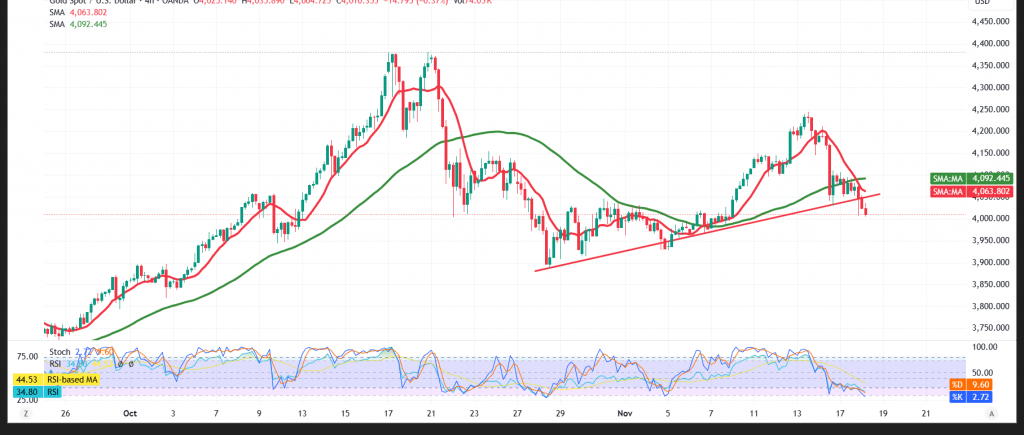

Gold confirmed the bearish trigger highlighted previously: a clean break below $4,055/$4,050 shifted near-term structure lower and extended losses toward the $4,004 area.

Technical outlook

- Trend/50-SMA: Price is below the 50-SMA, which now acts as dynamic resistance, reinforcing downside control.

- Momentum (RSI): Firm negative signals support continued selling pressure.

Base case (bearish while below $4,050 / $4,076)

- With former support at $4,050 now resistance (role-reversal), the path of least resistance remains lower.

- Focus on $3,975 first support; a decisive break/4H close below $3,975 would likely extend toward $3,940.

Invalidation / upside toggle

- Reclaiming and holding above $4,050, and more convincingly above $4,076 (1H close), would signal a corrective rebound, initially targeting $4,142.

Risk note

Gold is high risk and not suitable for all investors. Use prudent sizing and firm stops; reassess quickly if these key levels give way amid trade/geopolitical headlines.

Risk Disclaimer: Trading CFDs involves risks, and therefore all scenarios may be plausible. The content above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 3975.00 | R1: 4076.00 |

| S2: 3938.00 | R2: 4142.00 |

| S3: 3872.00 | R3: 4180.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations