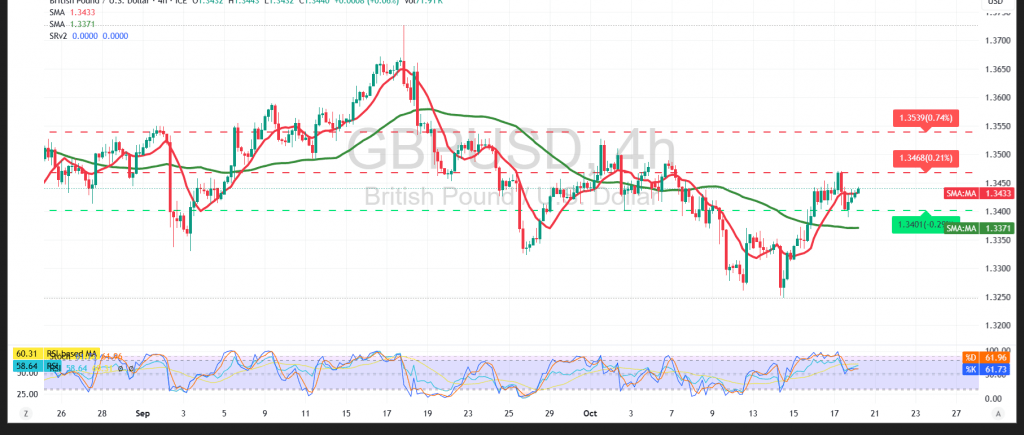

GBP/USD has turned positive intraday after a brief hold above 1.3400 (psychological support), but the recovery looks fragile into nearby resistance.

Technical:

RSI is hovering near overbought, hinting at fading momentum. The 50-period SMA sits near 1.3450, acting as overhead resistance and reinforcing a cautious tone on the 4-hour chart.

Base case:

Bias tilts bearish while capped by 1.3450. A decisive break below 1.3400 would likely extend losses toward 1.3350, then 1.3320.

Alternative:

A confirmed break and hold above 1.3450 would neutralize immediate downside pressure and could reopen 1.3520 on follow-through buying.

Risk:

Headline and geopolitical flows can drive sharp two-way moves. Use disciplined sizing and clear invalidation levels; conditions may not suit all risk profiles.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3400 | R1: 1.3475 |

| S2: 1.3350 | R2: 1.3520 |

| S3: 1.3310 | R3: 1.3580 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations