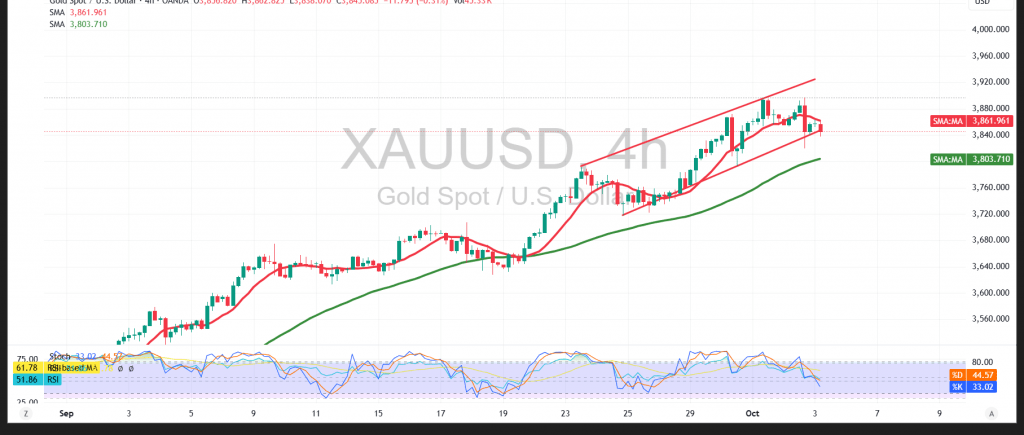

After reaching a record high of $3,897, gold prices faced heavy profit-taking, retreating to $3,819 before attempting to stabilize.

Technical Outlook:

- 50-day SMA: Price action remains supported above the moving average, preserving the broader bullish structure.

- RSI: Currently sending negative signals, reflecting weaker momentum and creating intraday volatility.

- Trend Bias: The overall trend remains bullish, but conflicting indicators suggest the market is in a consolidation phase.

Probable Scenario:

- Bearish Case: A break below 3,819 could trigger further selling, with downside targets at 3,810 and then 3,775 if bearish pressure extends.

- Bullish Case: A breakout above the recent high at 3,897 with sustained consolidation could reignite bullish momentum, targeting 3,931 as the next resistance.

Risk Warning: The risk/reward balance is skewed, and volatility is expected with today’s US Nonfarm Payrolls, Unemployment Rate, and Average Hourly Earnings data. Market reactions could be sharp in either direction.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 3810.00 | R1: 3887.00 |

| S2: 3775.00 | R2: 3931.00 |

| S3: 3731.00 | R3: 3965.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations