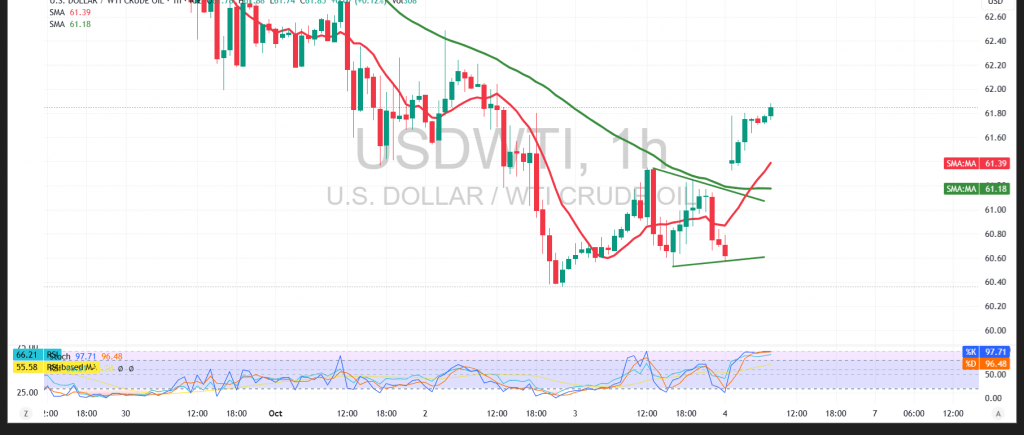

US crude oil futures (WTI) started the week with a bullish price gap, reaching a high of $61.88 per barrel.

Technical Outlook – 4-hour timeframe:

The price is attempting to consolidate above the $61.50 resistance level, supported by positive signals from the Relative Strength Index (RSI), despite entering overbought territory. The 50-day simple moving average (SMA) continues to act as a resistance level that may limit further intraday gains.

Intraday trading stability above $61.40 — the previously breached resistance — could encourage the price to extend its upward movement toward $62.00, followed by $62.30 as the next targets.

Conversely, a clear break below the $60.95 support level may immediately halt further upward attempts, paving the way for a return of the downward corrective trend toward $60.10.

Warning: The risk level is high amid ongoing trade and geopolitical tensions, and all scenarios are possible.

Trading in CFDs involves high risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 60.95 | R1: 62.30 |

| S2: 60.10 | R2: 62.70 |

| S3: 59.70 | R3: 63.60 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations