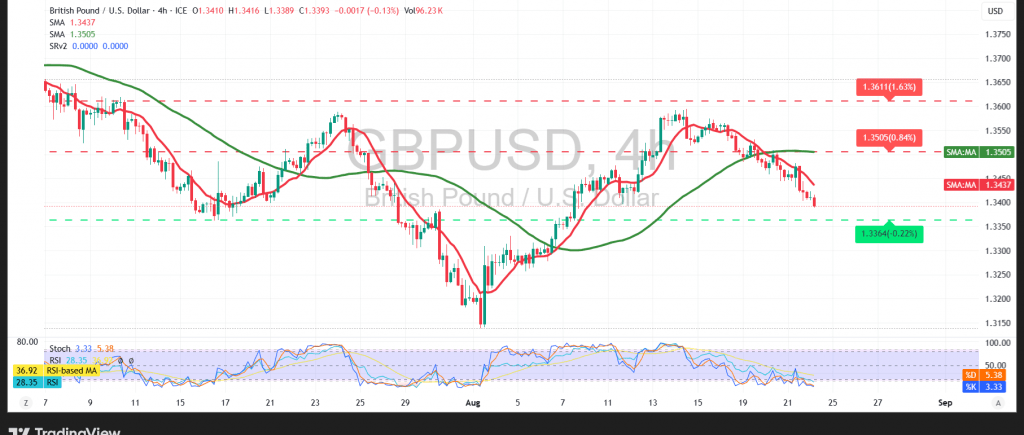

The GBP-USD pair successfully touched its first target of 1.3420 during the previous session, reaching its lowest level during today’s morning session at 1.3393.

Technical Outlook – 4-Hour Timeframe

The price’s continued stability below the Simple Moving Average increases the likelihood of extended selling pressure, especially with the clear negative signals from the Relative Strength Index (RSI). The break below the pivotal support level of 1.3420 also supports the hypothesis of a continued downward path.

Probable Scenario

Bullish Scenario: As long as the price remains below 1.3450, the downward trend is likely to stay dominant, targeting 1.3365 as the first support, followed by 1.3330. The downward wave could later extend to visit 1.3275.

Bearish Scenario: Conversely, a confirmed break and a one-hour candle closing above 1.3450 could reverse the downward trend, paving the way to retest 1.3510 and then 1.3560.

Fundamental Note:

We are awaiting high-impact economic data today, namely “Jerome Powell’s speech at the Jackson Hole Economic Symposium throughout the day.” This event could cause strong price volatility.

Warning

The risk level is high amid ongoing trade and geopolitical tensions, and all scenarios may be plausible.

Disclaimer

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3365 | R1: 1.3330 |

| S2: 1.3270 | R2: 1.3450 |

| S3: 1.3510 | R3: 1.3560 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations