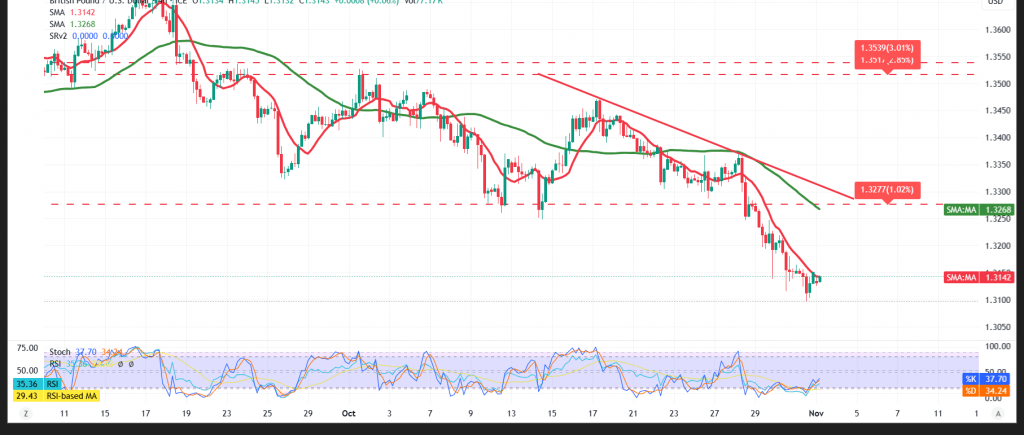

Sterling extended its downtrend into last week’s close, meeting the 1.3105 target and printing a 1.3097 low.

Technical outlook

- RSI: Back out of oversold but still sending negative momentum signals—consistent with bearish control.

- SMAs: Price holds below the simple moving averages, which continue to act as dynamic resistance.

- Structure: Ongoing stability below 1.3175 reinforces the downside bias.

Base case (bearish while below 1.3175)

- A drift toward 1.3100 support is likely.

- A decisive break/4H close below 1.3100 would open 1.3065 next.

Invalidation / upside toggle

- A confirmed 1H close above 1.3175 would neutralize immediate downside pressure and allow a corrective push toward 1.3210.

Risk note

Volatility remains elevated amid trade and geopolitical headlines. Consider prudent sizing and hard stops; reassess quickly if the key levels give way.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3105 | R1: 1.3175 |

| S2: 1.3065 | R2: 1.3210 |

| S3: 1.3030 | R3: 1.3245 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations