A fresh batch of data eagerly awaited by markets to clarify the Federal Reserve’s future monetary policy path, eliminating uncertainty around potential interest rate cuts, their magnitude, and related factors, is the US retail sales figures.

Fed rate cut expectations entered a new phase where investors, observers, and analysts alike are debating not whether the Fed will initiate rate cuts in September or later meetings, but rather whether the cut will be 25 or 50 basis points in the upcoming meeting.

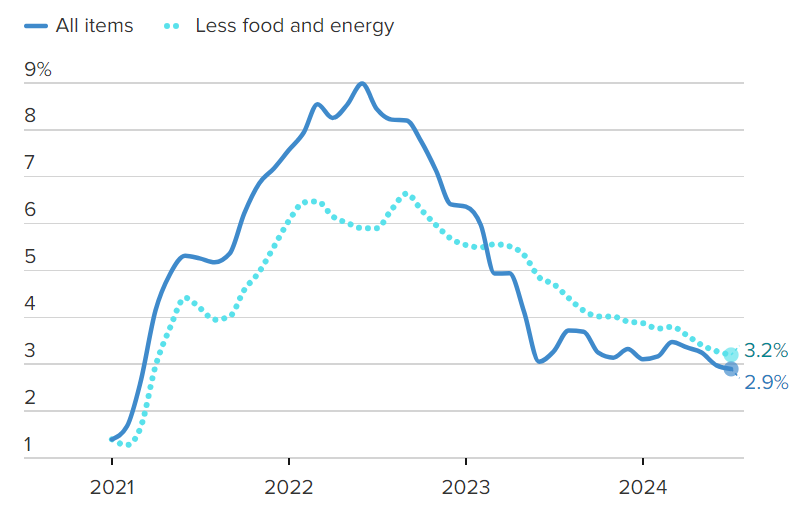

US inflation data had reflected a decline in price growth rates in July, continuing the downward trend in US prices recently. This data, encompassing both producer and consumer price indices, suggested prices are falling across the board, potentially allowing the Fed room to comfortably cut rates in the upcoming September meeting.

However, US retail sales data contradicted the trend set by inflation data, as sales surged far beyond market expectations. A higher retail sales rate confirms increased demand, which in turn suggests the possibility of renewed inflation in the coming period.

The data released on Thursday sparked speculation contrary to the path suggested by inflation data at the producer and consumer price levels. US retail sales saw a significant improvement in July, shedding light on the resilience of the US economy and its strong performance recently.

This data contradicted market expectations over the past week that the US economy was nearing a recession, speculations that emerged following the release of the latest US employment data on the first Friday of August.

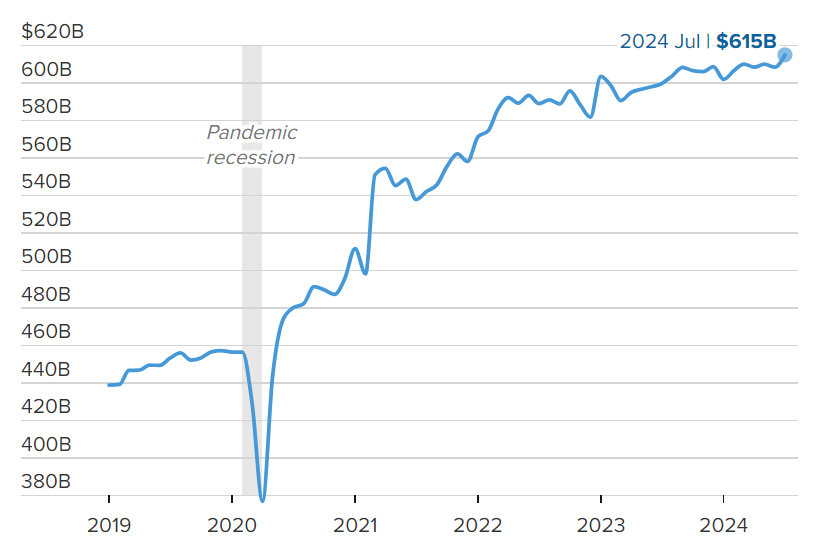

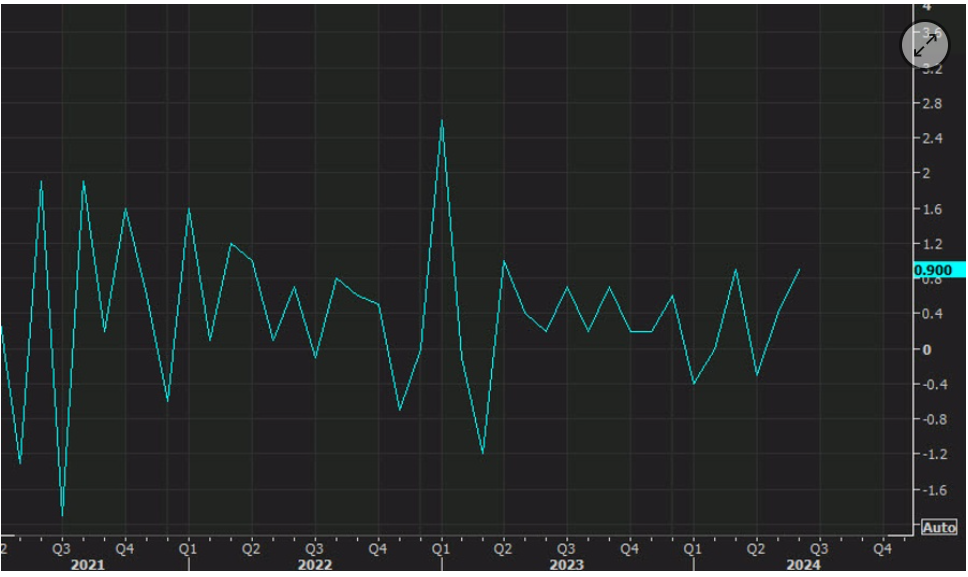

Retail sales jumped to 1.0% in July compared to the previous reading of -0.2%, surpassing market expectations of 0.3%.

The monthly reading of retail sales excluding auto sales also rose to 0.4% in July compared to the previous month’s reading of 0.5%, exceeding market expectations of 0.1%.

Conflicting Signals: Retail Sales and Inflation

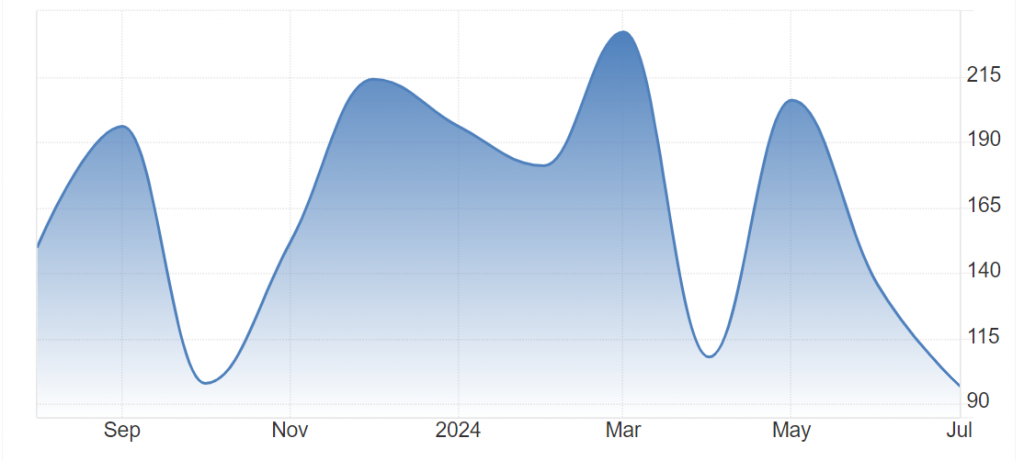

The latest US economic data has sent mixed signals, causing a stir in markets and complicating the Federal Reserve’s decision on interest rate cuts. While stronger-than-expected retail sales data initially dampened expectations for a significant 50 basis point rate cut in the upcoming September FOMC meeting, easing inflation figures have reignited hopes.

The upbeat retail sales report had initially pushed down the probability of a rate cut to 28% from a previous 75%. However, the subsequent release of inflation data painted a more nuanced picture.

Inflation Eases, Paving Way for Rate Cuts

Recent US inflation data has indicated a slowdown in price growth, setting the stage for the Fed to begin easing monetary policy. Lower interest rates typically stimulate borrowing, boosting corporate profits and overall economic activity. This increased demand can, in turn, lead to higher oil prices.

The monthly reading of the US Consumer Price Index (CPI) rose by 0.2% in July, matching market expectations. However, the more significant annual reading, which provides a clearer picture of overall price trends, climbed by 2.9%, slightly below forecasts.

Producer Prices Cool, Reinforcing Rate Cut Bets

Similarly, the Producer Price Index (PPI) also showed signs of cooling. The monthly reading increased by 0.1% in line with expectations, while the annual rate declined to 2.2% from 2.7% in the previous month, undershooting forecasts.

These data points have fueled speculation that the Fed is nearing a rate cut, particularly given the proximity of inflation to the central bank’s 2% target.

Employment Data

Overall, the conflicting signals from retail sales and inflation data have created uncertainty about the timing and magnitude of future Fed rate cuts. While easing inflation supports the case for lower interest rates, the strength of the consumer spending has raised questions about the sustainability of this trend.

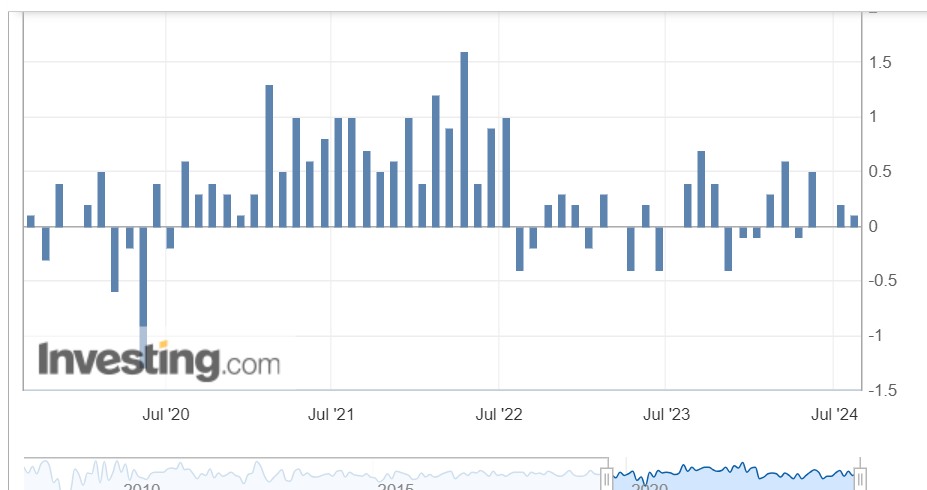

Mixed Signals from the Job Market Shake Up Markets

The latest US employment data has sent shockwaves through global financial markets, triggering wild swings in asset prices, particularly the US dollar, oil, and gold. The US Bureau of Labor Statistics reported that non-farm payrolls increased by a modest 114,000 jobs in July, falling short of the 175,000 jobs that economists had anticipated. Moreover, wage growth decelerated, with average hourly earnings rising by 3.6% year-on-year, down from 3.8% in the previous month.

These figures suggest that the labor market might be cooling, potentially bolstering the case for the Federal Reserve to cut interest rates in September. This prospect initially lifted market sentiment.

However, the increase in the US unemployment rate to 4.3% from 4.1% cast a shadow over these gains. Investors grew increasingly concerned about the possibility of a looming recession.

Market Reactions

US Treasury yields climbed on Thursday as investors responded positively to the overall strength of the economic data, which alleviated recent recession fears. The benchmark 10-year Treasury yield rose to 3.915%, from 3.851% the previous day.

The US Dollar Index, which measures the greenback’s value against a basket of major currencies, gained about 0.5% on the back of the better-than-expected economic data. This strengthened the dollar and reduced expectations for a more aggressive 50 basis point rate cut by the Federal Reserve at its upcoming September meeting.

In essence, the latest US employment report has painted a complex picture. While the softer-than-expected job growth and wage data support the case for easier monetary policy, the uptick in the unemployment rate has raised recession concerns. This conflicting data has created a volatile environment for financial markets.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations