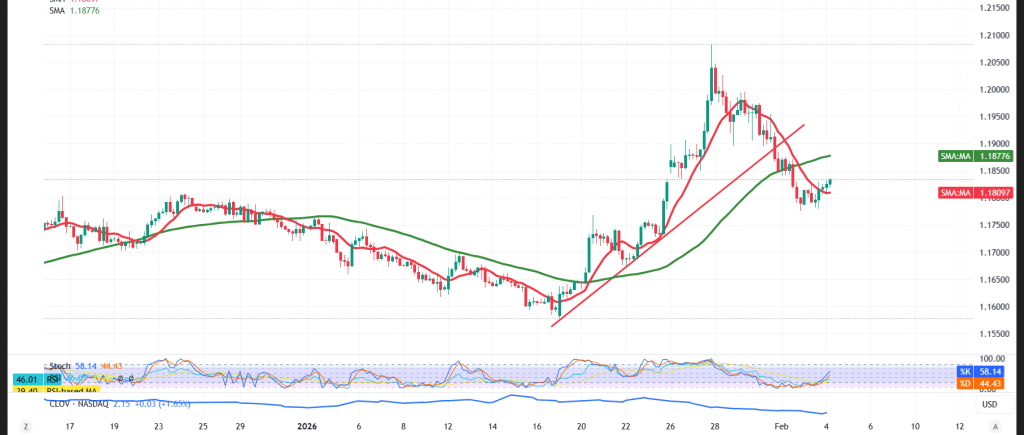

The EUR/USD pair posted modest gains in the previous session, briefly consolidating above the 1.1800 level, which offered temporary support and helped stabilize price action.

Technical Outlook – 4-Hour Chart

Momentum indicators are providing some support, as the Relative Strength Index (RSI) is working to ease oversold conditions and has started to generate positive signals.

However, despite these recovery attempts, the simple moving averages (SMAs) continue to weigh on price action, acting as dynamic resistance and limiting upside potential. Within this context, the broader corrective structure remains tilted to the downside, keeping the daily bias bearish.

Preferred Technical Scenario

As long as trading remains capped below the 1.1850 resistance level, the bearish scenario remains the preferred outlook. Under this setup, downside targets are seen at 1.1800 initially, followed by 1.1765.

On the other hand, a sustained hourly close above 1.1850 would temporarily invalidate the bearish bias and could trigger a recovery attempt toward 1.1910, with scope for a further move toward 1.1940.

Market Note:

High-impact U.S. economic data is due today, particularly the Non-Farm Payrolls (NFP) report and the ISM Services PMI. Elevated volatility is expected around the release, which may trigger sharp moves across major currency pairs.

Risk Disclaimer: Trading CFDs involves risks, and therefore the scenarios outlined above are not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.1800 | R1: 1.1855 |

| S2: 1.1765 | R2: 1.1910 |

| S3: 1.1730 | R3: 1.1940 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations