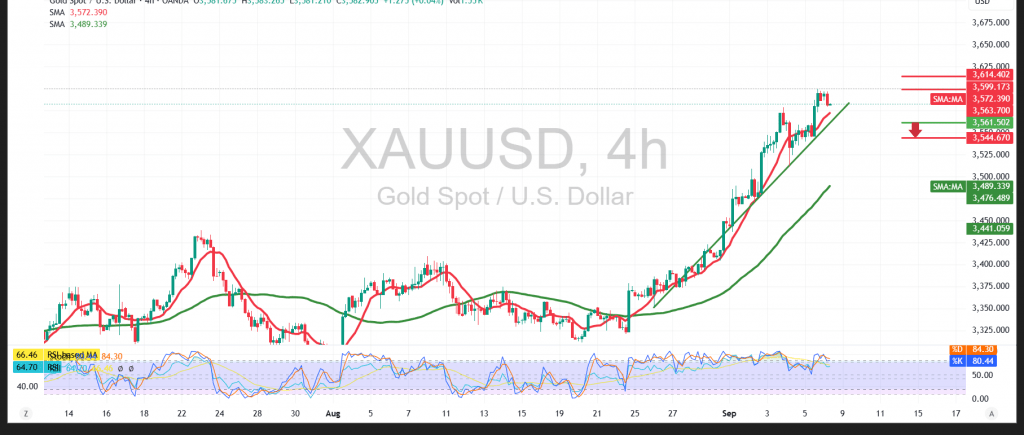

Gold prices (XAU/USD) reached a fresh all-time high at $3,600 per ounce before easing into a natural pullback driven by profit-taking.

Technical Outlook – 4-hour timeframe:

The Relative Strength Index (RSI) has begun to unwind from overbought levels, adding mild pressure on prices. However, the broader structure remains constructive, with trading holding above the simple moving averages and the ascending trend lines, both of which continue to reinforce the prevailing uptrend.

Likely Scenario:

The key levels protecting the intraday bullish bias lie around 3,560, and more importantly 3,547. A confirmed break above the 3,600 peak would strengthen bullish momentum, opening the door to deeper gains toward the next resistance levels shown on the chart.

Conversely:

A sustained move below 3,547 would reinstate selling pressure, paving the way for a retest of lower retracement zones highlighted on the chart.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 3547.00 | R1: 3607.00 |

| S2: 3513.00 | R2: 3633.00 |

| S3: 3487.00 | R3: 3667.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations