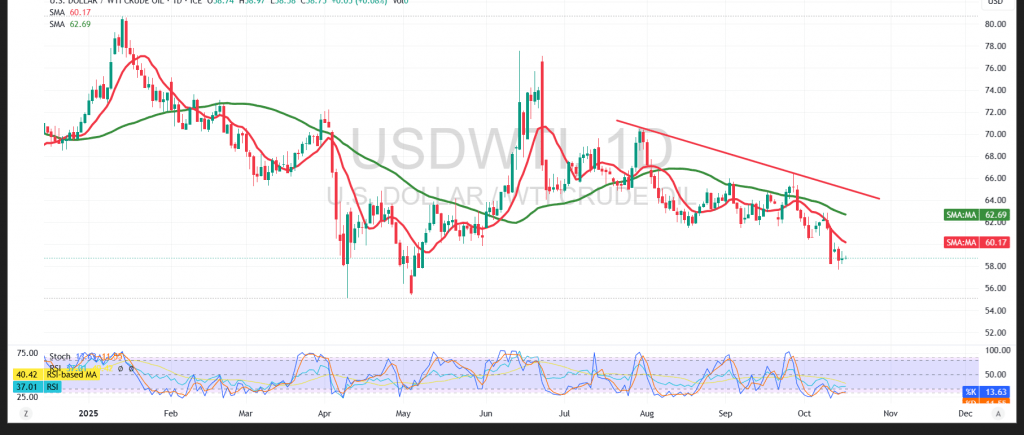

WTI crude futures extend their downtrend, with strong selling pressure driving prices to multi-month lows despite brief intraday rebounds.

Technical (4H):

Price action remains below a descending trend line, keeping bears in control. Down-sloping simple moving averages continue to act as dynamic resistance, capping recovery attempts and reinforcing the broader bearish structure.

Base case (downside continuation):

While below $58.00, the path of least resistance stays lower. A clean break beneath $56.60 would likely extend losses toward $56.00.

Alternative (tactical rebound):

If buyers can force a sustained intraday recovery, upside is likely to be corrective while MAs trend lower. Only reclaiming and holding above successive resistance layers would ease immediate pressure.

Risk:

Geopolitical/trade headlines can spark sharp two-way moves. Use disciplined sizing and clear invalidation levels; conditions may not suit all risk profiles.

Trading in CFDs involves high risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 56.60 | R1: 57.80 |

| S2: 56.10 | R2: 58.40 |

| S3: 55.50 | R3: 59.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations