The Federal Reserve Chairman Jerome Powell said on Wednesday that the Fed will most likely begin by scaling back the bond-buying before it considers raising interest rates, reiterating the planned reduction of monetary easing policies as the U.S. economy shows recovery signs.

“We will reach the time at which we will taper asset purchases when we’ve made substantial further progress toward our goals from last December, when we announced that guidance.”

“That would in all likelihood be before, well before, the time we consider raising interest rates. We haven’t voted on that order but that is the sense of the guidance.”

He further repeated that the planned interest rate hikes won’t take place until inflation reached a 2% annual rate and be on track to run moderately above 2% for some time.

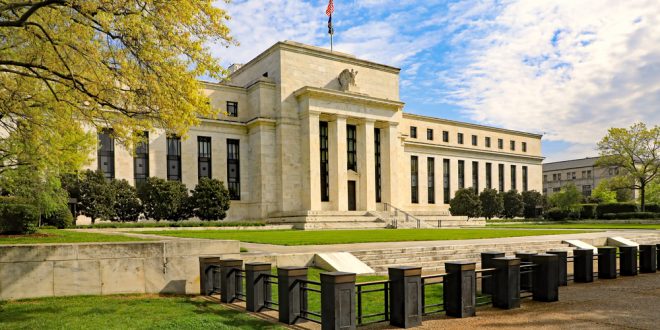

Remarks came as Powell spoke to a virtual event hosted by the Economic Club of Washington on Wednesday.

Powell tried to address fears about the expansion of the balance sheet with the Fed’s current stance, saying: “when the purchases go to zero, the size of the balance sheet is constant, and when bonds mature you reinvest them. And then another step, and we took this late in the day in the last cycle, was to allow bonds to start to runoff. And we haven’t decided whether to do that or not.”

The Fed Chair ruled out offering bonds in the market.

Powell also defended the incorporation of climate risks into its oversight of the financial system.

“The reason we’re focused on climate change is that our job is to make sure that financial institutions, banks, particularly the largest ones, understand and are able to manage the significant risks that they take. We see it only through the lens of that existing mandate.”

“We question both the purpose and efficacy of climate-related banking regulation and scenario analysis, especially because the Federal Reserve lacks jurisdiction over and expertise in environmental matters.”

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations