In defiance of prevailing concerns over escalating interest rates and anticipated delays in their mitigation until mid-year, US stocks have orchestrated a resolute ascent since the dawn of 2024. Amidst a landscape where inflation remains static, yet optimism for its eventual ebb extends, the stock market has burgeoned, boasting a formidable 10% surge in the inaugural quarter alone. This meteoric rise is further underscored by a staggering 30% uptick in total returns over the preceding 12-month epoch.

The Technological Epoch

Propelled by the relentless momentum of the digital age, the technology sector has emerged as the forefront of US equities, advancing its march towards unparalleled innovation. In an era defined by the artificial intelligence revolution, tech giants have excelled, securing substantial gains while leading the charge in technological advancement. Concurrently, the resurgence of value stocks has spurred strong performances across financial services and energy sectors, exemplifying Wall Street’s inherent resilience and appeal to discerning investors.

Perturbation in Interest Rate Dynamics

Attention now turns to the delayed prospect of three anticipated rate cuts, tentatively scheduled for post-midyear execution. The dynamic performance of the US stock market in the first quarter of 2024 finds its driving force in the enthusiastic embrace of technological advancements, alongside a resurgence within the value segment.

Deciphering Market Movers

Navigating the financial landscape, the quintet of technological juggernauts has borne witness to significant developments, each testament to their profound influence. Amazon, epitomizing market prowess, has bolstered overall gains with resolute profitability, buoyed by its unrivalled dominance in e-commerce and cloud services. Meta, charting a course towards sustained growth, has adeptly recalibrated its trajectory towards long-term viability.

Unfurling Success Stories

Against this backdrop, Nvidia surged to the forefront, its supremacy in AI chip manufacturing driving remarkable gains, soaring to an impressive 82.5% surge in share value. Meanwhile, Microsoft sustained its ascent, leveraging the burgeoning demand for cloud services and AI-centric solutions. Conversely, Apple, despite its iconic stature, weathered headwinds amidst consecutive months of share depreciation.

Global Market Pulse

The Standard & Poor’s 500 index heralded a robust commencement to the fiscal year, notching a formidable 10.6% surge in the inaugural quarter. This surge, bolstered by a triumphant culmination to the preceding fiscal term, underscored a cumulative uptick of 22.3% since September’s denouement. However, April bore witness to a marginal setback, with the index receding by 4.1%, emblematic of burgeoning concerns over inflationary pressures and the Federal Reserve’s concerted efforts to stave off escalating prices.

The Nascent Optimism of the Nasdaq

Simultaneously, the Nasdaq index heralded a promising inauguration to the fiscal year, buoyed by burgeoning optimism within AI-centric stocks. Yet, May witnessed a marginal decline, with futures dipping by 0.66%.

Positively inclined investor sentiment propelled the Dow Jones Industrial Average to a commendable performance in the inaugural quarter. Buoyed by sanguine expectations surrounding imminent interest rate cuts, it rode the wave of overarching market buoyancy.

Intricacies of Corporate Earnings

Tesla’s first-quarter earnings for 2024 unveiled a stark juxtaposition, with revenue witnessing a decline vis-à-vis the preceding fiscal term. Concurrently, US banks, spearheaded by Bank of America, JPMorgan, Citi, and Wells Fargo, outpaced earnings projections, buoyed by stellar interest income and investment banking prowess.

Eurozone Dynamics

Amidst an economic terrain beset by headwinds, Eurozone corporate profits beckon scrutiny, spotlighting a pivotal juncture in the region’s economic trajectory. Bolstered by steadfast resilience, Eurozone enterprises have navigated adversities, projecting a vista of burgeoning profitability amidst a backdrop of economic recalibration.

The Eurozone’s tapestry of growth opportunities unfurls with resplendent diversity, with stalwarts like the Italian conglomerate Iveco Group emblematic of the region’s latent potential. Simultaneously, Unipol Group, an Italian insurance colossus, has seized investor interest with an impressive surge in share value, mirroring the region’s burgeoning resurgence.

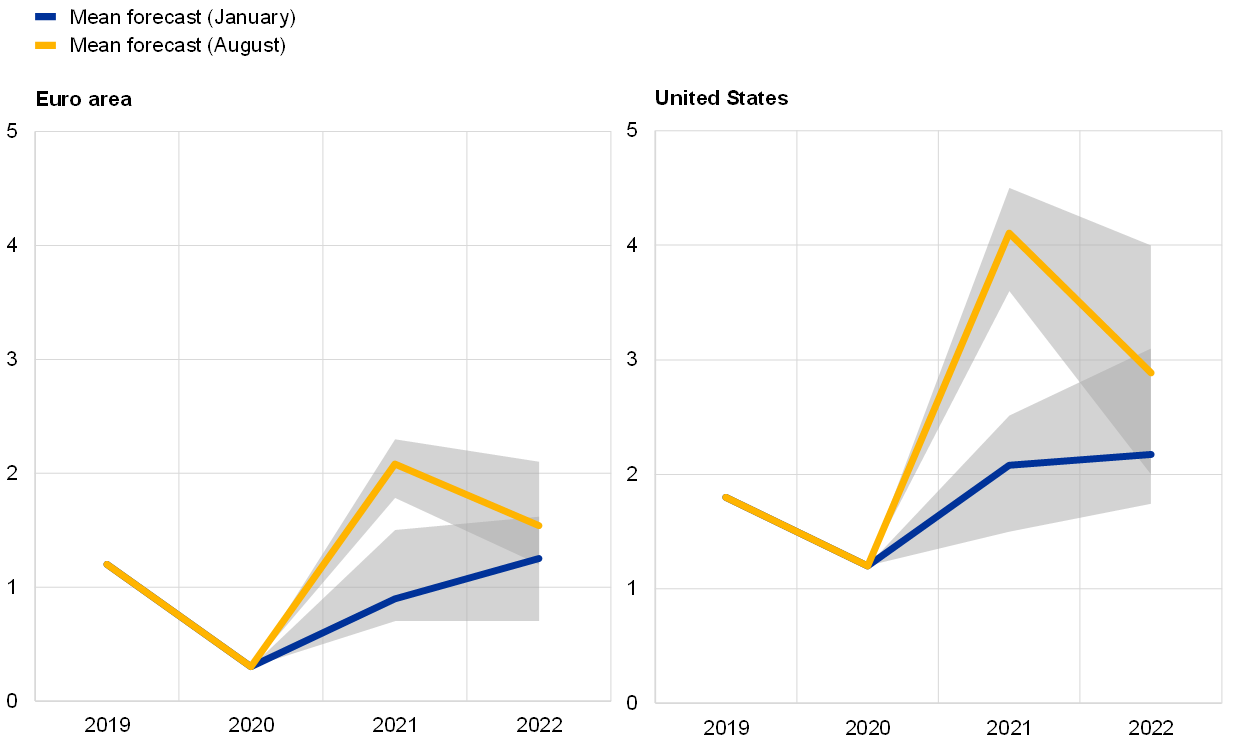

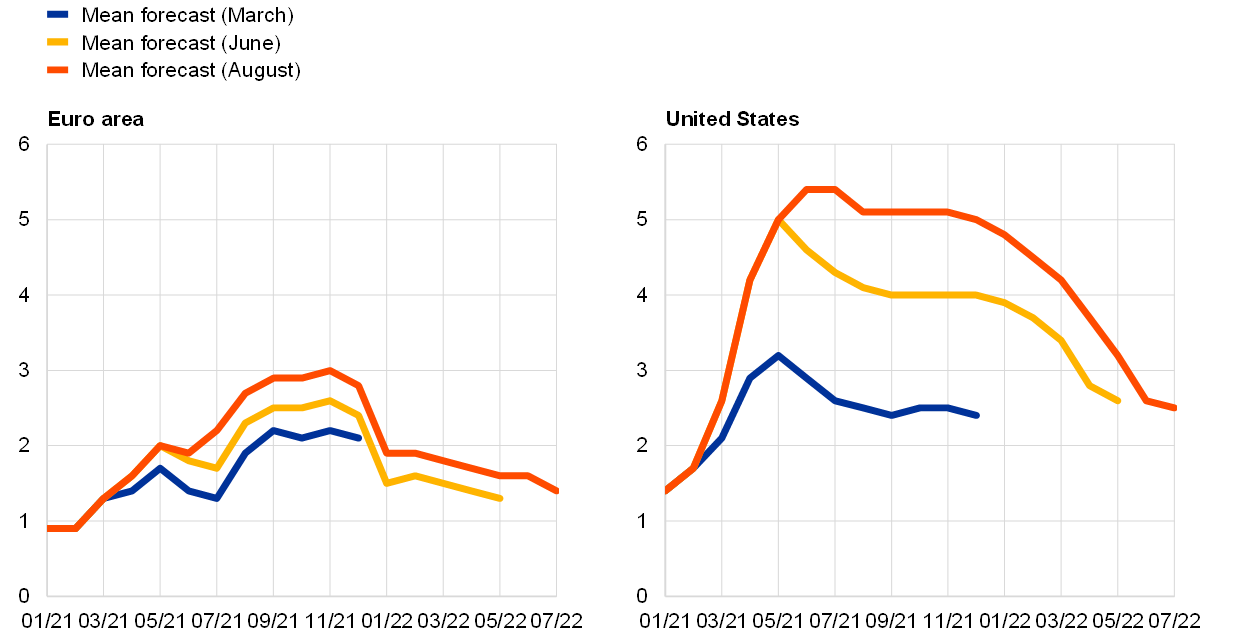

Inflation expectations from Consensus Economics for US headline CPI and euro area headline HICP inflation

Market Sentiment and Future Trajectories

Despite prevailing challenges, European equities have ascended, with the Euro Stoxx 500 index registering a commendable 12.4% surge in the inaugural quarter. This burgeoning optimism underscores investor faith in the region’s capacity for revitalization, paving the way for a nuanced exploration of future trajectories and emergent opportunities.

Navigating the Impact of Monetary Policy Tightening:

In the intricate dance of monetary policy adjustments, the European Central Bank (ECB) confronts a nuanced challenge. With inflation edging towards the coveted 2% mark, the specter of a substantial reduction in interest rates looms large as a mechanism to invigorate economic growth. However, the persistent specter of elevated interest rates casts a pall over household spending and investment. Eurozone enterprises, adorned with strengths and beset by diverse challenges, must deftly navigate the tumultuous waters with sagacious foresight.

Euro Stoxx 500:

The Euro Stoxx 500 index, serving as a barometer for a diverse spectrum of European enterprises, delivered a commendable performance in the inaugural quarter of 2024. Its ascension by 12.4% during this epoch underscored a resurgence within the Eurozone market. Other pivotal European indices mirrored this trajectory:

- DAX (Germany): Ascended by 10.3%

- CAC 40 (France): Garnered an 8.8% uptick

- FTSE 100 (UK): Forged ahead by 2.6%

Propellants of European Equities:

Improved Economic Outlook: The sunnier economic vista catalyzed a resurgence in stocks with heightened sensitivity to economic shifts, while financial institutions reaped the rewards of announcements pertaining to shareholder returns.

Attractive Valuations: European corporations have historically secured alluring stock valuations, particularly when juxtaposed with their American counterparts. Despite the rigours of tightening financing conditions and escalating production costs, European entities are regaining investor allure amidst an environment characterized by burgeoning profitability, waning inflationary pressures, and the subsidence of last year’s energy shock. Forecasts anticipate that headline inflation within the Eurozone will converge with the European Central Bank’s 2% target, or even temporarily dip below it. Such a scenario promises to galvanize consumption while cushioning the blow on real incomes tethered to the cost of living crisis.

In the labyrinthine landscape of global finance, the Eurozone emerges as a crucible of resilience, poised to capitalize on emergent opportunities whilst navigating the vagaries of monetary policy adjustments with astute acumen.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations