The Swiss National Bank (SNB) is anticipated to maintain its current interest rate stance until at least June, aligning with its counterparts such as the European Central Bank and the US Federal Reserve. The SNB may opt to observe its peers’ actions regarding the cessation of monetary tightening before making any rate cut moves, primarily to anticipate a potential weakening of the Swiss franc, which has already seen a 3.5% decline in 2024.

Current Interest Rate and Inflation Landscape

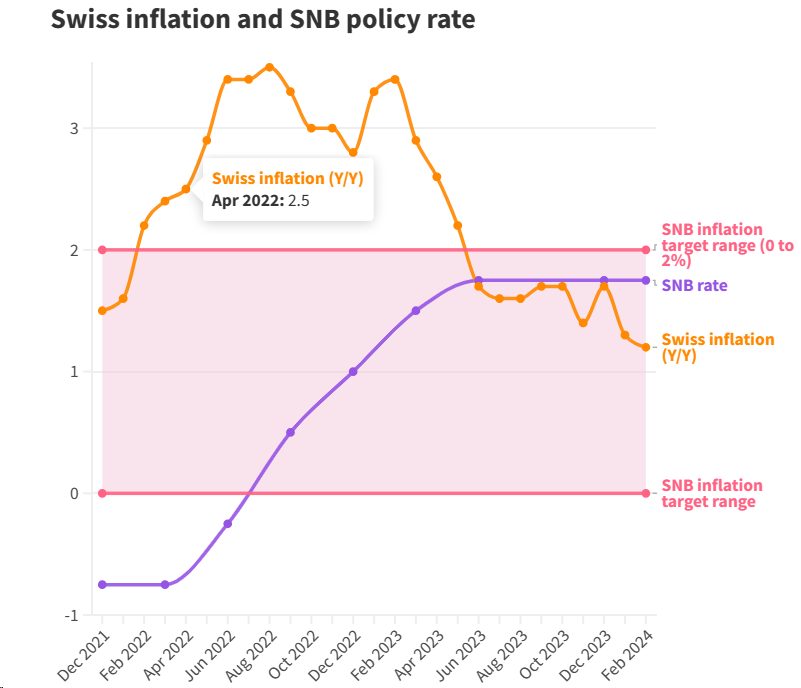

Presently, the Swiss interest rate stands at 1.75%, with the central bank targeting an inflation rate ranging from 0 to 2%. Despite Swiss inflation figures for February being slightly lower than anticipated, with a rise of 1.2% compared to the previous year, the SNB remains vigilant amidst signs of economic stability.

Market Expectations and Monetary Policy Implications

Despite market expectations of a rate cut in March, with a 40% probability priced in, the SNB may choose to adopt a cautious approach, especially considering the recent weakness of the Swiss franc and its potential impact on inflation dynamics. Given that the inflation rate has remained within the bank’s target range since May 2023, the SNB is likely to prioritize economic stability and may delay monetary tightening to avoid exacerbating currency fluctuations.

Financial experts, including UBS, anticipate that the SNB will postpone rate cuts until the second quarter of the year, aligning its policy trajectory with other major central banks. Meanwhile, the Swiss government maintains a cautious outlook for economic growth in 2024, with predictions of slow growth at 1.1% and a decline in the inflation rate to 1.5%, down from 2.1% in 2023.

In line with global assessments, the Organization for Economic Cooperation and Development (OECD) foresees modest growth for the Swiss economy, projecting a growth rate of 0.9% in 2024 and 1.4% in 2025. These forecasts underscore the prevailing cautious sentiment and the need for prudent monetary policy decisions in navigating economic uncertainties.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations