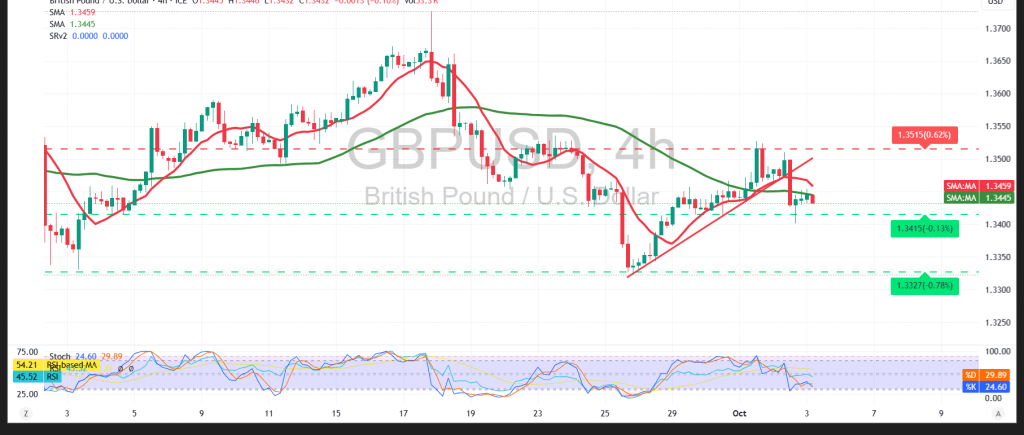

The pair extended its bearish trajectory in line with expectations, reaching the first downside target at 1.3430 and printing a session low of 1.3401.

Technical Outlook:

- RSI: Cleared the oversold zone from the prior session but continues to show weak momentum, reflecting limited buying strength.

- 50-day SMA: Still acting as dynamic resistance, maintaining pressure on the pair from above.

Probable Scenario:

- Bearish Case (preferred): The 1.3500 psychological resistance remains the pivotal barrier. While trading below it, the downside bias dominates. A break of 1.3390 could extend losses toward 1.3340.

- Bullish Case (alternative): A decisive break and hold above 1.3500 would shift momentum in favor of buyers, opening the way for gains towards 1.3560.

Risk Warning: Volatility is expected with today’s release of US Nonfarm Payrolls, Unemployment Rate, and Average Hourly Earnings. Sharp moves in both directions are possible.

General Warning: Risk remains high amid trade and geopolitical tensions.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3390 | R1: 1.3500 |

| S2: 1.3340 | R2: 1.3560 |

| S3: 1.3280 | R3: 1.3605 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations