After a surprising agreement by OPEC+ to reduce additional output, oil prices soared on Monday, registering their largest daily increase in over a year.

After reaching its highest price in a month at $86.44, Brent crude was up $4.91, or 6.2%, to $84.80 a barrel as of 12:15 GMT.

After reaching its highest point since late January, West Texas Intermediate oil U.S. was trading at $80.27 a barrel, up $4.60, or 6.1%.

The announcement of additional production goal cuts of around 1.16 million barrels per day (bpd) on Sunday by the Organization of the Petroleum Exporting Countries and their allies, including Russia, jolted the markets.

Nevertheless, an increase in oil prices on Monday following an unexpected reduction in production by the Organization of Petroleum Exporting Countries and allies (OPEC+) sparked some worries about a possible revival in inflation, particularly if gasoline costs stay high.

Major central banks, especially the Fed, could adopt more monetary tightening measures as a result of this.

Gains in Asian markets on Monday were constrained by this idea. A number of central bank meetings and economic indicators are also in the spotlight this week. Interest rate decisions are expected from the Australian and Indian central banks this week, while more hints about the direction of US monetary policy are anticipated from the nonfarm payrolls statistics. “a precautionary measure aimed at supporting the stability of the oil market.”

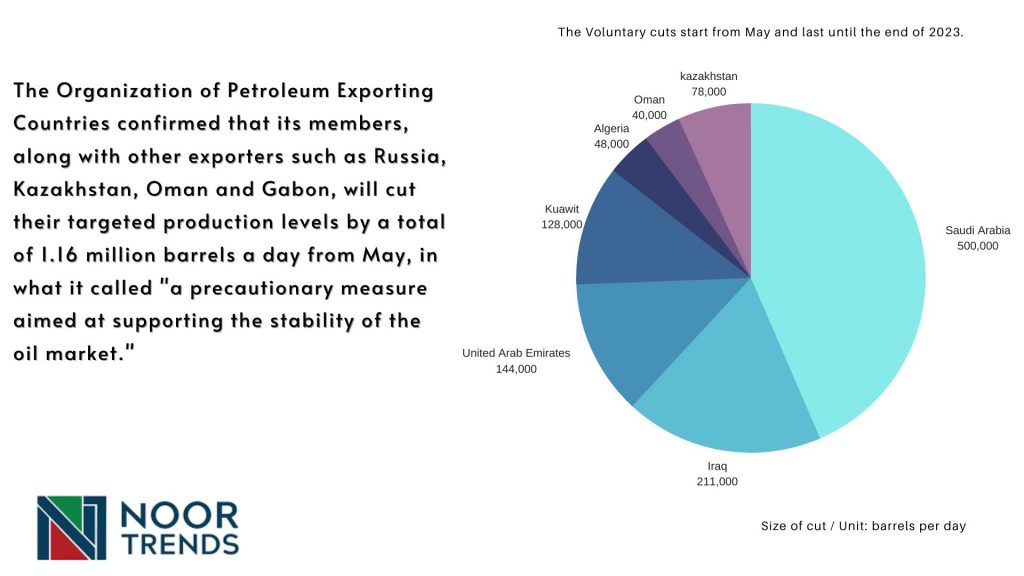

OPEC said its members will make the following “voluntary production adjustments” from May:

Saudi Arabia: 500,000 barrels a day

Iraq: 211,000 b/d

United Arab Emirates: 144,000 b/d

Kuwait: 128,000 b/d

Algeria: 48,000 b/d

Gabon: 8,000 b/d

In addition, Kazakhstan – which is not a member of OPEC itself but which is part of the broader, so-called ‘OPEC+’ group, will cut its output by 78,000 b/d.

Those cuts come on top of a unilateral 500,000 b/d cut announced by Russia earlier in the year.

The actions may dramatically tighten the global supply-demand balance by removing a short-term supply overhang brought on by slow demand in the United States, Europe, and China since the year’s beginning. Its impact is expected to increase if, as generally forecast, the Chinese economy expands throughout the year, putting the pandemic’s interruption behind it for good.

Experts claimed that considering that the majority of OPEC countries were producing below their agreed-upon limits as a result of different issues, the actual fall in output is likely to be lower than declared. Regarding their output quotas, Nigeria, Iran, Venezuela, and Angola remained silent, while Russia’s actual output in March was over 200,000 b/d more than what its official measurements had predicted.

JPMorgan analysts predicted that rather than the 1.16 million b/d disclosed, the real drop in OPEC output will be closer to 700,000 b/d.

Crude oil prices increased on Sunday as Saudi Arabia made the first of many statements by various nations taking action to reduce supply. They did, however, lose some of their gains on Monday when the market reexamined the effects of the change. U.S. oil futures were up 6.4% at $80.52 a barrel by 7:50 ET (11:50 GMT), while Brent futures were up 6.3% at $84.89 per barrel.

The market may be undecided as to whether the Fed will raise interest rates again in May as the turbulence in the US financial system subsides and the Fed’s preferred inflation measure showed indications of weakening last week.

But, there is less discussion in Europe, where core inflation climbed in March and reached a record high, according to data released last week.

On Saturday, Luis de Guindos, vice president of the European Central Bank, reiterated the ECB’s position that “getting inflation down to our 2% medium-term objective will remain data-dependent” despite the fact that headline inflation is slowing.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations