Investors and traders are paying attention to oil prices ahead of the summer driving and travel season amid a mix of optimistic expectations, well-founded fears and high demand for fuel.

Optimism about OPEC+ trends

Oil recently achieved its first weekly gains in a month, supported by reports and data that injected more optimism about demand levels in the second half of the year. OPEC+ made a remarkable effort to reassure the markets of the possibility of reconsidering its plans to pump more oil into the market if circumstances dictate that, and demand expectations appear to be improving.

Strong demand for fuel in the next quarter, the subject of the October increase to prevailing conditions, and the additional focus on exceeding quotas to reduce production, are factors that support energy prices.

Chinese Data

Traders bought back quantities of oil that were previously sold last week after OPEC+ confirmations. Chinese economic data also led to a rise in oil prices on Monday amid more optimism about the growth in oil demand. While Chinese industrial output came in below expectations, investment in manufacturing has risen so far this year; overall by 9.6%.

China’s domestic crude oil production in May rose 0.6% year-on-year to 18.15 million tons, and production since the beginning of the year reached 89.1 million tons, an increase of 1.8% from the previous year. National crude oil production decreased by 1.8% in May compared to the same level a year ago to 60.52 million tons, bringing its total since the beginning of the year to 301.77 million tons, an increase of 0.3% from last year. The slowdown in the real estate sector has not improved, increasing pressure on Beijing to support growth. The data released on Monday was pessimistic, confirming the difficult recovery of the second largest economy in the world.

Demand growth forecast

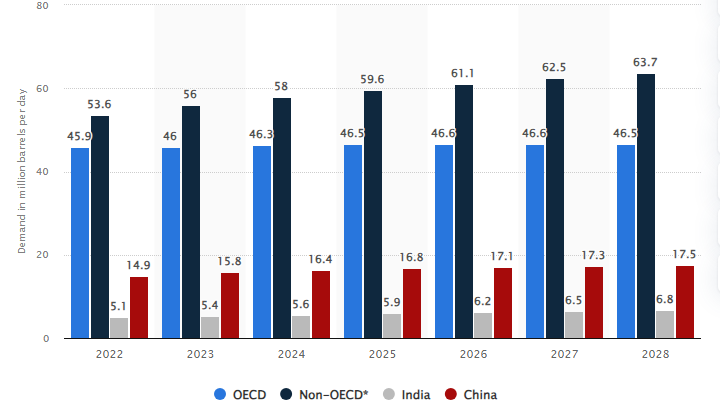

The US Energy Information Administration recently increased its forecast for global oil demand growth for 2024 to 1.1 million barrels per day and OPEC maintains a similar forecast for strong demand growth.

More stable supply

US oil production is expected to reach a record level in 2024, thus providing more stable supplies. Global oil supply growth is also expected to slow in 2024 and perhaps in 2025, due to an extension of the voluntary OPEC+ cuts. For this year, OPEC+ is expected to remove 830 thousand barrels per day from the market, while 2025 may witness an expanded withdrawal of about 1.04 million barrels per day from the market.

Last week’s strong rally was driven by forecasts of strong demand in 2024 from OPEC+ and the International Energy Agency, and weak US consumer confidence numbers on Friday suggest the resilience of the US consumer and US economy will be tested as households exhaust their savings to keep up with rising interest rates.

Geopolitical factors

Fears of a broader war in the Middle East continue. The beginning of this week witnessed a noticeable decrease in the exchange of fire between Hezbollah and Israel. Markets in Singapore, the main center for oil trade, were closed for a public holiday on Monday. Oil prices rose by nearly two dollars a barrel on Monday to their highest settlement levels. It has been in stock for more than a month, adding to last week’s gains as investors grew more optimistic about the demand outlook.

Demand poised to recover in the second half

Last week, both benchmarks posted their first weekly gain in four weeks after reports from the OPEC+ producer group, the International Energy Agency and the US Energy Information Administration, renewed confidence that oil demand will improve in the second half of the year and help draw down inventories.

Holiday season, driving and travel

Traditionally, gasoline prices rise during the summer due to increased demand and the shift to summer gasoline blends. 24 hours ago, crude oil prices fell in Asian trading after weak US consumer demand data and energy consumption adjustments for May in China, the world’s largest crude importer, and on Friday. Last, a survey revealed that American consumer sentiment fell to a seven-month low this June, with families concerned about their personal finances and fears of a return to record levels of inflation. However, both benchmark contracts rose by about 4% last week, the highest weekly gains since April, due to signs and indications of increased demand for fuel with the start of the holiday season, driving and traveling during the summer months.

• As of June 13, the average U.S. gasoline price was $3.46 per gallon, a welcome decline from recent highs. This provides some temporary relief for drivers.

• This decline helped reduce the overall inflation rate in May, as the gasoline index fell by 3.6% compared to April.

Peak oil demand is looming, but when?

The International Energy Agency expects global oil demand to peak before 2030, perhaps as early as 2029. This indicates a long-term shift away from oil dependence. However, there is a great deal of uncertainty surrounding this projection due to various factors. Such as economic conditions and technological progress, on the other hand, OPEC expects that peak oil demand will not occur until 2045.

Monday saw US crude oil trading higher by more than 2%, with Brent crude rising more than 2.10% as the market continued to digest recent data indicating an improving demand outlook. Early Monday morning, Brent crude rose 1.73% to $84.05, achieving a gain of $1.43 on the day. WTI was also trading 2.17% higher at $80.15, achieving a gain of $1.70 on the day. At the time of writing, Brent crude was above $83.80 per barrel. US crude is above $80.30 per barrel.

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations