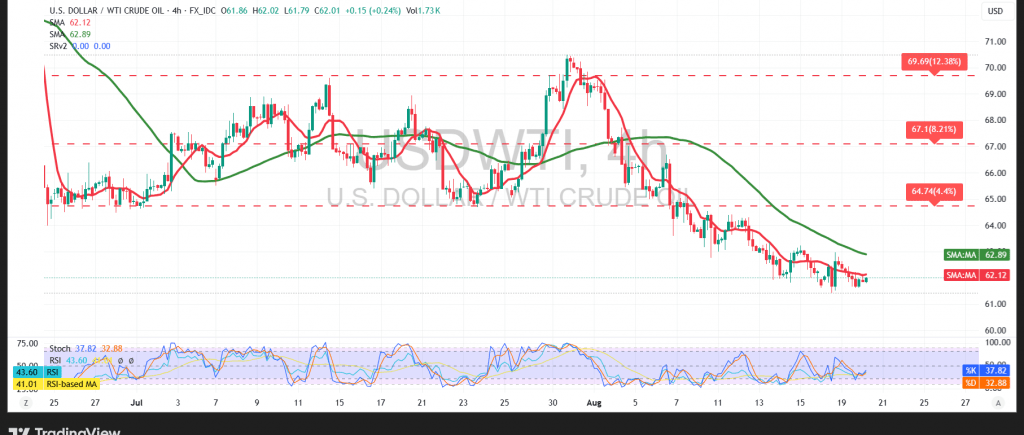

WTI crude oil futures have continued to record consecutive losses over several sessions, with the price reaching its lowest level at $61.68 per barrel.

Technical Outlook – 4-Hour Timeframe

Current price action shows attempted bullish rebounds as the Relative Strength Index (RSI) tries to correct from oversold conditions. Meanwhile, the Simple Moving Averages (SMAs) continue to act as dynamic resistance levels that could limit upward attempts, reinforcing the prevailing bearish trend.

Probable Scenario

Bullish Scenario: As long as daily trading remains stable below the 62.50 resistance level, the bearish trend is the most favored scenario. We are targeting 61.50 as the first support area. A break below this level would increase and accelerate the bearish momentum, paving the way for a visit to 61.00.

Bearish Scenario: In the event that the price manages to close above the 62.50 resistance level, it would give the price an opportunity for a temporary gain starting at 63.00 and potentially extending toward 63.50. This rise is contingent on a clear breakout.

Fundamental Note:

- High-Impact Data: Today, we are awaiting high-impact economic data from the U.S. economy: the Federal Reserve’s FOMC Meeting Minutes. This data could cause strong price volatility upon its release.

Warning

- High Risk: The risk level is high amid ongoing trade and geopolitical tensions, and all scenarios could be possible.

Disclaimer

Trading in CFDs involves high risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 61.45 | R1: 62.50 |

| S2: 61.00 | R2: 63.05 |

| S3: 60.55 | R3: 63.60 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations