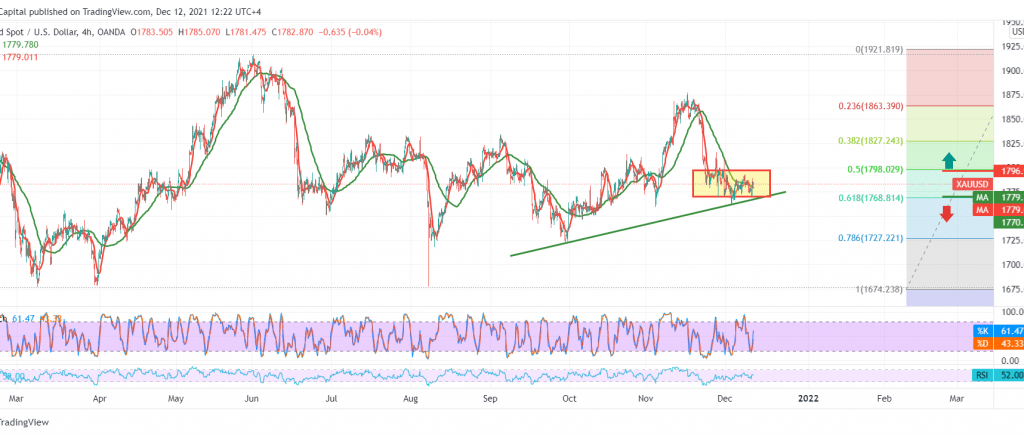

Mixed trading dominated gold prices at the end of last week’s trading. Trading is still limited to a short, unclear stable trend from below, above the demand area 1770, and below the main supply area of 1799.

Technically, despite the temporary bullish bounce, gold prices are still moving within an unclear short direction, between minor corrections, 1768, 61.80% Fibo, and 1799, 50.0% Fibo.

The 14-day momentum indicator provides positive signals coinciding with positive crossover signs on Stochastic. Despite the technical factors that support the occurrence of a bullish trend during the session, we prefer to wait until the following pending orders are activated:

Long positions require the breach of 1799, 50.0% correction, and most notably 1800, and from here, gold recovers, heading directly to test the non-key peak 1810 and 1817.

Activating short positions requires breaking 1768, retracement of 61.80%, which may extend gold’s losses, so we will wait to touch the 1734 buying area.

| S1: 1768.00 | R1: 1790.00 |

| S2: 1761.00 | R2: 1799.00 |

| S3: 1753.00 | R3: 1810.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations