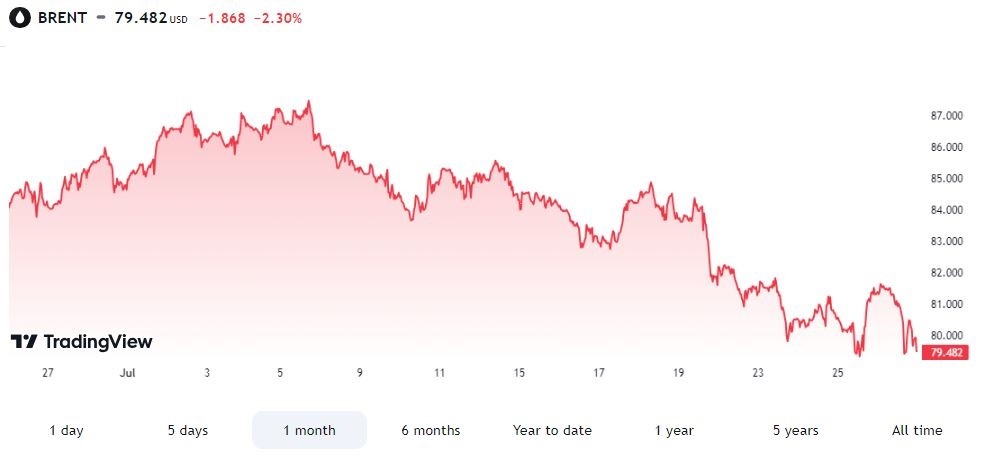

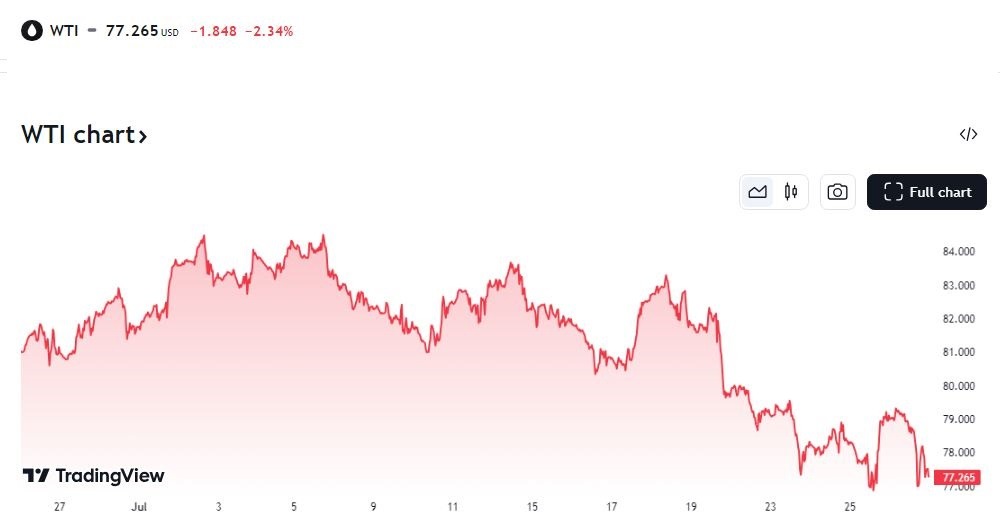

In the days leading up to the important OPEC meeting on August 1, oil prices are collapsing. The drop this week, which was caused by worries over China’s slowing consumption, puts the oil cartel in a risky position as it navigates a volatile market. At the time of writing WTI crude oil is trading at $ 77.26 per barrel, down −2.34% and Brent crude oil is trading at $ 79.48, down -2.30% as charts denote daily, weekly as well as monthly decline.

China’s Dozing Dragon Restrains Inquiry Demand

In light of the sluggish state of the Chinese economy, refinery utilization in China has plunged 3.5% year-over-year, coupled with a significant drop in crude oil imports. This paints a bleak picture for global oil demand, raising fears of a potential surplus in the latter half of 2024 and beyond.

The Balancing Act of OPEC: Cave-In vs. Cuts

The pressure is growing even though OPEC leaders have mentioned holding a “routine” meeting. Even if some analysts anticipate changes to production, OPEC has always been cautious when reintroducing barrels into the market.

However, declining prices can need a change in approach. The two biggest members of OPEC, Saudi Arabia and Russia, might support delaying any intended reduction in production cutbacks.

Differing Indications: Stock Depletions vs Geopolitical Events

Countervailing forces further muddy the picture. Despite a sharp reduction in recent weeks in U.S. crude oil inventories, U.S. output has resumed reaching all-time highs. Furthermore, the expectation of a future peace agreement between Israel and Hamas has caused prices to decline.

Looking Ahead: A Week of Uncertainty for Oil Markets

The oil market is on the verge of instability with only a few days till the OPEC summit on August 1. A strong argument for adjusting production is made by the declining pricing and the declining demand from China. But analysts and traders are left wondering due to OPEC’s cautious attitude and countervailing factors like U.S. production. The week preceding the summit is probably going to be somewhat unpredictable, since everyone is watching Vienna closely for any indications of a change in OPEC’s approach.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations