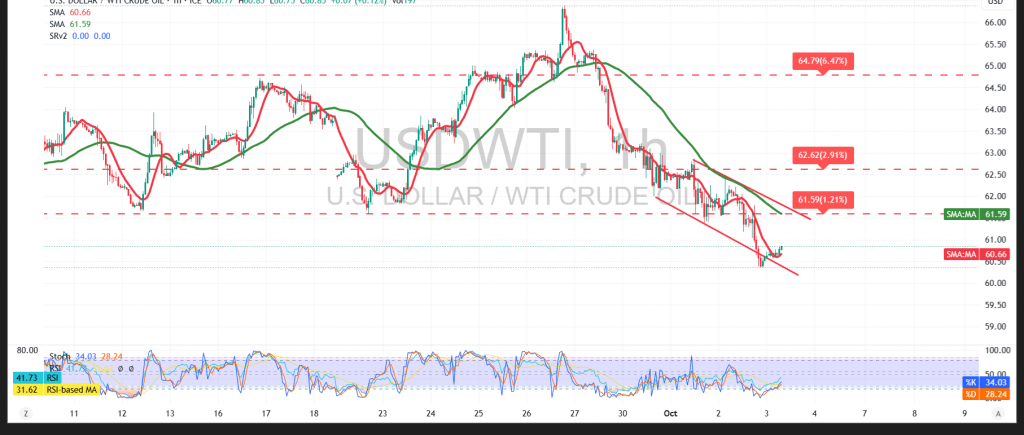

US crude oil futures faced heavy selling pressure in the last session, sliding to a low of $60.42 per barrel.

Technical Outlook:

- Moving Averages: The simple moving averages continue to weigh on price from above, with the 50-day SMA converging near 61.80, reinforcing resistance.

- RSI: The index is in oversold territory, though early positive signals suggest the possibility of a short-term rebound. However, this does not negate the broader daily downtrend, which remains intact.

- Bias: The steep bearish structure continues to dominate, but short-lived corrective rebounds remain possible.

Probable Scenarios:

- Bearish Case (preferred): Continued trading below 61.80 keeps the downside bias intact. A clear break below 60.40 could extend losses towards 60.00, and further to 59.20 if selling intensifies.

- Bullish Case (alternative): Holding above 61.80 may trigger a corrective rebound, with targets at 62.10 and 62.80.

Risk Warning: Volatility may surge with the release of US Nonfarm Payrolls, Unemployment Rate, and Average Hourly Earnings today. Market reactions could produce sharp movements in either direction.

Trading in CFDs involves high risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 60.00 | R1: 62.10 |

| S2: 59.15 | R2: 63.30 |

| S3: 57.90 | R3: 64.15 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations