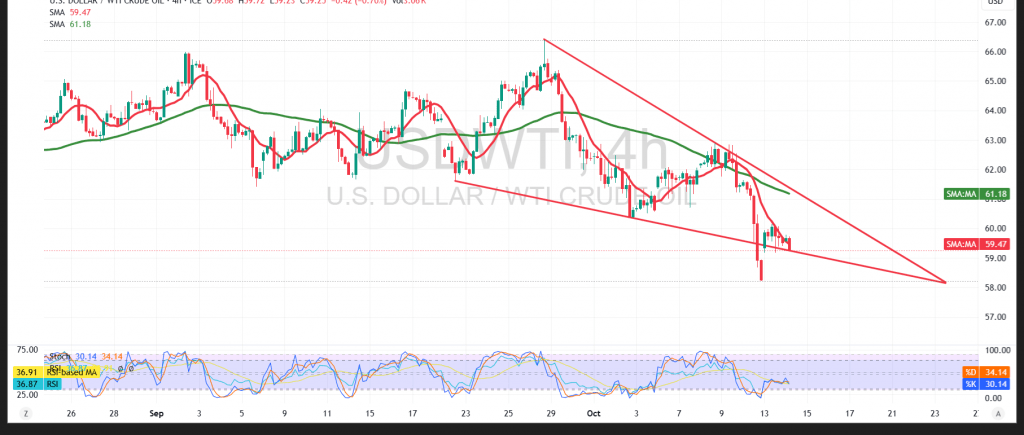

U.S. crude oil futures attempted to recover a portion of their previous losses, reaching an intraday high of $60.14 per barrel during the prior trading session. However, the broader trend remains under pressure amid persistent bearish sentiment.

Technical Overview

The simple moving averages (SMAs) continue to weigh on price action from above, acting as dynamic resistance levels that limit the potential for a sustained recovery within the ongoing downtrend.

Meanwhile, the Relative Strength Index (RSI) is signaling renewed weakness after reaching overbought territory, suggesting a likely loss of short-term bullish momentum.

Probable Scenario

As long as trading remains below the $60.10 resistance level, negative pressure is expected to dominate intraday movements. A break below $59.10 could accelerate bearish momentum, opening the way toward the $58.70 target area.

Conversely, a confirmed break above $60.15 may temporarily halt the bearish scenario, paving the way for a short-term recovery attempt targeting $60.50, and potentially $60.90.

Caution

Volatility may increase significantly ahead of the upcoming speeches by the Bank of England Governor and the U.S. Federal Reserve Chair, which could heavily influence market sentiment and energy prices.

Traders should remain cautious, as risk levels are elevated amid ongoing trade and geopolitical tensions, leaving multiple scenarios possible in the near term.

Trading in CFDs involves high risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 59.10 | R1: 60.00 |

| S2: 58.70 | R2: 60.50 |

| S3: 58.20 | R3: 60.90 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations