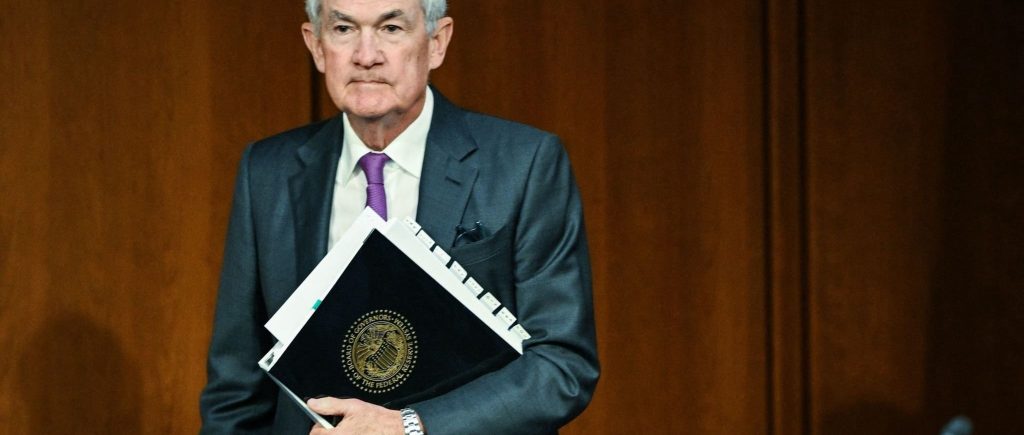

The recent banking crisis, which resulted in stricter lending regulations, has lessened pressure to raise interest rates, according to US Fed Chair Jerome Powell on Friday. “Our policy rate may not need to rise as much as it would have otherwise,” Powell continued.

In relation to market expectations, Powell stated that the rate path that markets are pricing in differs from the one that the Fed has predicted. “The risks of doing too little versus doing too much are becoming more balanced,” Powell said.

During Powell’s remarks, the US dollar fell as traders raised their bets on rate reduction by year’s end and lowered their forecasts for rate hikes at the June FOMC meeting. To 103.00, the US Dollar Index dropped.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations