Even if oil prices have dropped recently, there are some encouraging signs that can help them rise once again in the near future. The aforementioned factors encompass geopolitical conflicts, global demand, and additional economic conditions-related factors.

The negative effect from OPEC’s reduction of its forecasts of global oil demand last Monday—which indicated that demand would be lower throughout the rest of this year—was carried over into Wednesday’s closing of US oil futures, which saw a 1.5% loss.

The lack of tangible actions from any of the conflict’s parties on the ground has also caused other causes, such worries about geopolitical tensions in the Middle East, to somewhat dissipate.

Significant sets of economic data have surfaced in recent days that provide insight into a slowdown in price rise at several levels in the US in July of last year, which had a significant effect on world oil prices.

Global demand estimates

Following five sessions of increases, both types of oil saw a decrease on Tuesday. This decline was caused by OPEC’s propensity to lower its projections of the world’s oil demand in 2024, which helped to explain the Wednesday decline for the second straight session.

Due to concerns over a slowdown in Chinese oil imports, expectations surfaced last Monday that OPEC may revise its projections for world oil demand, which were previously at their most bullish level.

In the midst of efforts by group members to boost output next October, the Organization of the Petroleum Exporting Countries and its partners among the world’s top oil producers, known as the OPEC+ group, decreased their predictions of oil demand in 2024.

Geopolitical tensions

Both types of oil futures contracts saw increases for five straight trading sessions, the most recent one taking place last Monday. These increases were sparked by changes in the degree of geopolitical tension in the Middle East.

The US State Department declared over the weekend that the US would dispatch a guided missile-equipped submarine to the Middle East in case Iran and its allies decide to strike Israel.

This week has also seen a state of tension between Israeli Defense Minister Yoav Galant and Prime Minister Benjamin Netanyahu over potential negotiations for a ceasefire in Gaza in exchange for the release of Israeli hostages held by Hamas. These negotiations could cause a delay in reaching an agreement.

Concerns about geopolitical tensions are heightened by claims that Israeli media cited, citing anticipation that Iran may react quickly to the death of Ismail Haniyeh, the late chairman of the Hamas political bureau, on Iranian soil.

US inflation data

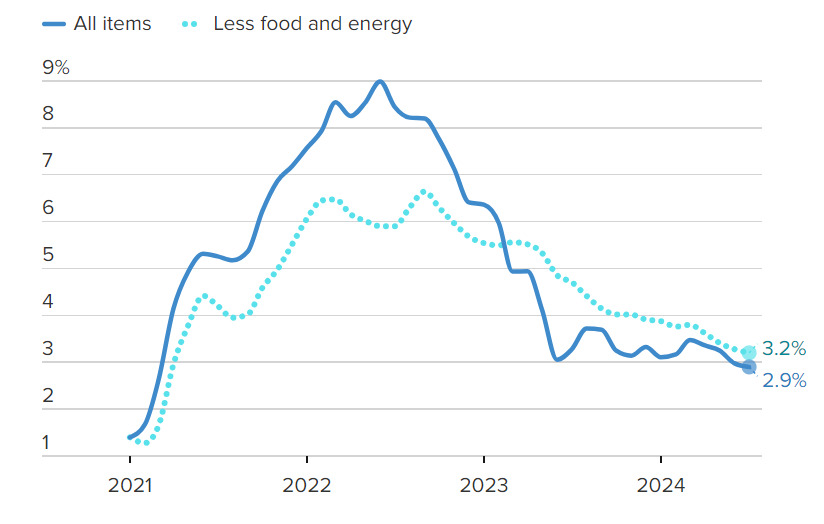

As one of the key factors influencing the direction of the Federal Reserve’s monetary policy, which sets the tone for monetary and financial matters globally, inflation rates are closely linked to global oil prices. This is because the United States economy is the largest in the world and has the highest inflation rates.

The most recent set of US inflation data showed that price rally has slowed down recently, which clears the way for the central bank to start lowering rates. Lower borrowing costs result from lower interest rates, which creates the perfect environment for businesses to borrow money at lower interest rates, boosting their profits and observing a prosperous state that will drive up demand for oil to support business expansion.

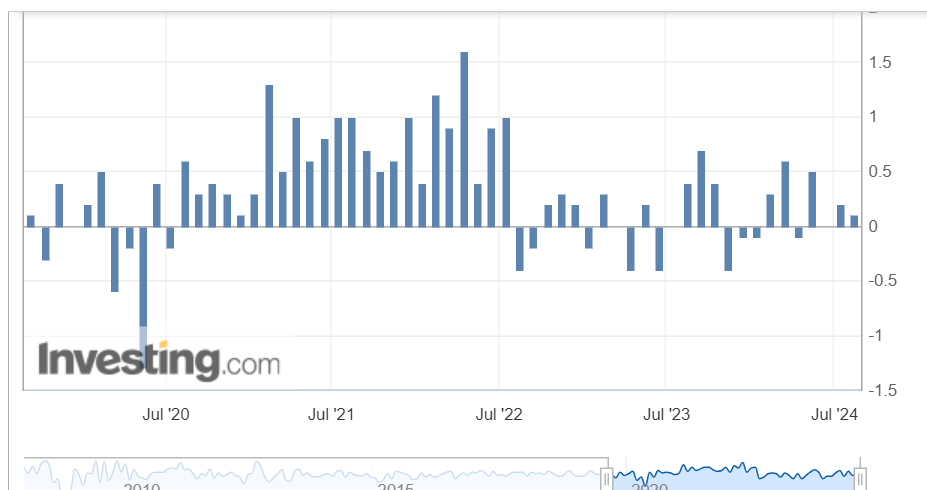

In July 2023, the monthly reading of the US Consumer Price Index showed a 0.2% increase as opposed to the previous reading, which showed a less than 0.1% increase that was consistent with market forecasts.

But the annual reading, which is the most important and most expressive of the reality of price growth in the country, recorded an increase of 2.9% last July, compared to the reading recorded the previous month at 3.00%, and lower than market expectations that indicated the same figure recorded in the previous reading.

Given that inflation is approaching the Federal Reserve’s target of 2.00%, these figures sparked rumors that the Fed is about to cut interest rates, with hopes that it will start doing so in September of next year.

This occurred one day after the US Producer Price Index’s monthly reading for July of last year showed an increase of 0.1% as opposed to the previous reading’s 0.2% gain, which was consistent with what the market had anticipated.

In July of last year, the index’s yearly reading dropped to 2.2% from the previous reading of 2.7%, which was less than the 2.3% gain that the market had anticipated.

This data sparked optimism in the markets, which led to a rise in the levels of US stocks, coinciding with the decline of the US dollar, which expects returns on it and its assets to decline.

US stockpiles

Absent developments in the Middle East crisis, which deprived black crude of the best bullish catalysts in the previous time, US inventories would have decreased dramatically in the week ending August 9, pushing world prices upward.

In contrast to the reading from the previous week, which showed a decline of -3.728 million barrels, US oil inventories increased to 1.357 million barrels in the week ending the ninth of this month. This was higher than the market’s expectations, which suggested a possible decline of -2.00 million barrels.

But according to the American Petroleum Institute’s inventory report released last Tuesday, there was a 5.2 million barrel decrease in the stock of oil and its derivatives during that same time period. Given the signs of improving demand for black crude in the world’s leading economies, any reduction in US oil inventories would be beneficial to global oil prices.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations