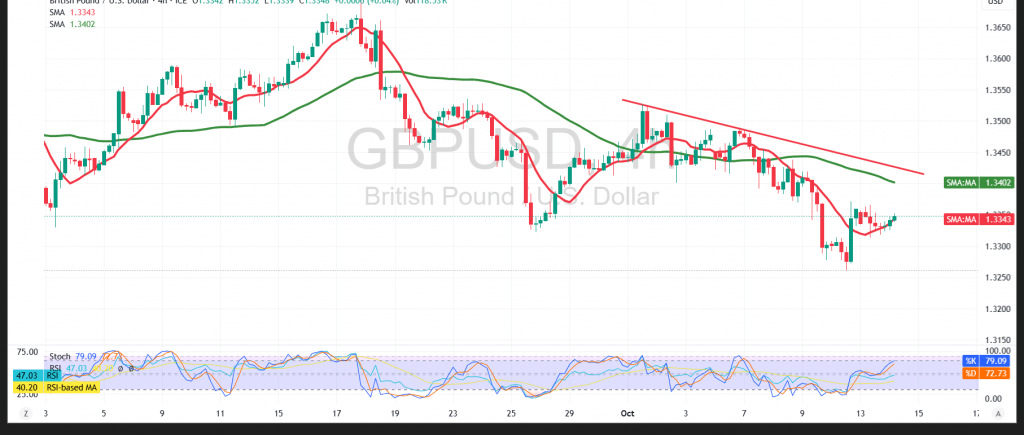

The GBP/USD pair extended its decline within the bearish trend anticipated in the previous report, reaching a low of 1.3315 as selling pressure continued to dominate market sentiment.

Technical Overview

- Relative Strength Index (RSI): The indicator continues to issue negative signals despite approaching oversold levels, confirming the strength and persistence of the downtrend.

- 50-Period Simple Moving Average (SMA): The SMA continues to act as a dynamic resistance, maintaining pressure on the pair and limiting upward corrections.

Probable Scenario

With the pair breaking below the previous support at 1.3370—now acting as resistance—the bearish bias remains dominant for today’s session.

A decisive break below 1.3320 would reinforce downside momentum, paving the way for targets at 1.3290 and 1.3260.

Conversely, a clear move above 1.3370 could trigger a short-term rebound, opening the path for a retest of 1.3395, which now represents the next resistance level.

Caution

Heightened volatility is expected ahead of the upcoming speeches by the Bank of England Governor and the U.S. Federal Reserve Chair, which may significantly impact price action.

Traders should remain alert, as risk levels are elevated amid ongoing trade and geopolitical tensions, leaving all scenarios possible in the near term.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3320 | R1: 1.3370 |

| S2: 1.3290 | R2: 1.3395 |

| S3: 1.3260 | R3: 1.3420 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations