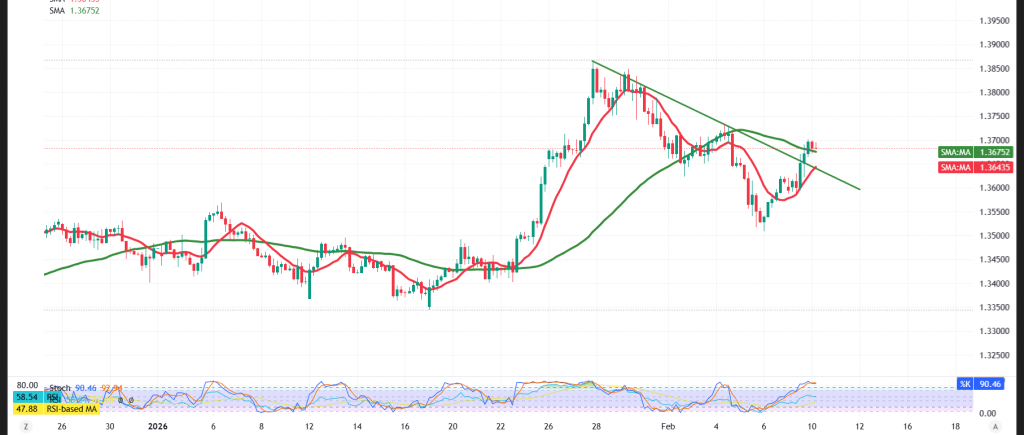

The GBP/USD pair posted strong gains in the previous session, advancing to a high near the 1.3700 level and reinforcing short-term bullish momentum.

Technical Outlook – 4-Hour Chart

Simple moving averages have shifted back into a supportive role, providing positive momentum and encouraging further upside attempts during today’s session. The Relative Strength Index (RSI) is also trying to build momentum, although the pair may need some consolidation to ease current overbought conditions before extending gains.

Expected Scenario

As long as daily trading remains above the 1.3620 support level, the bullish scenario remains the preferred outlook. A confirmed break above the 1.3700 resistance would strengthen upside momentum, opening the way toward 1.3730 initially, followed by 1.3770.

On the downside, a return to trading below 1.3620 would weaken the bullish structure and could place the pair under temporary downward pressure, with scope for a corrective pullback toward 1.3545.

Market Note:

High-impact U.S. economic data is due today, including monthly Retail Sales and the Employment Cost Index. Elevated volatility is expected around the release.

Risk Warning:

Market conditions remain high-risk amid ongoing trade and geopolitical tensions, and all scenarios remain possible.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3615 | R1: 1.3730 |

| S2: 1.3545 | R2: 1.3770 |

| S3: 1.3500 | R3: 1.3840 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations