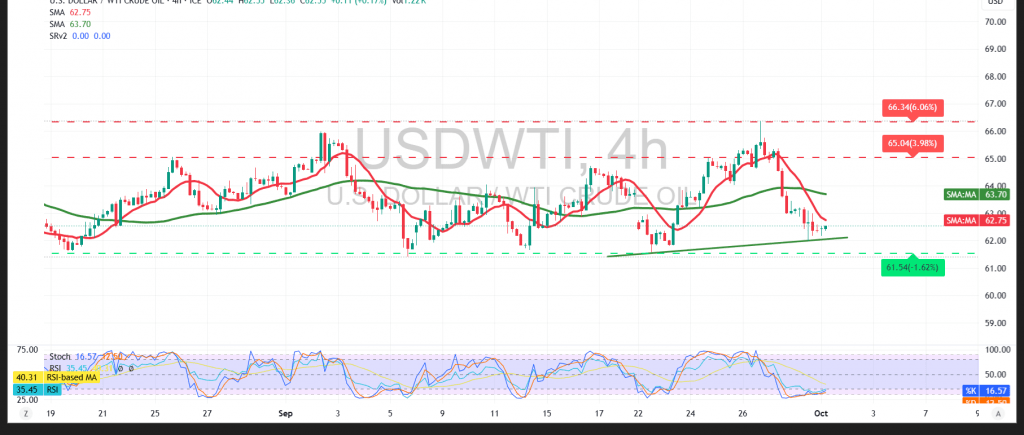

WTI crude oil successfully reached the downside target highlighted in the previous report at $62.20, recording a low of $62.00 per barrel.

Technical Outlook:

- Moving Averages: Prices remain pressured from above, with dynamic resistance forming near $63.15, limiting recovery attempts.

- RSI: Hovering near oversold territory, the indicator is beginning to send positive signals, suggesting the possibility of a short-term corrective rebound. However, this does not negate the broader daily downtrend given the steep nature of recent declines.

Probable Scenario:

- Bullish Case: Intraday stability above $62.00 may support a rebound towards $63.10, with a confirmed break above this level acting as a catalyst for further recovery towards $63.70.

- Bearish Case: A decisive break of the psychological support at $62.00 would quickly reintroduce selling pressure, exposing $61.45 and potentially $60.80 as the next downside targets.

Risk Warning: Markets face heightened volatility today with the release of ADP Non-Farm Employment Change and ISM Manufacturing PMI data from the US. All scenarios remain possible amid ongoing trade and geopolitical tensions.

Trading in CFDs involves high risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 62.00 | R1: 63.15 |

| S2: 61.45 | R2: 63.75 |

| S3: 60.80 | R3: 64.30 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations