessions, currently stabilizing above the 1.3700 level.

Technical Outlook – 4-Hour Chart

Simple moving averages have shifted back into a supportive position, providing positive momentum and encouraging intraday upside attempts. The Relative Strength Index (RSI) is also showing signs of strengthening momentum. However, despite this improvement, the broader corrective downward structure remains dominant, keeping downside risks in play.

Preferred Technical Scenario

As long as daily trading remains capped below the 1.3760 resistance level, the bearish bias remains the more likely scenario. A confirmed break below 1.3690 would reinforce downside pressure and could pave the way for a move toward 1.3635.

On the other hand, a return to sustained trading above 1.3750 would temporarily invalidate the bearish bias and may trigger a recovery attempt toward 1.3770, followed by 1.3820.

Market Note:

High-impact U.S. economic data is due today, particularly the Non-Farm Payrolls (NFP) report and the ISM Services PMI, which may lead to heightened volatility.

Risk Warning:

Market conditions remain high-risk amid ongoing trade and geopolitical tensions, and all scenarios remain possible.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3635 | R1: 1.3730 |

| S2: 1.3585 | R2: 1.3770 |

| S3: 1.3540 | R3: 1.3820 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations