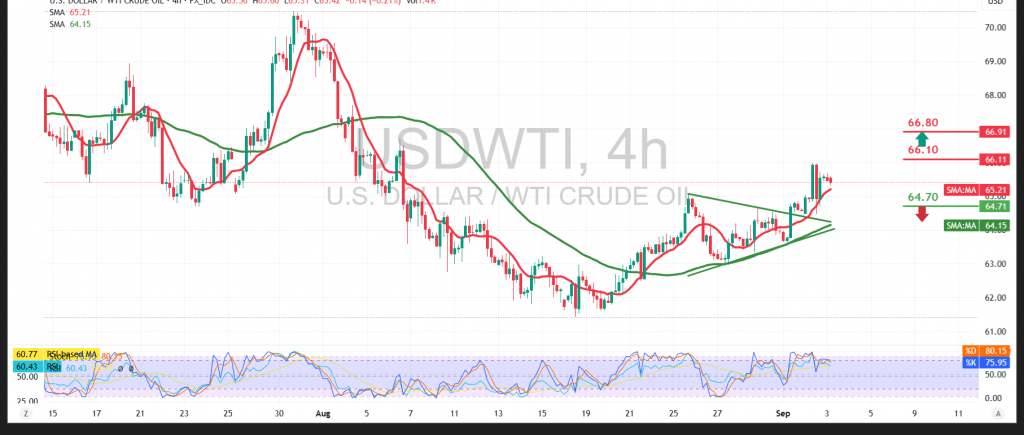

US crude oil futures extended their bullish momentum in line with the outlook from the previous report, climbing to a high near the psychological barrier of $66.00 per barrel.

Technical Outlook – 4-hour timeframe:

The price is moving within an upward corrective channel, supported by the breakout above the 65.00 resistance level and sustained stability along a clear ascending trend line. The 50-period simple moving average continues to act as dynamic support, reinforcing the positive bias. Meanwhile, RSI indicators reflect ongoing buying strength, having successfully cleared the overbought zone, which supports the potential for further short-term gains.

Probable Scenario:

As long as prices remain stable above 65.00—and more broadly above 64.60—the bullish corrective trend is expected to prevail. A confirmed break above the 66.10 resistance would open the door for extended gains toward the next resistance levels on the chart. Conversely, a move back below 64.60 would weaken the bullish case and expose the price to tests of minor support areas.

Fundamental Note:

Today’s session features high-impact US economic data, including job openings and labor turnover (JOLTS). These releases could trigger sharp price volatility.

Warning: Risks remain elevated amid ongoing trade and geopolitical tensions, and all scenarios should be considered.

Trading in CFDs involves high risk, and therefore all scenarios are subject to potential outcomes. The analysis provided above is not a recommendation to buy or sell but rather an illustrative reading of price action on the chart.

| S1: 64.60 | R1: 66.10 |

| S2: 63.80 | R2: 66.80 |

| S3: 63.10 | R3: 67.60 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations