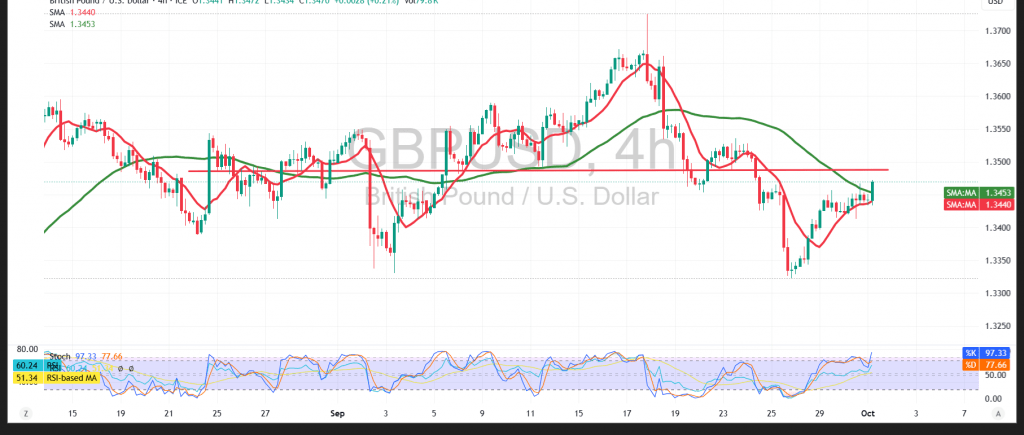

The pair is trading with a slightly positive intraday bias but remains capped below the key resistance level of 1.3480, keeping the overall pressure tilted to the downside.

Technical Outlook:

- RSI: Showing early negative signs after entering overbought territory, hinting at potential negative divergence and weakening upside momentum.

- 50-period SMA: Acting as dynamic resistance from above, limiting the pair’s ability to extend its recovery.

Probable Scenario:

- Bearish Case: Stability below 1.3480 keeps the downside bias intact, with a break of 1.3430 likely to extend losses toward 1.3390.

- Bullish Case: A decisive break above 1.3480 could restore buying momentum, targeting the next resistance at 1.3530.

Risk Warning: Today’s session carries high volatility risk with the release of US ADP Nonfarm Employment Change and ISM Manufacturing PMI data. All scenarios remain possible amid ongoing trade and geopolitical tensions.

Trading CFDs involves risks, and therefore all scenarios may be plausible. The information provided above is not a recommendation to sell or buy but rather an explanatory reading of price movement on the chart.

| S1: 1.3430 | R1: 1.3485 |

| S2: 1.3390 | R2: 1.3505 |

| S3: 1.3365 | R3: 1.3535 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations