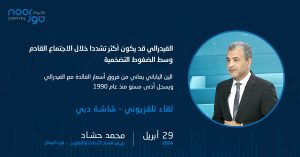

Mohammed Hashad, Head of Research and Development at Noor Capital and member of the US Association of Technical Analysts, commented and analyzed the most prominent market developments and the performance of the most important assets, in an interview on Dubai TV.

US Interest Expectations, Federal Reserve Decisions:

Asked about his expectations for the important event expected this week, that is, the monetary policy meeting of the Federal Reserve, and whether it can be said that now it has become almost certain that there is a tendency for the US Central Bank to maintain tightening monetary policy for a longer period, Hashad replied: “Yes, the Federal Reserve meeting is one of the most important headlines on the economic agenda this week, and everyone is watching and waiting with caution for what the Fed Chief, Jerome Powell, will say from his point of view. The most important thing is not reducing, stabilizing, or raising interest rates, rather; the most important thing of all is what he will announce during the press conference following the interest rate decision, and from my personal point of view, Jerome Powell may be tending to more tightening based on the latest economic data, the most important of all is inflation data and perhaps the Fed’s favourite indicator for measuring inflation, that is, the recent reading of the Personal Consumption Expenditure Index (PCE), which recorded a growth of 2.7; higher than expectations on an annual basis, and the same index recorded a growth of 0.5 on a monthly basis.

Hashad also pointed out that the Durable Goods Orders Index recorded 2.7, higher than expected during the past month, which gives evidence that the US consumer is still reassured about the current and current economic conditions, and the labour market is also still strong, contrary to what Jerome Powell wants, meaning that Jerome Powell wants is that the labour market becomes less calm than it is now, so, inflation is still far from the Fed’s 2% target.

Hashad believes that the option of cutting interest rates during next June has become unlikely, and if there is a possibility of lowering interest rates, it may be by the end of September or by the end of next December, and the interest rate may be reduced only once during the year 2024, and the tightening approach may continue for a longer period of time.

Yen’s performance, Recent Statements by BoJ Officials

Moving on to the most prominent topic today, which is the Japanese yen, and what is believed about the levels that the yen has reached and whether there are indications that the monetary authorities will intervene to save or support the value of the Japanese currency, in light of the recent statements of the Governor of the Bank of Japan last week, and whether it is possible Changing the monetary policy approach, Hashad commented: “The Bank of Japan kept the monetary policy as it was without change and did not raise interest rates. In turn, the markets quickly interpreted that and realized that the Bank of Japan would not abandon accommodative monetary policy easily,” adding: “In one of the statements of the Bank Governor Japan was an important point, as it stated that it would not rely on just one indicator to change monetary policy, and thus we witnessed very large movements of the Japanese yen against the dollar at its lowest level since 1990.

Hashad believes that one of the reasons for the yen’s movements is a summary of two very important main points. The first is in the context of statements or between the lines, and this is what the Governor of the Bank of Japan stated when he announced that the current low value of the yen has not affected inflation levels so far.

“In my personal opinion, this indicates that the Central Bank of Japan will not intervene to save the Japanese yen. The other factor that contributed to these movements is the price differences between the interest rates of the Bank of Japan and the US Federal Reserve. The difference is estimated at about five hundred and forty basis points, meaning that “There is a big gap and I think it may continue for longer periods of time”, Hashad added.

Commenting on the statements of Bank of Japan officials that it will intervene or change its approach if the yen’s movements affect the economy, and about the factors it is waiting for in order to intervene in this way, Hashad believes that the meaning of these statements is that it is only waiting for inflation data given that the Bank of Japan is one of the most high-level central banks worldwide that is keen on commercial monetary policy and will not intervene to prevent the collapse of the Japanese yen unless absolutely necessary.

Oil Price Movements

As for oil prices and the recent declines due to the impact of more than one factor, including the anticipation of calm in the Middle East and at the same time expectations of tightening monetary policy, and whether this decline in oil prices is likely to continue if these factors continue and where it will reach. Oil price, Hashad answered: “We noticed that oil prices declined significantly with the opening of Asian trading on Monday, oil was able to reduce its losses, but it declined by one percent. There are several negative factors surrounding oil prices, but the most prominent of all is the relative calm in The Middle East region and the ongoing geopolitical tensions.

Investors now generally tend to reduce the risk potential, especially in the Middle East because it is a vital region for oil production, and one of the most important factors besieging oil prices in the current period is inventories.

Hashad continued: “We also find that Libya, the largest oil producer in North Africa, wants to increase its production capacity by about one million barrels during the coming period. One of the most important factors is also the rise in the US dollar, and this increases the cost of purchasing oil compared to other currencies, and in the case of trading, I think. “We may see a barrel of oil below the $80 level, reaching a price range of $75 per barrel.”

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations