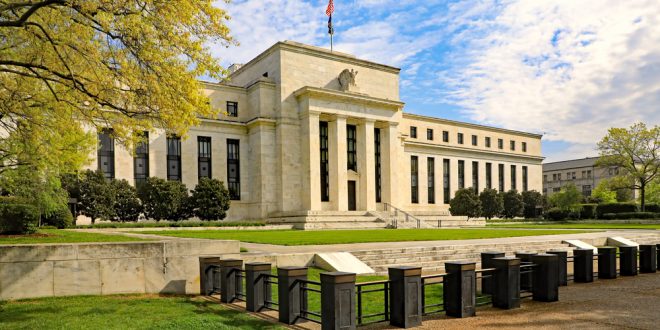

Outgoing Fed Vice Chair Richard Clarida, who will resign from his position on Friday, two weeks before the end of his term, said on Thursday that commencing policy normalization in 2022 would be entirely consistent with the Fed’s new flexible average inflation targeting framework.

The US economy is well above what Clarida would consider to be a moderate overshoot of the Fed’s 2.0% longer-run goal, he added, saying that the unwelcome surge in inflation in 2021 will, in the end, prove to be largely transitory under the appropriate monetary policy.

Once these relative price adjustments are complete and bottlenecks have unclogged, inflation will prove to be transitory. The underlying rate of inflation in the US economy is hovering close to the Fed’s 2.0% longer-run objective, he concluded.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations