The Kansas City Fed announced it would host its 2021 Economic Policy Symposium, “Macroeconomic Policy in an Uneven Economy,” virtually on Friday, Aug. 27.

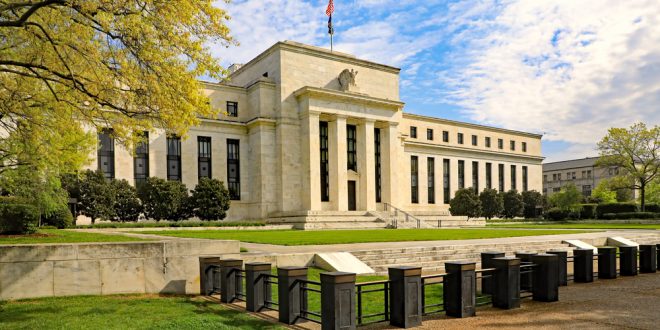

The Federal Reserve Bank of Kansas City’s Economic Policy Symposium in Jackson Hole, Wyo., is one of the longest-standing central banking conferences in the world. The event brings together economists, financial market participants, academics, U.S. government representatives, and news media to discuss long-term policy issues of mutual concern.

Jerome Powell is expected to try to balance the forces that have become more complex since the last Fed officials meeting.

In his speech, he is expected to address the challenges of recovering from the Corona pandemic, especially with the risks of spreading the delta mutated. Still, the primary attention will focus on the normalization of monetary policy of the Federal Reserve after the minutes of the July meeting revealed the bias of the majority of economic policymakers to start tapering before the end of this year. The step tapering, which is widely expected to take place during the last quarter of 2021 or the first quarter of 2022, comes for the Federal Reserve to announce the start of the easing policies that it announced at the beginning of the pandemic by increasing purchases of treasury bonds and mortgage-backed securities and reducing rates to a level near Zero.

On the other hand, some analysts expect Powell to give a softer tone and stress that the FOMC decision at the end of September will be based only on data and forecasts available at this time to leave the door open for later tapering.

Powell promises that monetary easing and stimulus policies will recover employment, similar to what the United States witnessed after the global financial crisis.

The Fed is currently focusing on restoring full employment, aiming to reduce unemployment rates while tolerating the significant rise in the inflation rate. However, the minutes of the Fed meeting showed that it had become a source of concern among Fed members with fears that it will remain above the 2% target for longer than expected.

Initial jobless claims were steady at 353k, a modest increase from the 349k last week, while the second reading for GDP in Q2 showed the US economy grew by 6.6%.

All times are U.S. Eastern:

Following is the agenda for Friday’s Jackson Hole Economic Policy Symposium.

Agenda

Aug. 27, 2021

9:00 a.m. – 12:00 p.m.

Morning Session

Chair:

Janice Eberly

Professor

Northwestern University

9:00 a.m.

Welcome and Opening Remarks

Speakers:

Esther L. George

President and Chief Executive Officer

Federal Reserve Bank of Kansas City

Jerome H. Powell

Chair

Board of Governors of the Federal Reserve System

9:30 a.m.

Monetary Policy and Uneven Shocks

Author:

Veronica Guerrieri

Professor

University of Chicago

Discussant:

Jing Cynthia Wu

Associate Professor

University of Notre Dame

9:55 a.m.

General Discussion

10:15 a.m.

Fiscal Policy and Uneven Shocks

Author:

Pierre-Olivier Gourinchas

Professor

University of California – Berkeley

Discussant:

Valerie Ramey

Professor

University of California – San Diego

10:40 a.m.

General Discussion

11:00 a.m.

The Interaction of Fiscal and Monetary Policy

Panelists:

Alan Blinder

Professor

Princeton University

Gita Gopinath

Economic Counsellor and Director of the Research Department

International Monetary Fund

Eric Leeper

Professor

University of Virginia

11:45 a.m.

General Discussion

12:00 p.m.

Adjournment of Morning Session

1:00 p.m. – 4:00 p.m.

Afternoon Session

Chair:

Lisa D. Cook

Professor

Michigan State University

1:00 p.m.

Remarks

Speaker:

Donald Kohn

Senior Fellow

Brookings Institution

1:30 p.m.

The Covid Shock and an Uneven Labor Market

Author:

Ayşegül Şahin

Professor

University of Texas – Austin

Discussant:

Betsey Stevenson

Professor

University of Michigan

1:55 p.m.

General Discussion

2:15 p.m.

Low Interest Rates and an Uneven Economy

Author:

Amir Sufi

Professor

University of Chicago

Discussant:

Fatih Guvenen

Professor

University of Minnesota

2:40 p.m.

General Discussion

3:00 p.m.

Monetary Policy in an Uneven Economy

Panelists:

Markus Brunnermeier

Professor

Princeton University

Kristin Forbes

Professor

Massachusetts Institute of Technology

Maurice Obstfeld

Professor

University of California – Berkeley

3:45 p.m.

General Discussion

4:00 p.m.

Adjournment of Afternoon Session

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations