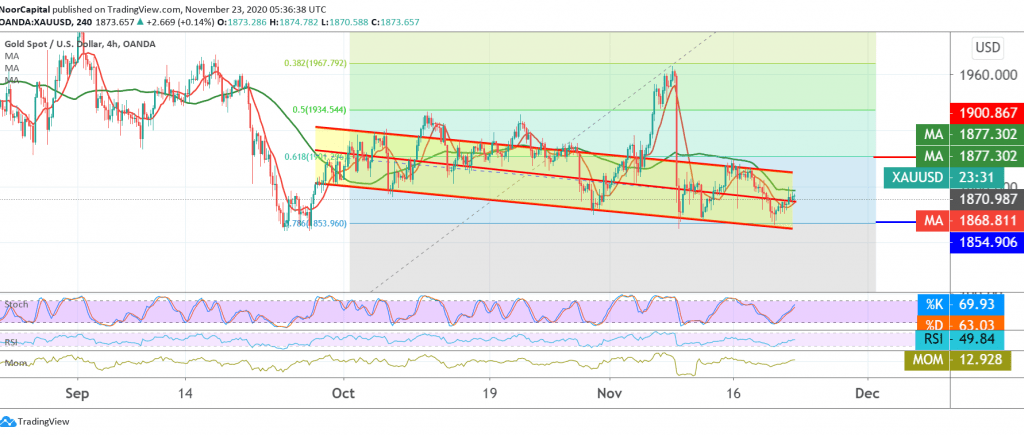

The current moves of the yellow metal are seeing a negative tilted sideways range from the bottom above 1860 and the top below 1882.

Technically speaking, and by looking at the chart, we found a contradiction between the negativity of the stochastic indicator on the 4-hour interval and the positive signs of the RSI on the short time intervals.

We will stand on the fence for the moment in order to maintain the profit rates that have been achieved and to obtain a good deal so that we are facing one of the following scenarios:

The continuation of the activation of the short positions depends on the intraday stability below the resistance level 1880/1882, and we also need to witness a break of 1865, which increases the possibility of touching 1852 and breaking it leads the price to the official target of the current downside wave at the price of 1845.

Activating long positions temporarily depends on the ability of gold to surpass up to the level of 1882, which opens the way to re-test the level of 1890, and then the resistance of the ascending channel 1901, a correction of 61.80%. In general, we continue to suggest the downside as long as trading is stable below 1901.

| S1: 1860.00 | R1: 1882.00 |

| S2: 1852.00 | R2: 1890.00 |

| S3: 1845.00 | R3: 1901.00 |

Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations