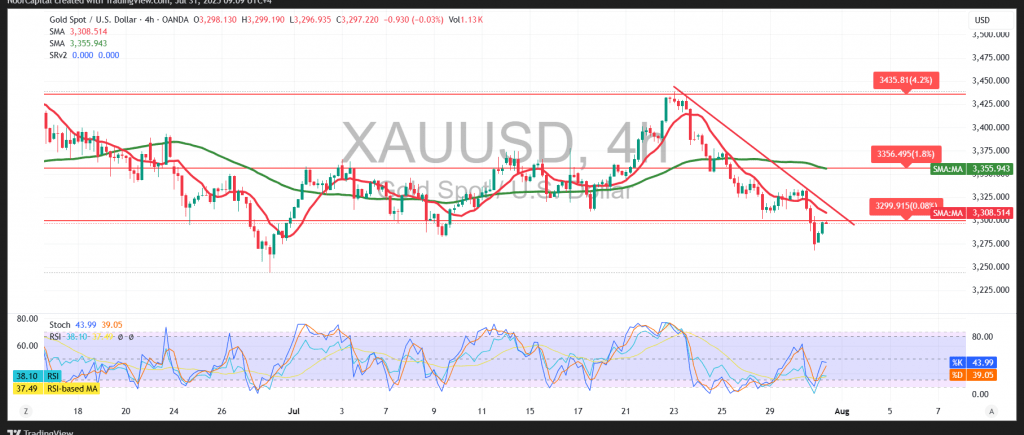

Gold prices recorded sharp losses in yesterday’s session, aligning with the bearish outlook outlined in our previous report. As anticipated, the break below the $3,308 support level accelerated the decline, with the price reaching $3,297 and $3,285 before marking a session low at $3,268 per ounce.

Technical Outlook:

The metal is currently attempting a modest rebound following the steep drop, supported by positive signals from the Relative Strength Index (RSI) as it recovers from oversold territory. However, the broader trend remains under strong bearish pressure, with price action continuing to trade below the 50-period Simple Moving Average (SMA)—a dynamic resistance level—while consolidating within a descending trend channel.

Likely Scenario:

Despite the possibility of short-term technical rebounds, the prevailing daily trend remains bearish. A break below the $3,282 support level would likely trigger renewed selling pressure, opening the way for declines toward $3,266 as an initial target, followed by $3,234 as the next major support.

Alternative Scenario:

If the price successfully breaks above the $3,315 resistance level and stabilizes above it, a short-term upward correction could unfold, with potential upside toward $3,332.

Key Risk Events – Volatility Expected:

Today, markets await several high-impact U.S. economic releases, including:

- Weekly Unemployment Claims

- Core Personal Consumption Expenditures (Core PCE)

- Employment Cost Index (Quarterly)

These data releases could trigger heightened volatility in gold prices.

Warning:

Risk remains elevated amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Disclaimer: Trading in CFDs involves risks, and all scenarios are possible. This analysis is not investment advice but rather an interpretation of the current technical landscape for gold.

| S1: |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations