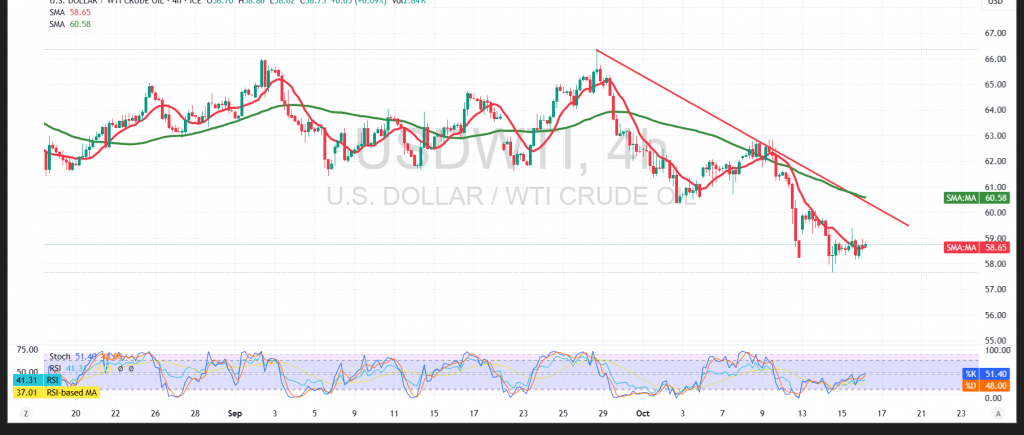

WTI crude (U.S. futures) met the prior report’s target at $58.70, printing a low of $58.22 before a modest rebound. The move appears corrective within a broader bearish structure.

Technical:

Price remains capped beneath down-sloping simple moving averages, which act as dynamic resistance and may limit upside attempts. RSI is trying to firm, but signals are tentative against the prevailing downtrend on the 4-hour chart.

Base case:

While intraday trading holds below $59.30–$59.35, the path of least resistance is lower. A clean break under $58.20 would likely extend losses toward $57.60.

Alternative:

A decisive close above $59.35 would temper immediate downside pressure and allow a recovery toward $60.00, though rebounds are assumed corrective unless higher levels are reclaimed.

Risk:

Geopolitical and trade headlines can drive sharp swings. Use disciplined sizing, clear invalidation levels, and tight risk control; this market may not suit all investors.

Trading in CFDs involves high risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 58.20 | R1: 59.35 |

| S2: 57.60 | R2: 60.00 |

| S3: 56.95 | R3: 60.50 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations